The advance tax rates on on profit on debt during tax year 2022 are under the First Schedule of the Income Tax Ordinance, 2001.

(more…)Tag: Income Tax Ordinance 2001

-

Tax rates on payments to non-residents during TY22

In a move to streamline tax regulations and provide clarity to businesses, the Federal Board of Revenue (FBR) has released the advance tax rates on payments to non-residents for the tax year 2022.

(more…) -

Tax rates on return on investment in sukuk for TY22

The Federal Board of Revenue (FBR) has established the advance tax rates on returns from investment in sukuk for the tax year 2022.

(more…) -

Advance tax rates on dividend for Tax Year 2022

The advance tax rates on dividends for the tax year 2022 are under the First Schedule of the Income Tax Ordinance, 2001.

The Federal Board of Revenue (FBR) issued the Income Tax Ordinance, 2001 updated up to June 30, 2021. The Ordinance incorporated amendments brought through Finance Act, 2021.

The rate of tax to be deducted under section 150 shall be-

(a) 7.5 per cent in case of dividend paid by Independent Power Producers where such dividend is a pass through item under an Implementation Agreement or Power Purchase Agreement or Energy Purchase Agreement and is required to be re-imbursed by Central Power Purchasing Agency (CPPA-G) or its predecessor or successor entity.

(b) 15 per cent in mutual funds, Real Estate Investment Trusts and cases other than those mentioned in clauses (a) and (ba); and

(ba) 25 per cent in case of a person receiving dividend from a company where no tax is payable by such company, due to exemption of income or carry forward of business losses under Part VIII Chapter III or claim of tax credits under Part X of Chapter III.

(Disclaimer: The text of above section is only for information. Team PkRevenue.com makes all efforts to provide the correct version of the text. However, the team PkRevenue.com is not responsible for any error or omission.)

-

Rates of tax on imports for Tax Year 2022

The advance tax rates for the tax year 2022 are under the First Schedule of the Income Tax Ordinance, 2001.

The Federal Board of Revenue (FBR) issued the Income Tax Ordinance, 2001 updated up to June 30, 2021. The Ordinance incorporated amendments brought through Finance Act, 2021.

The rate of advance tax to be collected by the Collector of Customs under section 148 shall be-

- The tax rate on persons importing goods classified in Part I of the Twelfth Schedule shall be one per cent of the import value as increased by customs-duty, sales tax and federal excise duty.

- The tax rate on persons importing goods classified in Part II of the Twelfth Schedule shall be two per cent of the import value as increased by customs-duty, sales tax and federal excise duty.

- The tax rate on persons importing goods classified in Part III of the Twelfth Schedule shall be 5.5 per cent of the import value as increased by customs-duty, sales tax and federal excise duty;

Provided that the rate specified in column (3),—

(a) in the case of manufacturers covered under rescinded Notification No. S.R.O 1125(I)/2011 dated the 31st December, 2011 as it stood on the 28th June, 2019 on import of items covered under the aforementioned S.R.O shall be 1%;

(b) in case of persons importing finished pharmaceutical products that are not manufactured otherwise in Pakistan, as certified by the Drug Regulatory Authority of Pakistan shall be 4%:

(c) in case of importers of CKD kits of electric vehicles for small cars or SUVs with 50 kwh battery or below and LCVs with 150 kwh battery or below shall be one percent:] Provided further that the rate of tax on value of import of mobile phone by any person shall be as set out in the following table, namely:-

(Disclaimer: The text of above section is only for information. Team PkRevenue.com makes all efforts to provide the correct version of the text. However, the team PkRevenue.com is not responsible for any error or omission.)

-

Minimum tax rates for tax year 2022

The minimum tax rates for the tax year 2022 are under the First Schedule of the Income Tax Ordinance, 2001.

The Federal Board of Revenue (FBR) issued the Income Tax Ordinance, 2001 updated up to June 30, 2021. The Ordinance incorporated amendments brought through Finance Act, 2021.

Following are the minimum tax rates under Section 113 of Income Tax Ordinance, 2001:

01. The tax rate shall be 0.75 per cent on the following:

(a) Oil marketing companies, Sui Southern Gas Company Limited and Sui Northern Gas Pipelines Limited (for the cases where annual turnover exceeds rupees one billion.)

(b) Pakistani International Airlines Corporation; and

(c) Poultry industry including poultry breeding, broiler production, egg production and poultry feed production;

02. The tax rate shall be 0.5 per cent on the following:

(a) Oil refineries

(b) Motorcycle dealers registered under the Sales Tax Act, 1990

03. The tax rate shall be 0.25 per cent on the following:

(a) Distributors of pharmaceutical products, fast moving consumer goods and cigarettes;

(b) Petroleum agents and distributors who are registered under the Sales Tax Act, 1990;

(c) Rice mills and dealers;

(d) Tier-1 retailers of fast moving consumer goods who are integrated with Board or its computerized system for real time reporting of sales and receipts;

(e) Person’s turnover from supplies through e-commerce including from running an online marketplace as defined in clause (38B) of section 2.

(f) Persons engaged in the sale and purchase of used vehicles; and

(g) Flour mills

04. The tax rate shall be 1.25 per cent in all other cases

(Disclaimer: The text of above section is only for information. Team PkRevenue.com makes all efforts to provide the correct version of the text. However, the team PkRevenue.com is not responsible for any error or omission.)

-

Tax rates on builders, developers for tax year 2022

Islamabad: The Federal Board of Revenue (FBR) has unveiled the tax rates applicable to builders and developers for the tax year 2022.

(more…) -

CGT rates on immovable property for Tax Year 2022

In a bid to streamline taxation procedures and ensure clarity for taxpayers, the Federal Board of Revenue (FBR) has released details regarding the tax rates on immovable property for the tax year 2022. The information is part of the Income Tax Ordinance, 2001, updated up to June 30, 2021, incorporating amendments introduced through the Finance Act, 2021.

(more…) -

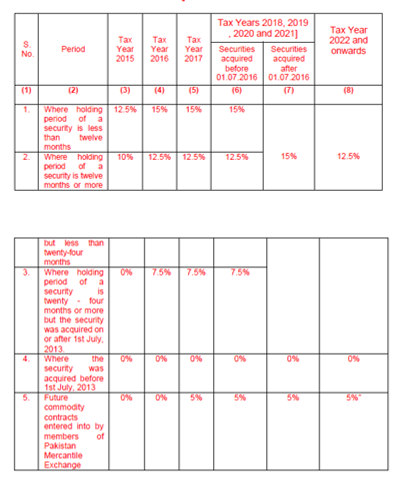

CGT rates on disposal of securities during Tax Year 2022

The tax rates on disposal of securities for tax year 2022 under the First Schedule of the Income Tax Ordinance, 2001.

The Federal Board of Revenue (FBR) issued the Income Tax Ordinance, 2001 updated up to June 30, 2021. The Ordinance incorporated amendments brought through Finance Act, 2021.

Following are the rates on disposal of securities:

The rate of tax to be paid under section 37A shall be as follows:—

TABLE I

Provided that the rate of tax on cash settled derivatives traded on the stock exchange shall be 5% for the tax years 2018 to 2020.

Provided that the rate for companies shall be as specified in Division II of Part I of First Schedule, in respective of debt securities;

Provided further that a mutual fund or a collective investment scheme or a REIT scheme shall deduct Capital Gains Tax at the rates as specified below, on redemption of securities as prescribed, namely:—

Category Rate Individual and association of persons 10% for stock funds 10% for other funds Company 10% for stock funds 25% for other funds Explanation.- For removal of doubt, it is clarified that, the provisions of this proviso shall be applicable only in case of a mutual fund or collective investment scheme or a REIT scheme.

-

Tax rates on shipping, air transport income

The Federal Board of Revenue (FBR) has specified the tax rates on shipping and air transport income earned by non-resident persons under Section 7 of the Income Tax Ordinance, 2001.

(more…)