The State Bank of Pakistan (SBP) has raised its benchmark policy rate by a significant 1400 basis points to 21 per cent over the past 18 months to address the economic challenges being faced by the country.

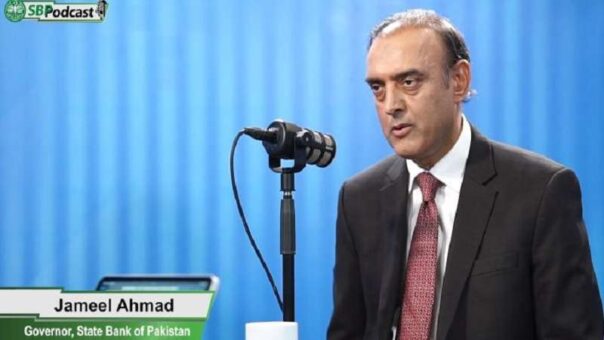

SBP Governor Jameel Ahmad recently met with key international investors and fund managers to discuss Pakistan’s economic challenges and the way forward.

READ MORE: Pakistan’s banking sector exposed to sovereign borrowing

Ahmad highlighted that Pakistan’s economy is facing high inflation and external balance of payments pressures, driven by adverse global shocks and domestic developments. He also emphasized that commodity prices in international markets are still significantly higher than their pre-Covid levels, leading to domestic inflation and external account pressures.

READ MORE: SBP extends implementation date for IFRS 9 for larger banks and DFIs

Moreover, global financial conditions have tightened, making it harder for emerging markets like Pakistan to access international financial markets, resulting in foreign exchange reserves and exchange rate stress. The Governor also noted that devastating floods during July-August 2023 have further accentuated the economic distress in the country.

READ MORE: SBP issues Rs50 commemorative coin to mark golden jubilee of Constitution

However, the Governor expressed confidence that Pakistan is on its way to achieving macroeconomic stability, as the impact of policy measures is already playing out in the economy. The current account deficit has narrowed, and foreign exchange reserves are increasing. While inflation is currently elevated, it is expected to start decelerating over the next few months. With the revival of the IMF program, the uncertainty regarding external financing will also fade away.

READ MORE: Public awaits SBP’s decision on issuing fresh currency notes for Eid-ul-Fitr

The Governor also highlighted that the country has undertaken a series of reform measures to address many structural weaknesses, including the strengthening of the central bank’s operational autonomy, prohibition of government borrowing from the central bank, AML/CFT-related regulatory interventions, and measures to increase digitalization in the economy.

In conclusion, Governor Ahmad emphasized that Pakistan’s economy has always rebounded strongly after undergoing severe shocks, and it will rebound strongly from the current challenges as well.