Islamabad: The Federal Board of Revenue (FBR) has unveiled the tax rates applicable to builders and developers for the tax year 2022.

These rates, outlined in the First Schedule of the Income Tax Ordinance, 2001, aim to provide clarity and guidance to the real estate sector regarding their tax obligations. The announcement comes as part of the FBR’s ongoing efforts to streamline taxation processes and ensure transparency within the construction and development industry.

Key Highlights of the Tax Rates for Builders and Developers (Tax Year 2022):

1. Income Tax Ordinance, 2001 Update: The FBR has released an updated version of the Income Tax Ordinance, 2001, incorporating amendments introduced through the Finance Act, 2021. This updated ordinance serves as the legal framework for taxation matters, including those related to builders and developers.

2. First Schedule of the Income Tax Ordinance, 2001: The tax rates for builders and developers for the tax year 2022 are specified in the First Schedule of the Income Tax Ordinance, 2001. This schedule provides a comprehensive overview of the applicable rates based on different income brackets and categories within the real estate sector.

3. Clarity for the Real Estate Sector: The release of specific tax rates brings clarity to the real estate sector, helping builders and developers understand their tax liabilities more precisely. This transparency is expected to foster compliance and enable businesses to plan their financial strategies effectively.

4. Alignment with Finance Act, 2021 Amendments: The tax rates announced by the FBR align with the amendments introduced through the Finance Act, 2021. This ensures that the taxation framework remains up-to-date, reflecting the latest legislative changes aimed at promoting fiscal responsibility and economic growth.

5. Encouraging Compliance and Accountability: By outlining clear and updated tax rates, the FBR aims to encourage builders and developers to comply with their tax obligations. This move also enhances accountability within the real estate sector, contributing to a fair and transparent taxation system.

6. Support for the Construction and Development Industry: The tax rates for builders and developers take into account the specific dynamics of the construction and development industry. This targeted approach reflects the government’s commitment to supporting the growth of the real estate sector, which plays a vital role in the overall economic landscape.

The FBR emphasizes the importance of adherence to the specified tax rates and compliance with the Income Tax Ordinance, 2001. The objective is to create an environment that promotes responsible financial practices, contributes to national revenue, and fosters sustainable economic development.

Builders and developers are urged to familiarize themselves with the updated Income Tax Ordinance, 2001, and the associated tax rates for the tax year 2022. This proactive approach will enable businesses to fulfill their tax obligations accurately and contribute positively to the economic landscape of the country.

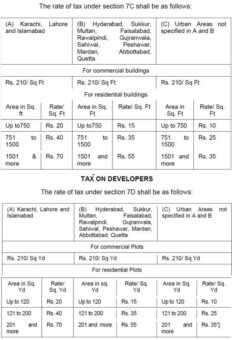

Following are the rates on builders and developers:

TAX ON BUILDERS: The rate of tax under Section 7C shall be as follows: