ISLAMABAD – The Federal Board of Revenue (FBR) has established a clear procedure for taxpayers to obtain exemption certificates for the exemption from advance income tax on imported goods.

(more…)Day: November 25, 2020

-

Return filing may reach 6.5 million if NTN holders make compliance

ISLAMABAD: The number of return filers may reach near 6.5 million if persons obtained National Tax Number (NTN) make compliance.

According to the Federal Board of Revenue (FBR) more than 3.5 million are those NTN holders are not filing income tax return.

Under Section 114 of Income Tax Ordinance, 2001 the filing of income tax return is mandatory for person whom the NTN is issued.

The existing income tax return filing is around 3 million for tax year 2019.

The FBR has launched a campaign to aware persons about their obligation. The revenue board also warned people of penal action in case remained non-compliant beyond the deadline for filing tax return for tax year 2020.

The last date for filing income tax return is December 08, 2020 and FBR has made it clear that no further extension will be granted beyond this date.

The FBR said that it had obtained information of various undeclared transactions from withholding agents and through third party.

-

Stock market ends up by 514 points amid activity in energy sector

KARACHI: The stock market witnessed a gain of 514 points on Wednesday as trading activity was seen in energy sector following increase in prices of international crude oil.

The benchmark KSE-100 index of Pakistan Stock Exchange (PSX) closed at 40,378 points as against 39,863 points showing an increase of 514 points.

Analysts at Arif Habib Limited said that E&P stocks drove the market today, contributing surge in the index, with OGDC and PPL hitting upper circuit at close.

Crude oil prices increased significantly overnight and maintained the momentum during today’s session as well, which particularly helped those Investors concerned with decline in Cement dispatches to switch to better alternative.

Banks, Textile and Fertilizer sector also contributed to the positivity. Cement sector continued the downturn today and traded below respective LDCPs the entire session.

Among scrips, FFBLR topped the volumes with 28.5 million, followed by TRG (21.1 million) and UNITY (20.8 million).

Sectors contributing to the performance include E&P (+280 points), Banks (+93 points), Technology (+78 points), O&GMCs (+31 points) and Fertilizer (+25 points).

Volumes increased from 174.7 million shares to 213.4 million shares (+22 percent DoD). Average traded value also increased by 42 percent to reach US$ 60.7 million as against US$ 42.6 million.

Stocks that contributed significantly to the volumes include TRG, UNITY, HASCOL, FFBL and OGDC, which formed 29 percent of total volumes.

Stocks that contributed positively to the index include PPL (+93 points), OGDC (+90 points), POL (+68 points), SYS (+41 points) and TRG (+34 points). Stocks that contributed negatively include HUBC (-23 points), LUCK (-17 points), FCCL (-9 points), EFERT (-8 points) and ABOT (-6 points).

-

FBR exempts sales tax on medical goods for COVID prevention, treatment

ISLAMABAD: Federal Board of Revenue (FBR) on Wednesday exempted whole of sales tax on import of medical instruments and equipments for prevention and treatment of COVID pandemic.

(more…) -

FPCCI demands expanding raw material list for reduced income tax rate

KARACHI: Federation of Pakistan Chambers of Commerce and Industry (FPCCI) on Wednesday urged the tax authorities to expand the list of raw material for purpose of reduced income tax rate at import stage.

FPCCI President Mian Anjum Nisar while reacting to SRO 1240(I)/2020 dated November 20, 2020 stated that through this notification a very few number of raw material had been added to 12th Schedule for the purpose of reduced income tax rate at 2 percent at import stage.

The Federal Board of Revenue (FBR) has allowed a list of industrial raw materials for benefits under 12 Schedule.

The anomalies committee of FBR declared very few raw materials not to be included in the finished goods and allowed to pay 2 percent income tax instead of 5.5 percent this of course resolves an important issue of commercial importers but there is still a long list of raw materials to be considered the same way.

The FPCCI has been emphasizing for the removal of duties / taxes on the industrial raw materials. However, the SRO 1240(1)/2020 dated 20-11-2020 cover a limited item that does not support industry, while there is an exhaustive list of industrial raw materials already contained in rescinded SRO 1125(1)/2011 dated 31-12-2011.

In order to further facilitate the industry there is an immediate need to revise the list of industrial raw materials as per SRO 1240(1)/2020 dated 20″ November, 2020.

FPCCI president strongly recommends addressing the grievances of the industry at the earliest and resolving the issues being faced by the industry through amendments and inclusion of all raw materials in the said SRO.

-

Minimum wage for unskilled laborers fixed at Rs17,500

KARACHI: Sindh government has fixed minimum wage for unskilled laborers at Rs17,500, a statement said on Wednesday.

According to the notification issued by Zahid Hussain Khemtio, Chairman, Minimum Wages Board, the Sindh government has fixed minimum wages of Rs. 17,500 per month for unskilled workers and under the Sindh Minimum Wages Act 2015, all industrial and commercial establishments across the province are bound to pay the fixed wages.

Chairman Sindh Minimum Wages Board Zahid Hussain Khemtio said in a statement that if anyone has a complaint in this regard, one should call these numbers and can lodge one’s complaint on 021-99211344 and 03003013110 and action will be taken against the institution which does not comply with the Act on receipt of the complaint. He further said that the said law is effective from July 1, 2019.

-

Rupee makes another gain of 82 paisas against dollar

KARACHI: The Pak Rupee gained another 82 paisas against dollar on Wednesday owing to ease in demand for import payment and improved economic indicators.

The rupee ended Rs159.27 to the dollar from previous day’s closing of Rs160.09 in interbank foreign exchange market.

Currency dealers said that due to second phase of covid pandemic globally and subsequent lockdowns discouraged importers to place new orders.

Further the improved foreign exchange reserves and current account surplus also supported the rupee to make gain.

The local currency recovered Rs1.72 against dollar during past three trading days.

-

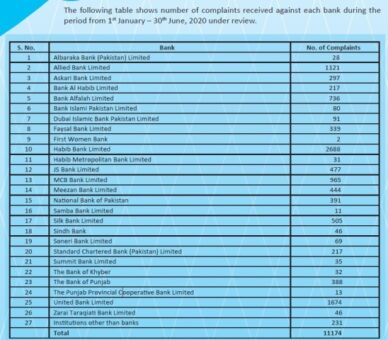

Mohtasib receives 11,174 complaints against banks during six months

KARACHI: Around 11,174 complaints have been filed against commercial banks during first half of current calendar year, said a report issued by Banking Mohtasib (Ombudsman) Pakistan.

The office of banking ombudsman in its half yearly report (January – June 2020) said that due to more public awareness about this institution as an alternate dispute resolution forum, in the last three years there has been seen an increase of 62 percent in public complaints.

“Although during the Global Pandemic of Covid-19 despite of the fact that our office was not working at full strength, we have received 11,174 complaints during first six months of the year 2020 (i.e. from 01.01.2020 to 30.06.2020).”

These also include the complaints received at the Prime Minister Portal relating to banking issues. The increase in number of complaints represents the confidence of general public in the working of this institution and the relief being obtained speedily and without any cost.

The recent development in the technological field such as the digital banking, internet banking, mobile banking and ATMs, in the development of the economic activity in the country is enormous.

Unfortunately, a large segment of our society is not financially literate besides, low level of education particularly those living in the rural areas do not have much knowledge about the products introduced by the banks.

Certain fraudsters taking advantage of the innocent people misguide them for their poor knowledge of the latest banking techniques.

All bank are continuously making public awareness campaigns, to discourage their evil designs and guiding the customers not to disclose details of their personal and financial credentials to any unknown person but during past two to three years, a large number of complaints of unauthorized fund transfer were received.

Recommendations in this regard to SBP have been made time to time to protect the depositors hard earned savings.

Related Stories