KARACHI: Pakistan Customs has issued Valuation Ruling No. 1516 for determination of duty and taxes at the time of clearance of imported food supplements (drinking powder), sources said on Wednesday.

The Directorate of Customs Valuation while issuing the valuation ruling dated February 18, 2021 stated that earlier the customs values of food supplements (drinking powder) were determined under Section 25A of the Customs Act, 1969 through Valuation Ruling No. 792/2016 dated January 11, 2016 read with Order in Revision No. 198/2016 dated June 15, 2016 and No. 176/2016 dated March 18, 2016.

It said that M/s. Nestle Pakistan and M/s. Unilever Pakistan had requested for re-determination of Customs values of the goods.

It further said that as the valuation ruling was very old and a considerable time had passed and significant variations in the international prices of food supplements (drinking powder) has taken place.

The directorate said that meetings were held on August 12, 2020 and October 13, 2020 with the stakeholders of the goods.

The importers/stakeholders were asked to submit documents so that customs values could be determined. The stakeholders were asked to provide following documents:

i. Invoice of import during last three months showing factual value.

ii. Websites, names and e-mail addresses of known foreign manufacturers of the item in question through which the actual current value can be ascertained.

iii. Copies of contracts made/Letter of Credit (LCs) opened during the last three months showing the value of items in question.

iv. Copies of sales tax invoices issued during last one year showing the difference in price (excluding duty and taxes) to substantiate their contention.

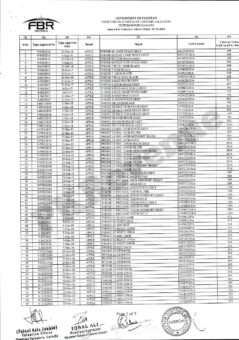

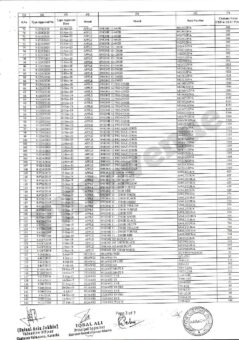

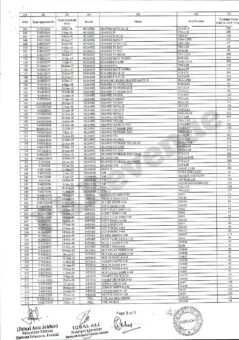

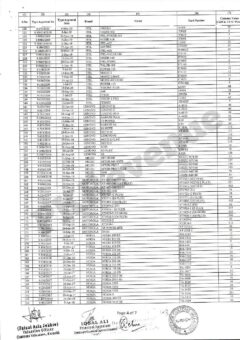

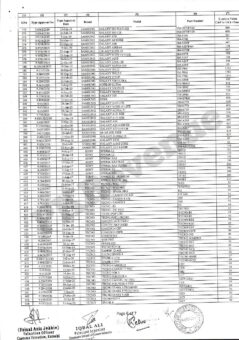

The directorate issued the following customs values (C&F) US$/kg:

01. Drinking Powders ‘Ovaltine’ in glass bottle: 3.66

02. Drinking Powder ‘Ovaltine’ in Plastic bottle: 3.28

03. Drinking Powder ‘Ovaltine’ in plastic bags/pouches: 3.12

04. Drinking Powder ‘Ovaltine’ in paper bag: 2.95

05. Drinking Powder’ Milo, Bournvita and Complan’ in plastic bottle: 4.43

06. Drinking Powder’ Milo, Bournvita and Complan’ in plastic bags/pouches: 3.62

07. Drinking Powder’ Milo, Bournvita and Complan’ in paper bags: 4.03

08. Drinking Powder ‘ Milo’ in tin pack: 4.63

09. Drinking Powder ‘Nesquick’ in plastic bottle: 3.92

10. Drinking Powder ‘Nesquick’ in paper bags: 4.90

11. Drinking Powder ‘Horlicks’ in plastic bottle: 3.75

12. Drinking Powder ‘Horlicks’ in paper bags: 3.60

13. Drinking Powder ‘Horlicks’ in glass bottle: 4.20

14. Drinking Powder ‘Milo’ in bulk packing (25kg or above): 2.90

The directorate said that above values do not apply to the imports made directly made by the multinational companies from their sister concerns. Such consignments shall be assessed in accordance with provisions of Section 25 of Customs Act, 1969 and kept under close watch.

Any anomaly observed may be taken cognizance of and reported to the directorate.