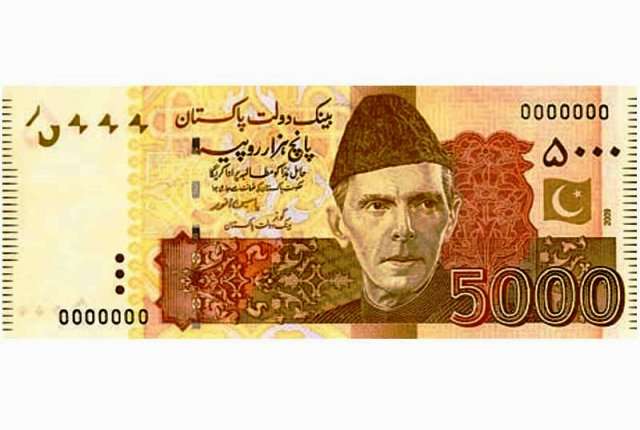

Islamabad, May 11, 2024: In a bold move aimed at curbing cash transactions and enhancing tax compliance, foreign investors operating in Pakistan have proposed the government to demonetize the Rs 5,000 banknote.

The recommendation comes as part of a comprehensive set of proposals put forth by the Overseas Investors Chamber of Commerce and Industry (OICC) for the upcoming budget 2024-25.

The OICC, representing the collective voice of foreign investors in Pakistan, has underscored the urgent need for measures to improve tax collection, broaden the tax base, and reduce the prevalence of cash transactions in the economy. The demonetization of the high-value banknote is seen as a crucial step towards achieving these objectives.

Tax Reform Recommendations

According to the OICC, the current tax collection in Pakistan falls significantly short of the government’s revenue targets. To address this issue, the chamber has called for an increase in the tax-to-GDP ratio to at least 15% and the allocation of substantial resources towards broadening the tax base. The proposals emphasize the need for all sectors, including agriculture, real estate, and wholesale/retail trade, to contribute proportionately to the national exchequer based on their GDP contribution.

The recommendations further outline specific measures targeting various sectors to enhance tax compliance. For instance, the wholesale and retail sector would face increased income tax withholding rates, with mandatory reporting of sales by manufacturers and importers to identify unregistered buyers. Tier-1 retailers, including jewelers and property dealers, would be subject to strict enforcement measures, such as 100% Point of Sale (POS) integration.

Taxation on Immovable Property and Service Providers

The proposals also address taxation on immovable property, suggesting the collection of withholding tax along with property tax by provinces, with a focus on identifying undeclared properties. Additionally, capital gains tax exemptions on the sale of immovable property would be limited to those who declared the property upon acquisition.

Service providers and professionals, including doctors, lawyers, and educational institutes, would be brought into the tax net through mandatory POS integration and compulsory tax return filings for license renewals. Similarly, non-corporate businesses would face enhanced withholding tax rates to incentivize incorporation and discourage undocumented transactions.

Tax Culture Promotion and Incentivization

In addition to structural tax reforms, the OICC has proposed initiatives to promote a culture of tax compliance and incentivize taxpayers. These include offering tax credits or deductions for businesses promoting compliance, establishing recognition programs for consistent taxpayers, and providing preferential treatment in government services for active taxpayers.

The chamber also advocates for tax education initiatives at the school level and the inclusion of taxes and levies knowledge in higher education curricula to enhance public awareness and understanding of tax obligations.

Call for Government Action

The recommendations put forth by foreign investors underscore the urgent need for comprehensive tax reforms to address the challenges of revenue collection, tax evasion, and cash transactions in the Pakistani economy. The proposed measures, if implemented effectively, have the potential to bolster government revenues, improve transparency, and create a more conducive environment for foreign investment.

As Pakistan prepares to unveil its budget for the fiscal year 2024-25, all eyes will be on the government to see how it responds to these bold proposals and charts a path towards a more robust and equitable tax system. With the support of foreign investors and concerted efforts from policymakers, Pakistan could embark on a transformative journey towards sustainable economic growth and development.