Karachi, April 10, 2024 – Pakistan Customs has initiated a significant revision in the valuation of imported potato chips to align them with international market standards. This move comes after approximately seven years since the last valuation update, reflecting the evolving dynamics of global trade.

(more…)Tag: Valuation Ruling

-

Pakistan Introduces New Valuation for Used LCDs and LEDs

Karachi, February 9, 2024 – In an effort to address under-invoicing concerns and streamline the determination of duties and taxes, Pakistan Customs has introduced a new valuation for old and used computer LCDs and LEDs.

(more…) -

PYMA rejects customs valuation for filament yarn

KARACHI: Pakistan Yarn Merchant Association (PYMA) on Tuesday rejected customs ruling issued for determination of value of polyester filament yarn.

READ MORE: PYMA seeks duty, taxes cut on yarn in budget 2022/2023

Saqib Naseem, Chairman Pakistan Yarn Merchants Association (PYMA) and Muhammad Junaid Teli, Vice Chairman, Sind & Balochistan region, have strongly rejected Valuation Ruling No. 1655 / 2022 Dated. 30.05.2022 which was issued on 31.05.2022 for Polyester Filament Yarn.

READ MORE: CGT exemption on private company shares suggested

PYMA office-bearers said that Director Valuation, Syed Fawad Ali Shah, had not consulted all stakeholders and refused the PYMA actual raw material price determination which was submitted earlier.

They said that fresh valuation of polyester filament yarn is totally against normal practice.

READ MORE: KTBA proposes up to 20% capital gain tax on real estate

“Pakistan Yarn Merchants Association is a Major stakeholder of Polyester Filament Yarn & demanded for immediate withdrawal of VR # 1655 / 2022 and Director Valuation should call a meeting of all stakeholders & issue New / Revised Valuation Ruling of PFY as per past practice of Valuation Department,” PYMA office-bearers demanded.

READ MORE: FBR urged to issue rules for WHT on digital transactions

-

Provisional valuation disallowed on existing VR

ISLAMABAD: Importers will not be allowed to avail of the facility of provision valuation for goods declaration when the valuation of such goods is already in the field.

An important amendment has been made into Customs Act, 1969 through Tax Laws (Third Amendment) Ordinance, 2021, which was promulgated through presidential order on September 15, 2021.

A proviso has been inserted to Section 81 of the Customs Act, 1969 to disallow provisional valuation.

Following is the amended text of Section 81:

81. Provisional determination of liability.- (1) Where it is not possible for an officer of Customs during the checking of the goods declaration to satisfy himself of the correctness of the assessment of the goods made under section 79 or 131, for reasons that the goods require chemical or other test or a further inquiry, an officer, not below the rank of Assistant Collector of Customs, may order that the duty, taxes and other charges payable on such goods, be determined provisionally:

Provided that the importer, save in the case of goods entered for warehousing, pays such additional amount on the basis of provisional assessment or furnishes corporate guarantee or pay order of a scheduled bank along with an indemnity bond for the payment thereof as the said officer deems sufficient to meet the likely differential between the final determination of duty, taxes and other charges over the amount determined provisionally:

Provided further that there shall be no provisional assessment under this section if no differential amount of duty and taxes and other charges is paid or secured against corporate guarantee or pay order.

Following is the new proviso added to Section 81:

“Provided further that no provisional determination of value shall be allowed in those cases where a valuation ruling (VR) is in the field, irrespective of the fact whether any review or revision against that VR is pending in terms of section 25D or relevant rules, as the case may be.”

-

Member Customs to make orders in valuation rulings

The Tax Laws (Third Amendment) Ordinance, 2021 has granted enhanced powers to the Member Customs, allowing them to annul or modify orders previously passed by the Director-General of Customs Valuation.

(more…) -

Pakistan customs assures early disposal of valuation ruling issues

KARACHI: Pakistan Customs has assured business community of early resolution of pending valuation ruling issues on priority basis.

Director General Customs Valuation Ms. Shahnaz Maqbool assured this at a meeting held with members of Pakistan Federation of Chambers of Commerce and Industry (FPCCI), a statement said on Thursday.

According to the statement the FPCCI and Pakistan Customs had agreed in principle to form an advisory committee to resolve issues pertaining to valuation through consultation.

DG Customs Valuation Ms. Shahnaz Maqbool in a meeting held at Federation House agreed with the various recommendations of Shabbir Mansha Churra – Convener, Central Standing Committee on Customs, FPCCI – and his team.

The DG also assured of expeditious disposal of cases pending for many years related to valuation rulings. Former President FPCCI Mian Anjum Nisar; VPs FPCCI Hanif Lakhany and Adeel Siddiqui; Former VP Khurram Ejaz and others were also present on the occasion.

Shabbir Mansha Churra drew the attention of DG Valuation to the growing issues related to valuation rolling; and, said that for strong liaison between FPCCI and Customs, it was necessary to form a Joint Advisory Committee.

The committee will have representatives of the concerned stakeholders/associations; and, their legal and business experts.

Mian Anjum Nisar, Former President FPCCI, pointed out that the business community was facing severe problems due to delays in valuation ruling and because of very old valuation business community have to pay extra charges; although, the valuations have come down due to the reduction in the prices of some items.

But, the business and trade community still have the old rates and it calls for a swift and comprehensive process to update valuation ruling.

FPCCI demands that businesses that are in appeals with customs valuation should be facilitated by the department on priority basis and resolutions offered.

-

Customs clearance of iron, steel scrap linked with LMB value

KARACHI: Pakistan Customs has linked the import value of iron and steel scrap with the prices published in London Metal Bulletin (LMB) in order to ensure smooth customs clearance, sources said on Thursday.

The sources said that the Directorate of Customs Valuation last week issued valuation ruling for iron and steel scrap after considering fluctuation in prices in the international markets and on a solution recommended by stakeholders regarding adoption of LMB prices.

The sources said that the directorate previously amended the values of iron and steel scrap through a valuation ruling issued on July 02, 2020.

However, the directorate had received recommendations from stakeholders that the values fixed for the imported goods were causing problems to importers at the clearance stage because the international market varied with demand and supply factor.

The stakeholders also recommended that prices of scrap were also published in LMB for Pakistan imports. Therefore, to ensure transparency, fairness as well as uniformity in assessment, the value should be linked with LMB prices and freight factor should be added when published prices given as FOB (freight on board).

During the meetings to review the valuation of iron and steel scrap, the stakeholders provided copies of the LMB prices and contracts values imported to Pakistan.

Considering the facts, the directorate allowed the customs clearance of iron and steel scrap at the import value published by the LMB.

However, for compressor scrap the directorate fixed $660 per metric ton as customs value for determination of duty and taxes at the time of clearance.

The importers of compressor scraps informed the directorates that 90 percent of the scrap was imported from the USA where chances of under-invoicing were minimal. They demanded that either the scrap should be excluded from ruling or its value should be reduced from current value as per the invoices of recent import values provided by them.

-

Pakistan Customs revises valuation ruling for drinking powder

KARACHI: Pakistan Customs has issued Valuation Ruling No. 1516 for determination of duty and taxes at the time of clearance of imported food supplements (drinking powder), sources said on Wednesday.

The Directorate of Customs Valuation while issuing the valuation ruling dated February 18, 2021 stated that earlier the customs values of food supplements (drinking powder) were determined under Section 25A of the Customs Act, 1969 through Valuation Ruling No. 792/2016 dated January 11, 2016 read with Order in Revision No. 198/2016 dated June 15, 2016 and No. 176/2016 dated March 18, 2016.

It said that M/s. Nestle Pakistan and M/s. Unilever Pakistan had requested for re-determination of Customs values of the goods.

It further said that as the valuation ruling was very old and a considerable time had passed and significant variations in the international prices of food supplements (drinking powder) has taken place.

The directorate said that meetings were held on August 12, 2020 and October 13, 2020 with the stakeholders of the goods.

The importers/stakeholders were asked to submit documents so that customs values could be determined. The stakeholders were asked to provide following documents:

i. Invoice of import during last three months showing factual value.

ii. Websites, names and e-mail addresses of known foreign manufacturers of the item in question through which the actual current value can be ascertained.

iii. Copies of contracts made/Letter of Credit (LCs) opened during the last three months showing the value of items in question.

iv. Copies of sales tax invoices issued during last one year showing the difference in price (excluding duty and taxes) to substantiate their contention.

The directorate issued the following customs values (C&F) US$/kg:

01. Drinking Powders ‘Ovaltine’ in glass bottle: 3.66

02. Drinking Powder ‘Ovaltine’ in Plastic bottle: 3.28

03. Drinking Powder ‘Ovaltine’ in plastic bags/pouches: 3.12

04. Drinking Powder ‘Ovaltine’ in paper bag: 2.95

05. Drinking Powder’ Milo, Bournvita and Complan’ in plastic bottle: 4.43

06. Drinking Powder’ Milo, Bournvita and Complan’ in plastic bags/pouches: 3.62

07. Drinking Powder’ Milo, Bournvita and Complan’ in paper bags: 4.03

08. Drinking Powder ‘ Milo’ in tin pack: 4.63

09. Drinking Powder ‘Nesquick’ in plastic bottle: 3.92

10. Drinking Powder ‘Nesquick’ in paper bags: 4.90

11. Drinking Powder ‘Horlicks’ in plastic bottle: 3.75

12. Drinking Powder ‘Horlicks’ in paper bags: 3.60

13. Drinking Powder ‘Horlicks’ in glass bottle: 4.20

14. Drinking Powder ‘Milo’ in bulk packing (25kg or above): 2.90

The directorate said that above values do not apply to the imports made directly made by the multinational companies from their sister concerns. Such consignments shall be assessed in accordance with provisions of Section 25 of Customs Act, 1969 and kept under close watch.

Any anomaly observed may be taken cognizance of and reported to the directorate.

-

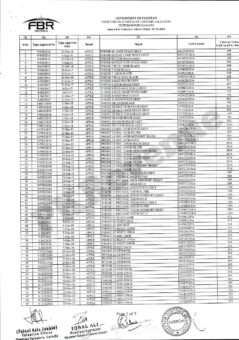

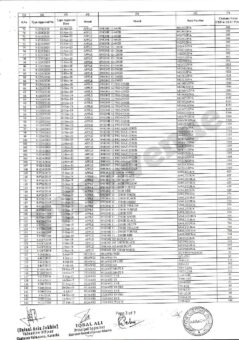

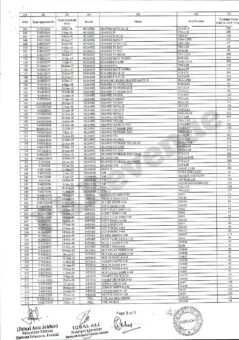

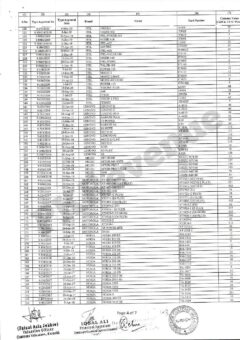

FBR issues fresh customs valuation for mobile phones

KARACHI: Federal Board of Revenue (FBR) has issued fresh customs values of mobile phone devices for the determination of duty and tax, sources said on Tuesday.

The Directorate General of Customs Valuation has issued valuation advice dated February 18, 2021, in respect of mobile phone devices to determine assessable customs values of mobile phone devices.

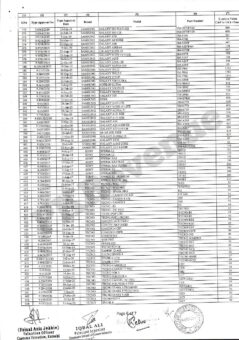

The directorate said that customs values as given in column 7 of the attached images may be considered for the purpose of assessment of duty and taxes.

These values will also be relevant for assessment and proceedings under SRO 1455(I)/2018 and SRO 1456(I)/2018 both dated November 29, 2018 read with Customs General Order No. 06/2018 dated November 29, 2018.

The directorate further said that the enclosed list is not exhaustive; however, mostly traded brands and models as provided by Mobile Phone Importers and Manufacturers Association (MPIMA).

For assessment of brands and models which are imported in commercial quantity but are not included in the enclosed annexure, the clearance collectorate have been advised to assess those under Section 81 of the Customs Act, 1969 and then forward a reference to the directorate for final determination of values thereof.

It further said that where in the enclosed annexure, type approval is not given or is under process, clearance collectorate shall fulfill the regulatory requirements pertaining for type approval/certificate of compliance from PTA first as envisaged under the law.

It is pertinent to mention that the valuation advice will be regularly updated and issued accordingly.

Following is the fresh customs valuation for mobile phone devices:

To watch the news in Urdu please visit and subscribe our YouTube Channel at

-

Customs values increased for imported imitation jewellery

KARACHI: Customs values of imported artificial / imitation jewellery have been increased for determination of duty and taxes at the time of customs clearance.

The Directorate General of Customs Valuation has issued Valuation Ruling No. 1509/2021 dated January 27, 2021.

The directorate said that earlier the customs values of artificial jewellery were determined under Section 25A of Customs Act, 1969 through Valuation Ruling No. 1376/2019 dated May 30, 2019.

The directorate general of customs valuation was tasked by the Federal Board of Revenue (FBR) to identify the items/goods where variation with respect to values in exporting countries viz-a-viz import values in Pakistan were observed and where valuation ruling already exist.

Accordingly, a special team was constituted in Directorate General of Customs Valuation, which identified the subject items where vast variations in declarations/specifications were observed.

Accordingly, an exercise was initiated to re-determine the customs values of artificial imitation jewellery under Section 25A of the Customs Act, 1969.

The directorate invited stakeholders to present evidence of the import values of the goods.

The meetings were attended by representatives from M/s. GA Jahangir & Associates authorized by various importers and stakeholders. The point of view heard in detail to arrive at customs values of subject goods.

The stakeholders claimed that their declared values were true transactional values and may be accepted as such. The stakeholders also submitted their proposal regarding values of artificial jewellery but failed to substantiate said values with documentary evidences.

The customs values of following artificial jewellery on import of various origins have been amended:

01. Electroplated white/yellow, without stones/beads:

The customs value enhanced to $3.85/kg from $3.54 on import from China.

The customs value enhanced to $5.40/kg from $4.97 on import from other origins.

02. Electroplated white/yellow, with plastic stones / beads:

The customs value enhanced to $4.40/kg from $4.12 on import from China.

The customs value enhanced to $6.55/kg from $6.12 on import from other origins.

03. Fancy Electroplated white/yellow, with crystal stones/beads:

The customs values enhanced to $12.5/kg from $11 on import from China.

The customs values enhanced to $27.35/kg from $24 on import from other origins.

In the previous valuation ruling a separate rate for imitation jewellery import from India was given. However, in the latest valuation ruling the rate of the goods on import from India has been eliminated.