ISLAMABAD: Federal Board of Revenue (FBR) has issued new rates of sales tax on mobile phones after implementation of the mini budget.

The federal government introduced the mini budget by presenting Finance (Supplementary) Bill, 2023 on February 15, 2023. The bill has been given the status of Act after both the assemblies and the President have approved the same.

READ MORE: FBR issues new rates of duty, taxes under Finance (Supplementary) Act 2023

Through the new amendments the rates of sales tax on mobile phones have been enhanced up to 25 per cent.

The sales tax on mobile phones is governed under Ninth Schedule of Sales Tax Act, 1990.

READ MORE: Experts question sales tax rate increase without Parliament approval

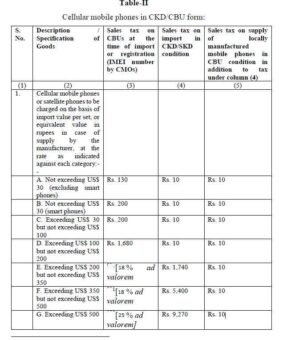

Following is the Ninth Schedule after the amendment made through Finance (Supplementary) Act, 2023:

Under the sales tax laws following are liability, procedure and conditions:

(i) The liability to pay the tax on the goods specified in this Schedule shall be–

(a) in case of the goods specified in Table-I, of the Cellular Mobile Operator (CMO);

(b) in case of goods specified in columns (3) and (4) of Table-II, of the importer; and

READ MORE: Salient features of mini budget or Finance Supplementary Bill 2023

(c) in case of goods specified in column (5) of Table-II, of the local manufacturers of the goods.

(ii) The time of payment of tax due under this Schedule shall be the same as specified in section 6;

(iii) The tax paid under this Schedule shall not be deductible against the output tax payable by the purchaser or importer of the goods specified in this Schedule;

READ MORE: Finance ministry announces salary increase, promotions of government employees

(iv) The input tax paid on the input goods attributable to the goods specified in this Schedule shall not be deductible for the tax payable under this Schedule; and

(v) The Board may prescribe further mode and manner of payment of tax due under this Schedule.