ISLAMABAD: Supreme Court of Pakistan (SCP) on Monday ordered the taxpayers to pay half of the super tax within seven days, according to a Tweet by the Federal Board of Revenue (FBRP).

The FBR spokesman said that the parliament imposed a super tax on profits of wealthy corporations whose earnings exceeded Rs 150 million through the Finance Act 2022. The Honorable Lahore High Court stayed the imposition of this levy through an interim order.

“Today, on petitions filed by FBR, the Supreme Court directed that 50 per cent of the due liability be paid within 7 days,” according to the spokesman.

The super tax has been imposed through Finance Act, 2022 by inserting Section 4C to the Income Tax Ordinance, 2001.

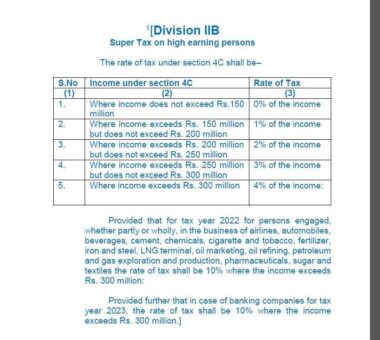

Following is the text of the Section 4C:

READ MORE: FBR notifies regulations for evidence of identity to accessing Pakistan Single Window

4C. Super tax on high earning persons.― (1) A super tax shall be imposed for tax year 2022 and onwards at the rates specified in Division IIB of Part I of the First Schedule, on income of every person:

Provided that this section shall not apply to a banking company for tax year 2022.

(2) For the purposes of this section, “income” shall be the sum of the following:—

(i) profit on debt, dividend, capital gains, brokerage and commission;

(ii) taxable income (other than brought forward depreciation and brought forward business losses) under section 9 of the Ordinance, excluding amounts specified in clause (i);

READ MORE: FTO directs fair treatment of salary taxation for temporary employees

(iii) imputable income as defined in clause (28A) of section 2 excluding amounts specified in clause (i); and

(iv) income computed, other than brought forward depreciation, brought forward amortization and brought forward business losses under Fourth, Fifth and Seventh Schedules.

(3) The tax payable under sub-section (1) shall be paid, collected and deposited on the date and in the manner as specified in sub-section (1) of section 137 and all provisions of Chapter X of the Ordinance shall apply.

READ MORE: Peshawar customs intelligence auctions motor vehicles on Feb 07

(4) Where the tax is not paid by a person liable to pay it, the Commissioner shall by an order in writing, determine the tax payable, and shall serve upon the person, a notice of demand specifying the tax payable and within the time specified under section 137 of the Ordinance.

(5) Where the tax is not paid by a person liable to pay it, the Commissioner shall recover the tax payable under sub-section (1) and the provisions of Part IV, X, XI and XII of Chapter X and Part I of Chapter XI of the Ordinance shall, so far as may be, apply to the collection of tax as these apply to the collection of tax under the Ordinance.

READ MORE: IRS officers directed to provide declaration of avoiding private consultancy

(6) The Board may, by notification in the official Gazette, make rules for carrying out the purposes of this section.