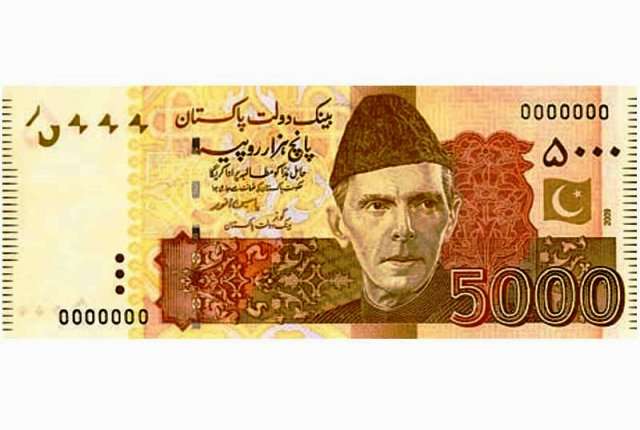

Pakistan Business Council (PBC) in a report suggested discontinuation of the highest denomination banknote of Rs5000 in order to formalize the country’s economy.

It said that Pakistan’s Tax to GDP ratio will remain more or less at the current rate as will its ability to invest in human capital – health and education, unless there is political will and capacity/capability in the enforcement machinery to formalize the economy and broaden the tax base.

Chasing existing tax payers for more, whilst allowing the informal sector to grow, is akin to killing the goose that lays the golden eggs.

With nearly a third of money in circulation outside the banking system, 80 per cent of the population unbanked and 60 per cent (80 Million people) not included in any financially transparent system, creating the opportunities for financial inclusion, concurrent with disincentives for the use of cash should be major thrusts.

READ MORE: SBP’s foreign exchange reserves drop to dangerous level of $3.09 billion

These can be achieved through leveraging the growing penetration of smartphones. The money transmission systems now in vogue, still depend on the use of cash and in that respect act as virtual ATM machines which do not serve the purpose of cash-less transactions. Point of Sales (POS) terminals are expensive which is why the number in the country has not grown. POS terminals serve to switch from cash to plastic and do create transactional transparency.

The Punjab Government’s incentive to reduce GST on some card payments is therefore a step in the right direction which should be replicated.

However, with intermediate commissions and charges, the use of cards will remain limited. Digital wallets with vendor QR codes are a better option to displace cash. “Discontinuation of the Rs.5,000 note and restrictions on use of cash above a certain limit would also assist,” it added.

Inter-bank transfer speed has improved and will further improve through Raast and Digital Banks.

The Universal Payment Interface (UPI) in India allows money to be transferred across 142 banks, to/from mobile wallets, beneficiaries using the CNIC equivalent and to vendors using QR codes etc.

The State Bank can also facilitate a common KYC process for all financial transactions including those on the Stock Exchange and for insurance purposes;

READ MORE: Pakistan trade deficit narrows by 32pc in 7MFY23

Address the large undocumented and under-valued parts of the economy – real estate, gold, cash, prize bonds, foreign currency etc., and a fiscal regime that fails to discourage accumulation of wealth in unproductive assets, thus denying the country full potential to invest in productive sectors. Hence Pakistan’s savings and investment levels are about half those of its neighbours.

A 17 per cent General Sales Tax (GST) rate in a poorly documented economy, together with relatively high import and excise duties provide an attractive incentive to evade, the spoils of which are then shared with a notoriously inefficient enforcement and collection machinery.

Since provincial GST does not apply on goods, provinces where most of the evasion of federal taxes takes place, have no financial interest to stem it. However, reducing the GST rate has significant negative impact on government revenue in the short term and the IMF conditionalities are unlikely to permit it.

Neither is government likely to summon enough political will to challenge much of the trader vote bank which benefits from evasion of the high GST rate. Until rates can be reduced and the collection machinery strengthened, the formal sector will continue to bear the brunt of these levies and the government will be denied taxes to fund social development.

Some measures like the requirement of Urdu language labelling on imported finished products need to be supplemented with raids on shops selling those not meeting this condition;

It is estimated that imports are under invoiced by $5 billion annually. This hurts the national exchequer and creates an unfair playing field for the formal sector. Agreement to exchange data on the value of imports/exports through Electronic Data Interchange (EDI) with partner countries would help stem under invoicing. It should at the very least be implemented with China;

READ MORE: Expected sales tax on petroleum products to further inflate consumer prices

The transit treaty with Afghanistan has been misused through diversion of goods to Pakistan. As the treaty has expired, Pakistan can renegotiate in current more regionally favorable environment, to put quantitative and qualitative restrictions on what can transit, insist on letters of credit, charge duty and GST on import which would only be refunded to the Afghan government on exit, track and monitor containers, strengthen inspection of empty containers returning and make physical controls along the border stronger. The civil and military authorities need to be on the same page to do this;

The provincial food authorities pursue the formal sector with greater vigor than the informal sector, firstly, because it is easier and secondly, due to its headline news value. Yet, the greater benefit to consumers of their actions would be in stemming adulteration, for example of unpacked and unbranded milk sold in milk shops and through home deliveries;

Front-loaded and unrealistic tax collection targets for an inadequately resourced Federal Board of Revenue (FBR) and provincial revenue authorities forces them to chase existing tax payers and adopt harassment rather than objective assessment as the means to meet these. Until the FBR and the provincial revenue authorities are radically restructured and their capacity to broaden the tax base through use of technology is not addressed, the scope of broadening the tax base will remain limited. Tax collection targets should be set separately for those in and outside the tax base so that its achievement of growing the latter becomes more visible;

Counterfeiting, especially of food and drugs is a menace that affects the consumers as much as it hurts the government and the formal sector. Weak enforcement of Intellectual Property Rights also puts off foreign investment. One way to check counterfeiting of consumer products is to move the trials to consumer courts and to allow prosecution to be conducted by the lawyers of the hurt parties rather than public prosecutors;

On a positive note, FATF and Anti Money Laundering laws have made it difficult for transactions to take place outside the banking system. This has effectively cut-off to a major extent the means to fund under invoicing and smuggling and is positive for the formalization of the economy;

READ MORE: Pakistan headline inflation increases by 27.6pc in January 2023

Real Estate has been a traditional repository of “black” money. Whilst there is some progress in stemming the flow into this sector, better collaboration between the Federation and the Provinces in taxation would accelerate its formalization. Fiscal policy also needs to ensure that investment in real estate and gains arising therefrom do not enjoy an unfair advantage over investment and gains in the formal corporate sector.

A large informal economy has the following detrimental effects:

— Weak resource mobilization resulting in under-investment in socio-economic development, impeding productivity. Hence high percentage of children out of school, stunting, poor health-care, low Human Development Indicators etc

— Poor physical infrastructure, difficult and costly to move people and goods

— Low levels of investment as the undocumented sector lacks access to formal banking

— Exploitation of labour as well as use of child labour

— Irresponsible environmental practices

— Non-compliance with product health and safety standards

— Theft/short payment of utility dues leading to increasing circular debt and reduced investments by utility companies

— Inability of the SME sector to integrate with larger businesses

— Poor gender balance and working conditions

— Exploitation by law enforcing agencies, bureaucrats, money lenders, intermediaries and sometimes criminals

— Increased likelihood of money laundering, reliance on hawala/informal monetary exchange

— Accumulation of undocumented wealth in non-productive assets, especially, unproductive investment in land.