Karachi, May 19, 2024 – According to the latest data released by the State Bank of Pakistan (SBP), bearer prize bonds worth Rs 4.61 billion remain unclaimed as of March 2024. These bonds are set to expire on June 30, 2024, after which they will hold no value.

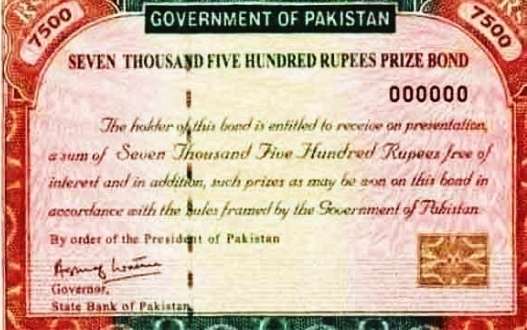

The Pakistani government ceased the circulation of bearer prize bonds with denominations of Rs 7,500, Rs 15,000, Rs 25,000, and Rs 40,000 as part of a broader strategy to document the economy and curb illicit financial activities. The deadline for redeeming or exchanging these bonds is rapidly approaching, urging holders to act before they become worthless.

The SBP’s data breaks down the unclaimed amounts as follows: Rs 1.413 billion in Rs 7,500 denomination bonds, Rs 1.641 billion in Rs 15,000 denomination bonds, Rs 754 million in Rs 25,000 denomination bonds, and Rs 800 million in Rs 40,000 denomination bonds. These figures highlight a significant amount of unredeemed value that bondholders must address promptly.

To facilitate the redemption process, the government has provided several options for bondholders. Bearer prize bonds can be exchanged for premium prize bonds or converted directly into bank account deposits. This initiative aims to transition the economy towards more transparent financial practices and integrate unregistered funds into the formal banking system.

The phasing out of these unregistered prize bonds is a part of broader economic reforms targeting greater financial transparency. By eliminating bearer bonds, which have historically facilitated anonymous transactions, the government aims to reduce the potential for money laundering and tax evasion.

For bondholders, the impending June 30 deadline marks a critical juncture. Financial experts urge all individuals and institutions holding these bonds to initiate the redemption process immediately to avoid financial loss. Failure to act will result in the bonds becoming void, rendering the Rs 4.61 billion currently in circulation effectively worthless.

The State Bank of Pakistan continues to encourage citizens to redeem their bonds, offering detailed guidance on the exchange process. This effort is part of a broader push to educate the public on the importance of integrating their assets into the formal economy.

As the deadline looms, the SBP’s ongoing outreach efforts aim to ensure that no bondholder is left uninformed or unprepared. With just over a month remaining, the urgency for action cannot be overstated. The transition away from bearer prize bonds marks a significant step towards a more documented and regulated financial environment in Pakistan.