KARACHI: The share market witnessed a robust increase of 170 points on Friday, propelled by the rebalancing of international stock markets and improved sentiments ahead of the forthcoming Monetary Policy Statement (MPS).

(more…)Month: September 2020

-

Rupee appreciates by 38 paisas on export receipts, remittances inflows

The Pakistani Rupee experienced a notable appreciation of 38 paisas against the US Dollar on Friday, closing at Rs165.83 in the interbank foreign exchange market.

(more…) -

Foreign direct investment surges by 40 percent in two months

The net inflow of foreign direct investment (FDI) in Pakistan has surged by an impressive 40% during the first two months of the current fiscal year, according to data released by the State Bank of Pakistan (SBP) on Friday.

(more…) -

PSX imposes restriction on New Peak Securities

KARACHI: Pakistan Stock Exchange (PSX) on Thursday imposed restriction on M/s. New Peak Securities (Private) Limited – TREC Holder – on failure to comply with the instructions of the exchange.

In a notification, the PSX informed all market participants that M/s. Peak Securities (Private) Limited – TREC Holder, PSX (New Peak) failed to comply with the instructions of the exchange, which is a non compliance of clause 20.5.1 of PSX Regulations.

The said clause is reproduced as:

“20.5.1. Pursuant to Clause 20.4 hereinabove, the CRO, sub-committee of RAC or RAC, as the case may be, may initiate disciplinary actions against a TRE Certificate Holder under sub-clause 20.5.2 when it is prima facie established that such TRE Certificate Holder has breached one or more of the PSX Regulations or failed to comply with a policy, procedure, order, notice, guideline, direction, manual, decision, instruction or ruling of the Exchange or failed to provide any required information or provided incomplete, false, forged or misleading information to the Exchange as may be required from time to time.”

In order to protect the interest of investing public, the exchange, after providing due hearing opportunity, has decided to “impose restriction on opening of new clients’ accounts” with immediate effect alongwith financial penalty on New Peak, under clause 20.5.2 of PSX Regulations.

The said clause is reproduced as:

“20.5.2. GENERAL DISCIPLINARY ACTIONS:

Disciplinary actions that may be taken pursuant to sub-clause 20.5.1 are as follows:

(a) Issue a warning in writing to act more carefully and vigilantly;

(b) Reprimand in writing that the conduct warrants censure;

(c) Impose a fine;

(d) Impose any one or more conditions or restrictions;

(e) Mandate educational qualification, training or such other program as may be determined by the relevant authority to be undertaken or implemented by the Broker for its employees;

(f) Direct to take remedial actions to rectify the breach including appropriate action(s) against any of its employees concerned behind such breach, whether directly or indirectly ; and/or take such other action as the relevant authority may deem appropriate;

(g) Suspend any or all trading terminals.”The PSX said that the enforcement action has been taken without prejudice to the right of the exchange to further initiate any inquiry, special audit with expanded, restricted or different scope to take any punitive action against New Peak in accordance with relevant regulations on matters subsequently investigated or otherwise brought to the knowledge of the exchange.

-

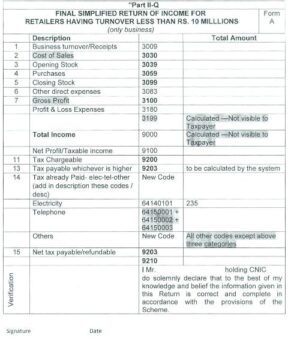

FBR issues single page return form for shopkeepers, traders

ISLAMABAD: Federal Board of Revenue (FBR) on Thursday issued final draft of single-page income tax return for shopkeepers /small traders having annual turnover less than Rs10 million.

The FBR issued SRO 885(I)/2020 to notify the final draft. Previously, the FBR on September 08, 2020 issued draft return form for shopkeepers/traders through SRO 821(I)/2020 to invite comments.

In the single return form, the traders are required to provide following details:

The traders will also require to submit simple wealth statement form. In this form the traders shall provide following details:

-

Banks directed to apply AML/CFT rules on issuance of saving certificates

KARACHI: State Bank of Pakistan (SBP) on Thursday directed banks to implement anti-money laundering (AML) and Counter Financing for Terrorism (CFT) rules related to issuance of National Saving Schemes (NSS).

The SBP said that commercial banks are performing functions of sale, encashment, profit payment etc. of various NSS such as prize bonds, SSC and DSC.

In this connection, your attention is invited towards National Savings Schemes (AML & CFT) Rules, 2019 promulgated by the Ministry of Finance, Government of Pakistan vide Notification No. F.No.16(1)GS-I/2019-98 dated January 23, 2020, sub-rule (3) of Rule 1 whereof reads as:

“These rules shall apply to all offices and persons responsible for the issuance, management, marketing, registration, replacement, sale and discharge of the instruments issued by and the accounts opened at and maintained with the National Savings Centers, Pakistan Post and any other office designated as offices of issue.”

In light of the cited rule, being the office of issue, the said Rules are also applicable on the commercial banks. Therefore, it is advised to ensure implementation of and compliance with the enclosed NSS (AML&CFT) Rules, 2019 and arrange for necessary dissemination to the concerned officials and branches, the SBP said.

-

FBR forms committees to eliminate inequalities in taxation system

ISLAMABAD: Federal Board of Revenue (FBR) on Thursday formed committees for elimination of inequality in taxation system and speedy resolution of taxpayers’ complaints.

(more…) -

Foreign exchange reserves remain flat at $19.959 billion

KARACHI: The liquid foreign exchange reserves of the country were remained flat at $19.959 billion by week ended on September 11, 2020, State Bank of Pakistan (SBP) said on Thursday.

The foreign exchange reserves of the country were at $19.961 billion by week ended September 04, 2020.

The official foreign exchange reserves of the SBP increased by $12 million to $12.82 billion by week ended September 11, 2020 as compared with $12.808 billion by week ended September 04, 2020.

The foreign exchange reserves held by commercial banks fell by $14 million to $7.139 billion by week ended September 11, 2020 as compared with $7.153 billion by week ended September 04, 2020.

-

Share market gains 53 points amid selling pressure

KARACHI: The share market gained 53 points on Thursday despite selling pressure seen in the market during the day.

The benchmark KSE-100 index of Pakistan Stock Exchange (PSX) closed at 42,334 points as against 42,282 points showing an increase of 53 points.

Analysts at Arif Habib Limited said that the market opened on a positive note with +193 points and added a total of 350 points on the index.

Selling pressure eroded most of the gains by the end of session, closing the index +53 points. Financial results of DGKC helped the stock post price gains.

Among technology stocks, PTC hit upper circuit whereas Chemical sector helped EPCL touch recent times high. Technology sector topped the volumes with 108.6 million shares, followed by Power (47.5 million) and Vanaspati (45.2 million). Among scrips, KEL led the table with 70.5 million shares, followed by HASCOL (37.4 million) and DCL (28.1 million).

Sectors contributing to the performance include Chemical (+23 points), Technology (+17 points), E&P (+14 points), Insurance (-15 points), Pharma (-7 points).

Volumes increased from 489.6 million shares to 508.7 million shares (+4 percent DoD). Average traded value also increased by 3 percent to reach US$ 90.8 million as against US$ 87.9 million.

Stocks that contributed significantly to the volumes include PTC, UNITY, HASCOL, FFL and PIBTL, which formed 42 percent of total volumes.

Stocks that contributed positively to the index include EPCL (+20 points), POL (+14 points), PTC (+13 points), PSO (+13 points) and ENGRO (+12 points). Stocks that contributed negatively include FFC (-12 points), AICL (-9 points), JLICL (-8 points), NESTLE (-6 points) and ABL (-5 points).