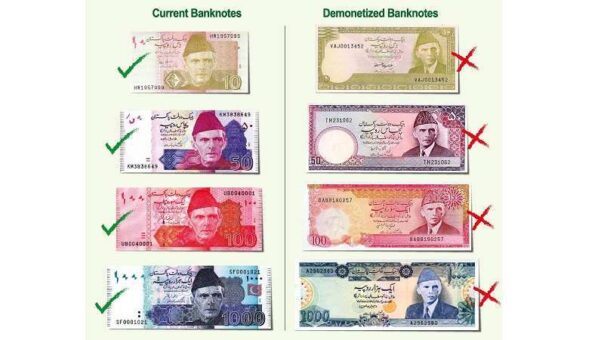

KARACHI: The field offices of the State Bank of Pakistan (SBP) will remain open on Saturday December 31 for exchange old design and large size banknotes.

(more…)Tag: SBP

-

Karachi Interbank Offered Rates KIBOR – December 28, 2022

KARACHI: State Bank of Pakistan (SBP) on Wednesday issued the Karachi Interbank Offered Rates (KIBOR) as on December 28, 2022.

(more…) -

State Bank issues foreign exchange rates on December 28, 2022

KARACHI: On Wednesday, the State Bank of Pakistan (SBP) published the foreign exchange rates for December 28, 2022.

(more…) -

SBP withdraws prior permission for import transactions

KARACHI: State Bank of Pakistan (SBP) has withdrawn prior approval for banks for initiating import transactions. Previously the condition was imposed in May 2022.

(more…) -

Karachi Interbank Offered Rates KIBOR – December 27, 2022

KARACHI: State Bank of Pakistan (SBP) on Tuesday issued the Karachi Interbank Offered Rates (KIBOR) as on December 27, 2022.

(more…) -

Last date to redeem bearer prize bonds extended: SBP

KARACHI: The State Bank of Pakistan (SBP) on Tuesday said that the last date to redeem bearer prize bonds has been extended considering the hardship of bond holders.

(more…) -

State Bank issues foreign exchange rates on December 27, 2022

KARACHI: On Tuesday, the State Bank of Pakistan (SBP) released the foreign exchange rates for December 27, 2022.

(more…) -

Karachi Interbank Offered Rates KIBOR – December 26, 2022

KARACHI: State Bank of Pakistan (SBP) on Monday issued the Karachi Interbank Offered Rates (KIBOR) as on December 26, 2022.

(more…) -

SBP approves agri-fintech app Digitt+

KARACHI: The State Bank of Pakistan (SBP) has approved the launch of Pakistan’s first agri-fintech app Digitt+ powered by Akhtar Fuiou Technology (AFT).

(more…) -

Bankers to sit late on year-end to facilitate taxpayers

KARACHI: Bankers have been directed to sit late on the last two days of year 2022 in order to facilitate taxpayers in payment of duty and taxes.

(more…)