The Federal Board of Revenue (FBR) has taken a significant step to boost the textile industry by withdrawing the five percent regulatory duty on the import of cotton yarn.

(more…)Tag: Federal Board of Revenue

The Federal Board of Revenue is Pakistan’s apex tax agency, overseeing tax collection and policies. Pakistan Revenue is committed to providing timely updates on the Federal Board of Revenue to its readers.

-

Tax rate at 15 percent applicable on profit on debt: FBR

ISLAMABAD: Federal Board of Revenue (FBR) on Wednesday said that the general rate of tax is 15 percent on yield on investments. However, it is reduced at 10 percent where annual profit is below Rs500,000.

The FBR issued Income Tax Circular No. 07 of 2020 to clarify tax rate under Section 151 of the Income Tax Ordinance, 2001.

The FBR said: “General rate of tax deduction on profit on dent under Section 151 of the Income Tax Ordinance, 2001 is 15 percent of the profit.

“However, provision to the Division IA of the Part III of the First Schedule to the Income Tax Ordinance, 2001, provides that tax rate shall be 10 percent in case where the taxpayer furnishes a certificate to the payer of the profit on debt that during the tax year, total yield or profit payable in this case shall remain at Rs500,000 or less.”

The FBR said that queries had been received regarding the nature or format of the certificate.

“The required certificate is to be furnished by the recipient of the profit on debt to the payer of such profit to the effect that total profit on debt received/receivable during the tax year from all investments in his case shall not exceed Rs500,000,” the FBR said, adding that the requisite certificate can be submitted on plain paper.

According to the withholding tax card for tax year 2021 issued by the FBR, the profit on debt may be on account of deposit, account or a certificate under the National Saving Schemes or Post office savings account.

Besides, the same rates shall be applicable on profit on debt paid by a banking company or financial institution on account or deposit maintained.

Furthermore, the tax rates are also applicable on profit on bonds, certificates, debentures, securities or instruments of any kind (other than loan agreements between borrowers and banking companies or development financial institutions.

The tax rate of 15 percent shall be increased by 100 percent to 30 percent for persons not appearing on Active Taxpayers List (ATL).

-

FBR directs conducting audit to cross match turnover

ISLAMABAD: Federal Board of Revenue (FBR) has directed field offices to conduct desk audit of returns filed for tax year 2020 to cross match turnover for avoiding misuse/mis-declaration.

The FBR on Tuesday said that it had clarified on December 03, 2020 on ‘technical issue in filing of tax return 2020 dated December 03, 2020’ on a communication sent by Lahore Chamber of Commerce and Industry (LCCI).

The LCCI had requested for clarification regarding the treatment of closing stock at the time of change of taxation regime from final to minimum tax.

The FBR said that the chamber had pointed out in case of importers, the tax collected at import stage during tax year 2019 had come final tax at the time of collection, therefore, the turnover or income arising from the disposal of such closing stock should not be included in taxable income for tax year 2020 as this would result in double taxation.

The FBR said that it had examined the matter. “The turnover resulting from disposal of closing stock already declared under Final Tax Regime (FTR) in previous tax year should not make part of next year’s turnover as it would be tantamount to double taxation. Therefore, such turnover should not be declared in the column of ‘subject to NTR [Normal Tax Rate] for tax year 2020.”

The FBR further said: “In order to void misuse/mis-declaration, field formation, are required to conduct desk audit/audit of all such cases for tax year 2020 and cross match turnover with relevant sales tax declarations.”

-

Dr. Faiz Illahi Memon posted as Executive Director of State Life Insurance

ISLAMABAD: Dr. Faiz Illahi Memon, a senior officer of Inland Revenue Service (IRS) has been posted as Executive Director of State Life Insurance Corporation of Pakistan on deputation basis for three years.

A notification issued on Tuesday, the Federal Board of Revenue (FBR) said that Dr. Faiz Illahi Memon, BS-21 officer of IRS presently posted as Member (FATE) FBR, Islamabad has been placed at the disposal of State Life Insurance Corporation of Pakistan for posting as Executive Director, State Life Insurance Corporation of Pakistan, on deputation basis for a period of three years or till the date of his superannuation, whichever is earlier, on standard terms and conditions of deputation.

Grant of performance allowance of the officer has been discontinued during his deputation period, the FBR added.

According to another notification, Dr. Faiz Illahi Memon has relinquished the charge of the post of Member (FATE) FBR Islamabad with effect from December 22, 2020.

-

FBR updates rates of duty, tax on import of vehicles

ISLAMABAD: Federal Board of Revenue (FBR) has issued updated rates of duty and tax for customs clearance of imported vehicle.

The Federal Government of Pakistan has extended various benefits / exemptions to the taxpayers for importing vehicles, according to updated rates up to June 30, 2020.

The details concessions / exemptions are given as under:-

i. S.R.O. 577(I)/2005 Dated 06.06.2005 (Exemption from customs duty, sales tax, withholding tax on import of certain specified Old and used automotive vehicles)

The import of old and used automotive vehicles of Asian makes meant for transport of persons, specified in column (2) of the Table below, falling under PCT heading No. 87.03 of the First Schedule to the Customs Act, 1969 (IV of 1969), is exempted from so much of the customs-duty, sales tax and withholding tax as are in excess of the cumulative amount specified in column (3) thereof,

Sr. No Automotive vehicles of Asian makes meant for transport of persons. Duty and taxes in US$ or equivalent amount in Pak rupees. (1) (2) (3) 1 Up to 800cc US$4800 2 Up to 801-1000cc US$6000 3 From 1001 – 1300cc US$13200 4 From 1301 – 1500cc US$18590 5 From 1501 – 1600cc US$22550 6 From 1601 – 1800cc (Excluding Jeeps) US$27940 It is relevant to mention that the Federal Government has fixed the leviable duty and taxes of automotive vehicles of Asian makes meant for transport of persons as discussed above irrespective of their physical condition. The Customs officers do not have any discretionary power to increase / decrease the leviable duties / taxes, the FBR said.

Watch this story on Youtube. Please subscribe the channel:

Related Stories

-

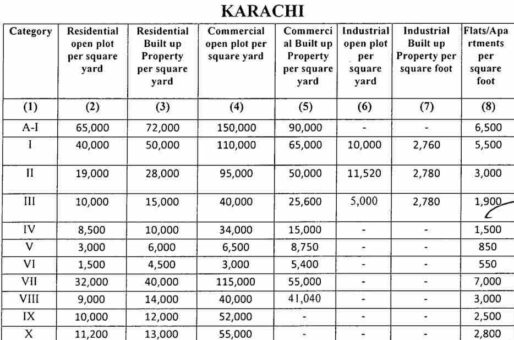

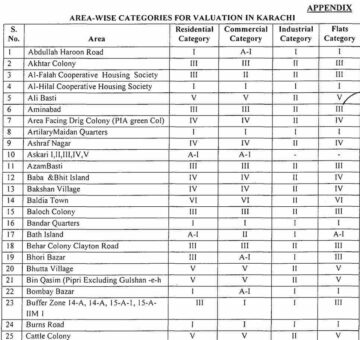

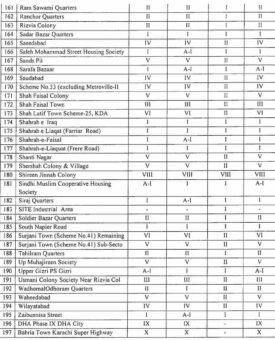

FBR’s valuation of immovable properties in Karachi

ISLAMABAD: Following is the table of valuation of immovable properties in Karachi issued by the Federal Board of Revenue (FBR) for the purpose of deduction and collection of withholding tax.

The valuation of immovable properties in Karachi has been issued through SRO 837(I)/2019 dated July 23, 2019 in supersession of notification SRO 120(I)/2019 dated February 01, 2019.

The valuation of immovable properties is applicable from July 24, 2019.

The FBR said that:

(i) Values in the above table are in rupees;

(ii) value is per square yard of the covered area of ground floor plus covered area for the additional floors;

(iii) commercial property built up value is per square yard of the covered area of the ground floor plus covered area of the additional floors, if any;

(iv) built up industrial property value is per square yard of the plot area per square foot;

(v) the value in respect of a residential building consisting of more than one storey shall be increased by 25 percent for each additional storey i.e. value of each storey other than ground floor shall be calculated at 25 percent of the value of the ground floor;

(vi) a property which does not appear to fall in any of the categories shown in the Appendix below shall be deemed to fall in the adjacent lowest category of the Appendix;

(vii) whether the land has been granted for more than one purpose. Viz residential, commercial and industrial, the valuation in such a case shall be the mean/average prescribed rate;

(viii) a flat means the covered residential tenement having separate property unit number / sub-property unit number;

(ix) in residential, multi storey building, additional storey shall be charged if it consists of bed room and bath room;

(x) the rates for basements of built in commercial property in categories I, II, III and IV shall be Rs13,500 per square yard; and

(xi) area-wise categories are in the following appendix

-

FBR officers to be deputed at FAFT secretariat

Officers from the Federal Board of Revenue (FBR) will be posted at the Financial Action Task Force (FATF) Secretariat on a deputation basis.

(more…) -

FBR constitutes refund resolution committee for KPK taxpayers

ISLAMABAD: Federal Board of Revenue (FBR) on Friday constituted a provincial complaint resolution committee for settlement of issues relating of sales tax refund matters for Khyber Pakhtunkhwa (KPK).

The FBR constituted the complaint resolution committee Khyber Pakhtunkhwa comprising following members for settlement of sales tax refund issues for taxpayers falling under the jurisdiction of field formations of Khyber Pakhtunkhwa:

01. Senator Nauman Wazir Khattak: Convenor

02. Chief Commissioner Inland Revenue, Regional Tax Office (RTO), Peshawar: Member

03. Chief Commissioner-IR, RTO, Abbotabad: Member

04. Adeel Rauf, CEO, Khyber Match and AYS Electronics, Peshawar: Member

05. Saad Zahid, Director Rakaposhi Pharmaceuticals: Member

06. Additional Commissioner (HQ), RTO, Peshawar: Member/Secretary

Terms of Reference (TORs) of the complaint resolution committee shall be as under:

i. Review the nature of complaints/issues possible solution and take immediate actions for resolution;

ii. Follow up with concerned field formation till issue is resolved;

iii. Maintain complete record of complaints/issues, mechanism adopted for resolution and post resolution action required, if any; and

iv. share data with the Board on monthly basis including issues received, issues resolved and issues pending for resolution and reasons for pendency.

-

Tax amnesty on money invested by builders, developers available till December 31

ISLAMABAD – A tax amnesty providing relief on undeclared money to builders and developers for new housing projects is set to expire on December 31, 2020.

(more…) -

Cash back to customers: FBR issues list of integrated retailers

ISLAMABAD: Federal Board of Revenue (FBR) has issued updated list of Tier-1 retailers, who have integrated their Point of Sales (POS) with the online system of the tax authorities.

Only a customer of Tier-1 retailer is eligible to get cash back of five percent sales tax out of total amount of sales tax paid at the time of purchase from such retailers.

All tier-1 retailers are required to integrate all their POSs with FBR’s computerized system. ‘Tier-1 retailer’ is defined in section 2(43A) of the Sales Tax Act, 1990, to be a person who falls in any of the following categories:

(a) a retailer operating as a unit of a national or international chain of stores;

(b) a retailer operating in an air-conditioned shopping mall, plaza or centre, excluding kiosks;

(c) a retailer whose cumulative electricity bill during the immediately preceding twelve consecutive months exceeds Rupees twelve hundred thousand;

(d) a wholesaler-cum-retailer, engaged in bulk import and supply of consumer goods on wholesale basis to the retailers as well as on retail basis to the general body of the consumers”; and

(e) a retailer, whose shop measures one thousand square feet in area or more.

Following is the list of Tier-1 retailers who integrated their POS with the FBR:

001. RANA TRADING COMPANY (RTC)

002. HI GOLD INTERNATIONAL ENTERPRISES

003. IFFI ELECTRONICS

004. M/S:- TAYYAB SUPER STORE & BUILDERS

005. AFZAL ELECTRONICS

006. AL HAFEEZ ELECTRONICS

007. M/S SEASONS FOODS PRIVATE LIMITED

008. MUNAWAR ASSOCIATES

009. TEAM-A VENTURE (PRIVATE) LIMITED

010. TAFRAL NIAZI TRADERS

011. MS ZUBAIDA ASSOCIATES

012. M/S SUPER ASIA ELECTRONICS,

013. M/S 3-STAR TRADING COMPANY,

014. REWAYAT

015. SEATS

016. TAZ & CO.

017. BIZTECH INTERNATIONAL

018. RETAIL 21

019. WOW SOLUTION (PVT.) LIMITED

020. PAKISTAN ELECTRONICS.

021. AL FALAH SWEETS & BAKERS

022. HAQ’S INTERNATIONAL

023. HOUSE OF CHARIZMA

024. RETAIL CONCEPTS.

025. TILE SELECT (PRIVATE) LIMITED

026. SAVE’N SAVE (PVT) LIMITED

027. SULAFAH

028. WORLD EELCTRONICS

029. KAHF INTERNATIONAL.

030. SAVE MART I-8

031. SAUDA SULF.

032. SHAHEEN CHEMIST

033. KHADIJA ENTERPRISES

034. SPEED (PRIVATE) LIMITED

035. M/S UNITED RETAIL (SMC-PRIVATE) LIMITED

036. H KARIM BUKSH ENTERPRISES

037. M/S PENSY GARMENTS (PVT) LTD

038. M/S PUNJAB CASH AND CARRY BAHRIA TOWN PHASE 4

039. BRAND MERCHANTS

040. JADE E-SERVICES PAKISTAN (PRIVATE) LIMITED

041. THE LEGEND

042. M/S OXFORD KNITTING MILLS (PVT) LTD,

043. NEAMAT KHANA BAKERS AND SWEETS

044. M/S. AM/PM

045. R&Y ENTERPRISES (PRIVATE) LIMITED

046. KIT AND KABOODLE

047. AL MERAJ BAKERS

048. SPRINGS STORES (PVT.) LIMITED

049. JS ENTERPRISES

050. THREADS AND MOTIFS

051. FOCUS

052. AR ASSOCIATES

053. THAL LIMITED

054. COTTON & SILK

055. NEEDLE IMPRESSIONS

056. CITY SMART ELECTRONICS

057. B & B ENTERPRISES

058. MANDAHAR MILLS (PRIVATE)LIMITED

059. M/S SARWAT ASSOCIATES

060. LIGHT SHOES

061. NEAMAT KHANA STORES (PRIVATE) LIMITED

062. BEHBUD CAFE

063. MSM SUPPER STORE

064. M/S MANOLO GELATO.

065. M STORE

066. HM SUPER MARKET

067. SANOOR (PVT.) LIMITED

068. SHALIMAR ELECTRONICS

069. MASTER OFFISYS (PVT) LTD

070. ABDULLAH ENTERPRISES

071. RIZWAN BEYG DESIGN

072. PAKITEX BOARDS (PRIVATE) LIMITED

073. MAF HYPERMARKETS PAKISTAN PVT. LTD.

074. AL BARAKA APPAREL

075. MINISO LIFESTYLE PAKISTAN (SMC-PRIVATE) LIMITED

076. USMAN TRADERS

077. PCC EXPRESS.

078. M/S WALK EAZE

079. EBRAHIM TEXTILE MILLS (PRIVATE) LIMITED

080. MASTER ENTERPRISES (PRIVATE) LIMITED

081. ABUZAR TRADING COMPANY

082. ONELIFE APPAREL (PVT.) LIMITED

083. HMZ SOURCING

084. MEMON BROTHERS

085. M/S. KARACHI TILE MART

086. DAAMAN

087. WALKEAZE EXCLUSIVE

088. NAHEED SUPER MARKET

089. M/S TEEPU TRADERS

090. MCC MALL

091. M/S MARIA B. DESIGNS (PVT) LTD

092. FAZAL DIN’S PHARMA PLUS

093. KHAS HOLDINGS.

094. WALK EAZE BRIDAL

095. AGHA NOOR

096. NOVA CARE (PRIVATE) LIMITED

097. NISAR AHMED & SONS KARYANA DEALER

098. M/S RAHIM MEDICAL AND PROVISIONAL STORE

099. ESAJEES

100. LVM (PVT.) LIMITED

101. SIBGHATALLAH ENTERPRISES

102. N-M ENTERPRISES

103. STYLE & COMFORT

104. PUNJAB CASH & CARRY..

105. AKHLAQ FURNITURE

106. MIAN SHAFIQ BUSINESS INTERNATIONAL

107. M/S BATIK

108. EBCO

109. MUHAMMAD YOUSAF TRADERS

110. CENTURY STEEL (PRIVATE) LIMITED

111. ROCK MARS INDUSTRIES PVT LIMITED

112. M/S. HAWA SOLUTION

113. MEER SWEETS & BAKERS

114. M/S RAZIKI (PVT.) LIMITED

115. EHAD HEALTHCARE

116. PREMIUM VENTURES

117. UMER ENTERPRISES

118. RENAISSANCE

119. THE LEATHER POINT

120. FABRICA

121. FISH COTTAGE

122. JINGGONG CONSTRUCTIONS (SMC-PRIVATE) LIMITED

123. MOHID PHARMACY

124. BEAN CORPORATION

125. AAK TRADING COMPANY

126. BIN RIAZ TRADERS

127. MOHSIN TRADERS

128. BS ENTERPRISES

129. AA FOODS

130. MASSAB ENTERPRISES

131. ABDULLAH ASSOCIATES

132. KHUSHI DIGITAL

133. ILYAS & SONS

134. M/S.M JAFFERJEES

135. M/S BUSINESS CORE.

136. VICTORIA RETAILERS

137. A.MOOSAJEE SONS

138. M/S FAIRDEAL TEXTILES (PVT.) LTD

139. MUSHTAQ SONS

140. MADINA CASH & CARRY (PVT) LIMITED

141. M/S ENGLISH BOOT HOUSE PVT LTD

142. DANIYAL KHAN TRADERS

143. HM ENTERPRISES

144. CROSS CONNECTION RETAIL (PRIVATE) LIMITED

145. WALK EAZE CLASSIC

146. SAMRIN (PVT.) LIMITED

147. G. N. STORE

148. J.A COLLECTIONS

149. ETIHAD ENERGY (PVT) LIMITED

150. PARAMOUNT LACE

151. MAYPOLE (PRIVATE) LIMITED

152. UMER TRADERS

153. COSMETICS TRADING COMPANY (PVT) LTD.,

154. ROLLOVER KIDS COMPANY

155. M/S MIAN GROUP OF CHAKWAL

156. RAJA SAHIB.

157. RESHAM ENTERPRISES

158. INTERNATIONAL INTERIOR (PVT) LIMITED

159. BIG BIRD FOODS (PRIVATE) LIMITED

160. MAISON DE LACE

161. ELAN FACON (SMC-PRIVATE) LIMITED

162. HILAL SILK

163. PUNJAB BAKERY

164. ACME ASSOCIATES

165. NAQSHBANDI STORE

166. MINISO

167. HOME KRAFT STYLE ARTS

168. SAVE MART

169. GOURMET FOOD

170. M/S . ZM

171. HEMANI HERBAL

172. ELECTRONICS MARKETING COMPANY (PVT.) LIMITED

173. THE CLOSET

174. HUSSAIN ENTERPRISES

175. PRIME TEXTILE

176. M/S UC FASHION

177. ENEM PAKISTAN.

178. ARUJ INDUSTRIES LIMITED

179. E-MART

180. LAIBA CORPORATION

181. SHAFIQUE SONS

182. TILE SELECT

183. SNZR ENTERPRISES (PRIVATE) LIMITED

184. COLLECTIBLES

185. BLESS CORPORATION

186. GATEWAY

187. SAVE MART (PVT) LIMITED

188. M/S SUPER ASIA HOUSE,

189. AL RAHIM RETAIL LIMITED

190. M/S ZEIT GEIST

191. ENEM ENTERPRISES.

192. LIFE STYLE COLLECTION

193. M/S INTELLIGENT SOLUTIONS

194. AL RAYAN BROTHERS

195. STYLO JALALPUR JATTAN

196. M/S STYLE WALK

197. PUNJAB CASH AND CARRY ASKARI VII

198. MAKKAH TILES

199. M/S. SAVE MART-BAHRIA TOWN

200. VEGAS COSMETICS

201. FATIMA ENTERPRISES

202. ADIDAS

203. PEOPLECONNECT (PRIVATE) LIMITED

204. AL-SAEED BAKERS

205. LEGENDS BY INZAMAMUL HAQ

206. INTERNATIONAL HOUSE OF LUGGAGE (SMC-PRIVATE) LIMITED

207. M/S ASGHAR ALI (PVT) LTD

208. PUNJAB CASH & CARRY – PARK ROAD

209. BEAUTE COLLECTION

210. M/S TOKYO TRADING INC,

211. MALIK AUTO CORPORATION

212. WALK EAZE CASUAL

213. PLATINUM AFFILIATES

214. CREDO STAR PAKISTAN (PRIVATE) LIMITED

215. AMANAH ESTATE (PRIVATE) LIMITED

216. MINE SAVE MART-TRAMRI

217. THEMES FURNITURE & HOMESTORE

218. M/S K & N’S FOODS (PVT) LTD

219. PUNJAB CASH & CARRY

220. ESAJEE’S

221. AL JAHAN

222. READYGO (PVT.) LIMITED

223. NOOR-E-YOUSAF FOODS (PRIVATE) LIMITED

224. M/S FAISHON VILLAZ

225. UNIFY SOLUTIONS

226. MAKKAH MARBLES

227. UNBEATABLE

228. SERVAID PHARMACY (PVT.) LTD

229. FDPP CONSUMER

230. TEE-EMM (PRIVATE) LIMITED

231. WARDA DESIGNER COLLECTION (PRIVATE) LIMITED

232. SHABBIR TILES & CERAMICS LIMITED

233. BED & BLANKET (PRIVATE) LIMITED

234. DAR CERAMICS TRADING COMPANY

235. M/S SANAULLA CORPORATION (PRIVATE) LIMITED

236. SONICA ELECTRONICS

237. FRENCH GALLERIA

238. M/S DEEPAK PARWANI

239. BRANDS JUST PRET

240. SHOE PLANET (PRIVATE) LIMITED

241. PUNJAB CASH & CARRY BHARRA KAHU

242. RAFUM INDUSTRIES (PVT.) LIMITED

243. M/S BAJWA CO. (PVT) LTD.

244. HAMZA FOODS (PVT.) LIMITED

245. SHAHZAD ZARI HOUSE

246. GHOURI’S DEPARTMENT STORE

247. VANGUARD TEXTILES (PRIVATE) LIMITED

248. M/S HILAL SILK PALACE

249. SHAHEEN CHEMISTS

250. AL HAFIZ ENTERPRISER

251. PARIS SUPER MART

252. AL-MAHMUD ELECTRONICS

253. METRO SHOES.

254. MAFCO (PRIVATE) LIMITED

255. INTERNATIONAL ENGINEERING CO.

256. METRO PAKISTAN (PRIVATE) LIMITED

257. NAEEM ELECTRONICS

258. CHEVRON PAKISTAN LUBRICANTS PRIVATE LIMITED

259. AKRAM & SONS

260. URGE PRET (PRIVATE) LIMITED

261. M/S CIZANO ENTERPRISES

262. RANGE ENTERPRISES

263. IBRAHIM ELECTRONIC

264. MOHSAN TRADERS

265. AMI’S PAN SHOP COLD DRINK STORE

266. AL-NAFEH TRADING COMPANY

267. ATA BAKERY SOLUTIONS (PVT.) LIMITED

268. SOURCECO (PRIVATE) LIMITED

269. BRAGGS KIDS

270. M/S G.B. TRADING COMPANY

Related Stories