PkRevenue.com – The Institute of Chartered Accountants of Pakistan (ICAP) has called for stricter measures to address rampant smuggling plaguing the Afghan Transit Trade (ATT).

In its proposals for the upcoming budget 2024-25, ICAP emphasizes the significant threat smuggling poses to Pakistan’s economic growth.

Smuggling: A Drain on the Economy

ICAP highlights the devastating impact of smuggled goods entering through borders with Iran, China, India, and most concerningly, via the ATT. This illicit activity fuels a vast informal economy, costing the national treasury billions of rupees in lost tax revenue.

Strangled Industries, Flooded Markets

The report paints a grim picture of Pakistani markets overflowing with smuggled goods. Local industries are struggling to compete against these cheaper, often untaxed imports, leading to declining sales and potential closures.

ICAP’s Proposals for a Fair Playing Field

To create a level playing field for Pakistani businesses and boost government revenue, ICAP proposes a multi-pronged approach:

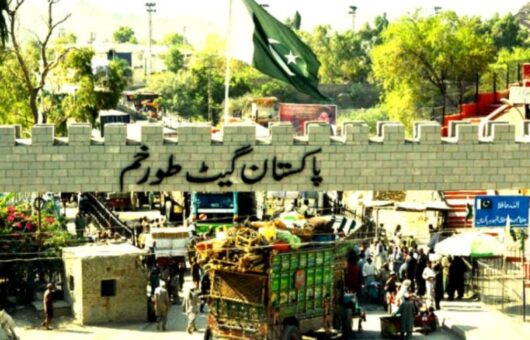

1. Scanner Technology: Installing scanners at Pak-Afghan borders (Torkham and Chaman) is crucial. Similar to the system used at Port Qasim for US exports, these scanners would enable real-time inspection of container contents, verifying their delivery to the Afghan border without tampering. ICAP emphasizes integrating these scanners with a tracking system that monitors containers from the point of entry into Pakistan to the Afghan border.

2. Synchronized Scans and Data Sharing: Matching the initial scan image at the import stage with the final scan at the Afghan border would provide a clear picture of any discrepancies or potential misuse of containers. Additionally, ICAP suggests that Afghan importers file entries in the Afghan WeBOC system (developed with Pakistan’s assistance). This would allow Pakistan customs to access Afghan customs data and mark cleared containers accordingly. Containers not cleared within a specified timeframe would be flagged for further scrutiny.

3. Duty Collection and Revenue Sharing: ICAP proposes that Pakistan Customs collect duties on behalf of the Afghan government at the time of entry. These collected funds would then be transferred to Afghanistan upon confirmation of the consignment’s clearance.

4. “Commitment Fee” for Safe Transit: To discourage misuse of the ATT system for smuggling, ICAP recommends a temporary 18% sales tax as a “commitment fee for safe transit into Afghanistan.” This fee, based on historical data of increased ATT activity for high-tariff items, would be refunded upon successful clearance of goods in Afghanistan, mirroring the system used for Pakistani exports.

5. Verification of Afghan Importers: To ensure the legitimacy of ATT participants, ICAP proposes requiring Afghan importers to submit their Income Tax/Sales Tax registration numbers. These numbers would be verified online with Afghanistan’s tax registration system. Additionally, a database would be maintained to track the annual import value under each registration number. Furthermore, importers would be required to submit copies of their Afghan sales tax returns to Pakistani customs at the end of each year. This would create a system of accountability, deterring companies from forming new entities to bypass regulations. ICAP acknowledges that Afghanistan might not have a fully functional tax registration system in place. In such a scenario, they propose allowing a grace period for Afghanistan to develop this system.

Curbing Smuggling: A Path to Growth

ICAP believes that implementing these stricter protocols is essential to curb smuggling, illegal trade, and fake imports and exports plaguing the ATT. By establishing a more transparent and secure system, the government can create a fairer environment for Pakistani businesses, generate much-needed tax revenue, and ultimately foster sustainable economic growth.