A separate declaration for immovable property income has been allowed only for those returns filed prior October 13, 2022.

The FBR issued SRO 2068(I)/2022 dated December 01, 2022 to enforce the draft amendments issued through SRO 2052(I)/2022 dated November 22, 2022.

As per the instant SRO 2068(I)/2022, the FBR said that where return has been furnished prior to coming into force of notification No. SRO 1891(I)/2022, dated October 13, 2022, the form specified in the said notification shall be furnished separately by December 31, 2022.

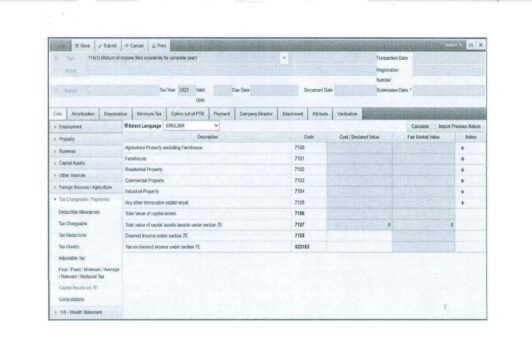

Through Finance Act, 2022 deemed income on immovable property has been imposed from tax year 2022 (July 01, 2021 – June 30, 2022) and declaration has been made mandatory of the deemed income along with annual return by December 15, 2022.

READ MORE: Tax on deemed income from immovable property under Section 7E

According the FBR, a new section 7E has been introduced through Finance Act, 2022 whereby for tax year 2022 and onwards, a resident person is treated to have derived income equal to five percent of fair market value of the capital assets situated in Pakistan which will be chargeable to tax at the rate of 20 per cent under Division VIIIC of Part I of First Schedule of the Ordinance.

Following exclusions have been provided to which this section will not apply:

(i) One capital asset owned by the resident person;

(ii) Self-owned business premises from where the business is carried out by the persons appearing on the active taxpayer’s list at any time during the year;

(iii) Self-owned agriculture land where agriculture activity is carried out by the person but excluding farmhouse and annexed land. Farmhouse has been defined in this section;

READ MORE: Supreme Court discourages taxpayers seeking relief in show cause notices

(iv) Capital asset allotted to —

(a) A Shaheed or dependents of a Shaheed belonging to Pakistan Armed Forces;

(b) A person or dependents of a person who dies while in the service of Pakistan armed forces or federal or provincial government;

(c) A war wounded person while in service of Pakistan armed forces or federal or provincial government;

(d) An ex-serviceman and serving personnel of armed forces or ex-employees or serving personnel of federal and provincial governments who are original allotees of the capital asset as duly certified by the allotment authority;

(v) Any property from which income is chargeable to tax under the Ordinance and tax leviable has been paid;

(vi) Capital asset in the first year of acquisition on which tax under section 236K has been paid;

READ MORE: Member Customs assures swift clearance of export consignments

(vii) Where fair market value of the capital assets in aggregate excluding capital assets mentioned in serial nos. (i) to (vi) above does not exceed rupees twenty-five million;

(viii) Capital assets which are owned by a provincial government or local government;

(ix) Capital assets owned by local authority, a development authority, builders and developers for land development and construction subject to the condition that such persons are registered with Directorate General of Designated Non-Financial Businesses and Professions.