Karachi Tax Bar Association (KTBA) on Thursday termed the collection of further tax on sales of pharmaceutical products to unregistered persons as unlawful.

In a letter sent to Asim Ahmad, Chairman of Federal Board of Revenue (FBR), the tax bar informed that substances registered as drugs under the Drugs Act, 1976 were earlier exempt from levy of sales tax under the Sales Tax Act, 1990, the Finance (Supplementary) Act, 2022, withdrawn, and the pharmaceutical products were made zero rated in terms of Serial No.19 to the Fifth Schedule of the Act.

READ MORE: Non-filers will not be included in ATL 2022

Later one, through the Finance Act 2022, Serial No.19 of the Fifth Schedule was omitted and a new Serial No.81 was introduced in Table-1 of the Eighth Schedule to the Act is as follow:

| Serial No. | Description | Heading Nos. of the First Schedule to the Customs Act, 1969 (IV of 1969) | Rate of Sales Tax | Condition |

| (1) | (2) | (3) | (4) | (5) |

| 81. | Manufacture or import of substances registered as drugs under the Drugs Act, 1976 (XXXI of 1976) | Respective Heading | 1% | Subject to the conditions that: (i) Tax charged and deposited by the manufacturer or importer, as the case may be, shall be final discharge of tax in the supply chain. (ii) No input tax shall be adjusted by the manufacturer or importer. |

The tax bar stated that it becomes clear that Serial No.81 created the sales tax charge at the rate of 1 per cent on manufacturer/importer of drugs and that the tax so charged and deposited by a manufacturer would be treated as final discharge of sales tax liability for the entire supply chain.

READ MORE: FBR directs BS-21 officers to submit declaration of assets

Therefore, once the manufacturer/importer has charged and deposited the sales tax at 1 per cent, the rest of the entire supply chain would be ousted from levy of sales tax.

KTBA invited the attention of the FBR chairman towards a clarification C.No. 3(16)ST&FE-Policy/2022/230285-R issued by the FBR on November 23, 2022, which has asked to pay further tax at 3 per cent on sale of drugs to unregistered persons.

READ MORE: Customs Intelligence Gwadar auctions motor vehicles on December 12

The tax bar said clarification and its directions are contradictory to the legal position. It is being re-iterated that Serial No.81 in Table-1 of the Eighth Schedule to the Act categorically states that tax collected and discharged by the manufacturer of drugs under the Drugs Act, 1976 is final discharge of tax for the entire supply chain.

Therefore, if further tax is asked to be levied on sale by the manufacturer/importer, it stands exactly opposite to the substantive law for declaring collection and discharge of tax by manufacturer/importer as final tax.

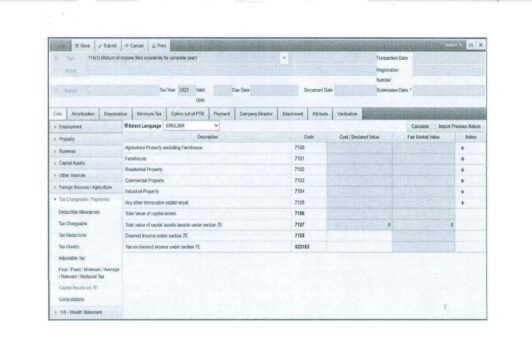

READ MORE: Separate property declaration under Section 7E only for returns already filed

“Needless to mention that the term ‘final tax’ in itself implies that no further collection of tax would be made under the Act irrespective of the nature/class/category/registration status of a person,” the tax bar added.

The FBR chairman has been urged that above clarification may be re-clarified in the light of decisions given by higher courts and Appellate Tribunal.

The position taken by the FBR yet for the second time and too knowingly, on the same issue, does not signify anything and is uncalled for on the part of Regulator. It is apprehended that the matter will yet again land in High Courts and will not yield anything but unnecessary and avoidable litigation.