KARACHI: The Sindh Revenue Board (SRB) has marked a historic milestone by achieving its highest-ever monthly tax collection in December 2022 since its inception in 2011.

(more…)Tag: Sindh Revenue Board

-

Dental practitioners given December 31 deadline for tax registration

KARACHI: Sindh Revenue Board (SRB) has given a deadline of December 31, 2022 to dental practitioners to get registered for sales tax on services, according to a notification issued on Wednesday.

(more…) -

SRB invites proposals for budget 2023-2024

KARACHI: Sindh Revenue Board (SRB) has invited proposals for budget 2023-2024 and advised stakeholders to send their recommendations by January 27, 2023.

In a notification issued on Tuesday, the SRB said that it had invited proposals in relation to the Sindh Sales Tax on Services Act, 2011 and the Rules and Notifications issued thereunder.

The provincial revenue body said that it was in the process of formulating budgetary proposals (for the Sindh Budget 2023-2024) in relation to taxation and procedural provisions of Sindh Sales Tax on Services Act, 2011, The Sindh Sales Tax on Services Rules, 2011, the Sindh Sales Tax Special Procedures (Withholding) Rules, 2014, the Sindh Sales Tax Special Procedure (Transportation or Carriage of Petroleum Oil through Oil Tankers) Rules, 2018, the Sindh Sales Tax Special Procedure (Services provided or rendered by cab aggregator and the services provided or rendered by the owners or drivers of the motor vehicles using the cab aggregator services) Rules, 2019 and Sindh Sales Tax Special Procedure (Online Integration of Business) Rules, 2022 and other various notifications issued under the said Act, 2011.

It has been a policy of the SRB to consult all chambers, associations, groups, stakeholders and taxpayers before finalizing the budget proposals.

With this end in view, the SRB requests all persons (including the chambers of commerce and industry, business councils, trade associations, tax bars, Institute of Chartered Accountants, Institute of Cost and Management Accountants, taxpayers etc.) to send written proposals in the given format urgently so as to reach through e-mail (followed by its hard copy to be sent by post / courier) latest by Friday, January 27, 2023.

The SRB asked the stakeholders to provide proposals in the format included: name of the act/rules/notification proposed to be amended; section no., schedule no., tariff heading no., rule no., para no., involved; existing provisions/rates of tax/ proposed provisions/rates of tax; reasons and rationale for the proposal; and estimated revenue effect, (if any).

-

SRB says cases worth Rs 80 billion stuck in litigation

KARACHI: Sindh Revenue Board (SRB) Friday said that cases worth Rs80 billion were stuck in litigation and it is willing to resolve amicably.

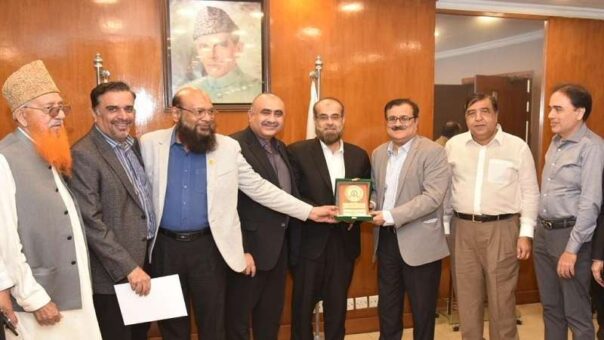

SRB chairman Dr. Wasif Ali Memon highlighted that Rs80 billion worth of cases are stuck in litigation and the provincial revenue board is all-willing to resolve as many cases amicably as possible.

READ MORE: Customs appraising officer awarded major penalty for inefficiency

“We want to be the facilitators and partners to the business community and no highhandedness is ever desired by SRB,” he added during his visit to Federation of Pakistan Chambers of Commerce and Industry (FPCCI).

On the demand of FPCCI, Dr. Wasif Ali Memon announced that an effective and inclusive Alternative Dispute Resolution Committee (ADRC) would be formulated by SRB in few weeks and we will include 5 – 6 nominees of FPCCI into the committee.

READ MORE: Further tax collection on pharmaceutical products unlawful: KTBA

Chairman SRB also proposed that FPCCI nominees should come from varied sectors to address issues of all the sectors. Additionally, he requested the business community to exhaust the ADRC and other SRB procedures before going into litigation as it only delays the dispute resolution.

On the occasion, Irfan Iqbal Sheikh, President FPCCI, has stressed upon the need to strengthen and broaden the scope of ADRC to save the precious time, resources and hassle of both the sides, i.e. business community and the SRB.

Co-chairing the high-profile meeting with SRB Chairman, Suleman Chawla, SVP FPCCI, offered to nominate technical and expert members of the business, industry and trade community from the platform of FPCCI to facilitate SRB’s efforts to strengthen ADRC.

READ MORE: Non-filers will not be included in ATL 2022

FPCCI nominees will come with the first-hand knowledge of real issues and with deep understanding of the taxation matters, he added.

Shabbir Mansha, VP FPCCI, demanded that as Karachi contributes the lion’s share of taxes in federal & provincial authorities, there should be an enhanced focus on the infrastructural development of Karachi – specifically in industrial& commercial areas and port infrastructure. This will only increase the revenue generation from Karachi, he added.

READ MORE: FBR directs BS-21 officers to submit declaration of assets

Shuakat Omerson, VP FPCCI, apprised the top management of SRB that many members of FPCCI are qualified in alternative dispute resolution mechanism; including the incumbent and former office bearers of FPCCI; and, they can offer great support to SRB’s ADRC initiatives.

Khurram Ejaz, Advisor to the President of FPCCI on FBR & revenue matters, said that FPCCI considers SRB as their partners and not as adversaries; because objectives of both the institutions are same – economic development of the province and resolution of all disputes & anomalies pertaining to provincial tax collection.

-

SRB posts 23pc growth in revenue collection during November 2022

Karachi: The Sindh Revenue Board (SRB) has demonstrated a remarkable growth of 23% in its revenue collection during the month of November 2022, overcoming economic challenges, as per an official statement released on Thursday.

(more…) -

Sindh exempts sales tax on services provides for floods relief by customs agents, port operators

The Sindh government has taken a significant step in supporting flood relief operations by exempting sales tax on services provided by customs agents and terminal operators.

(more…) -

Dental practitioners directed to get sales tax registration

KARACHI: Sindh Revenue Board (SRB) has directed dental practitioners to get registered for sales tax to avoid penal action.

The SRB in a circular issued September 21, 2022, said that the services of cosmetic dental surgery, orthodontics, aesthetic dentistry and such other cosmetic and aesthetic dental procedures are taxable services under tariff heading 9842.0000 of the Second Schedule to the Sindh Sales Tax on Services Act 2011 as per the definition provided under section 2 (29A) of the Act, 2011.

READ MORE: FBR advised to fix glitches for smooth filing of income tax returns

All Dental Practitioners providing the aforesaid taxable services are therefore advised to get e-registered with SRB by visiting www.e.srb.gos.pk and following the step by step procedure after entering the SNTN.

The service providers are also directed to charge, levy, and collect due Sindh sales tax at 13 per cent on the aforesaid taxable services and deposit the same in Sindh Government’s head of account “B-02384” in the prescribed manner.

READ MORE: Tax rates on profit from bank deposits during year 2022/2023

It further said that e-deposit the due amount of SST in any SRB-authorized branch of NBP by 15th of the month following the tax period to which it relates.

The dental practitioners are also advised e-file true and correct Sindh sales tax returns in Form SST-03 as prescribed under section 30 of the Act, 2011 by 18th of the month following the tax period to which it relates.

READ MORE: Up to 70% income tax imposed on dividends for year 2022-2023

For Example: Return filing and SST payment for the month of September is due on 15th and 18th of October, respectively.

The SRB said that full and timely compliance of above provision of law is expected and will be appreciated to avoid any penal action and legal consequences by the board.

-

Sindh exempts tax on services provided for flood relief

KARACHI: Sindh government has allowed whole of sales tax on services provided or rendered for flood relief operations.

In this regard, Sindh Revenue Board (SRB) issued a notification dated September 13, 2022, stated that the government of Sindh exempted the whole of sales tax payable on such taxable services as are certified by the National Disaster Management Authority (NDMA) or Provincial Disaster Management Authority (PDMA), Sindh to be meant for flood relief operations carried out in Sindh Province.

READ MORE: SBP allows flood relief donations through home remittance channel

The province allowed sales tax exemption on the following services:

01. Services provided or rendered by restaurants for free distribution as donation or charity.

02. Services provided or rendered by caterers, suppliers of food and drinks for free distribution as donation or charity.

READ MORE: FBR directs speedy clearance of flood relief goods

03. Advertisements for charity and donations in the Prime Minister’s Flood Relief Fund or in the Chief Minister Sindh’s Flood Relief Fund.

04. Renting of machinery, equipment, appliances and other tangible goods acquired and used for rehabilitation and reconstruction.

READ MORE: USC to disburse ration bags worth Rs540 million to flood victims

05. Labor and manpower supply services provided in the course of flood relief operations.

06. Services provided or rendered by persons engaged in inter-city transportation or carriage of flood relief goods by road.

The SRB said that the notification, if not rescinded earlier, shall stand rescinded on and from January 01, 2023.

READ MORE: Pakistani fintech enables individuals to donate flood victims

-

Sindh reduces sales tax on services for IT sector: SRB

KARACHI: Dr. Wasif Ali Memon, Chairman, Sindh Revenue Board (SRB) has said that as the Sindh Government has drastically reduced Sindh Sales Tax on IT, Software Businesses and Call Centers from 13 percent to just 3 percent, all relevant businesses which moved to other provinces, should come back to Karachi where they will enjoy the lowest sales tax as compared to other provinces.

“IT related businessmen from Karachi Chamber whose peer businessmen moved to Lahore or any other city, must advise them to get back to Karachi where they will be charged a mere 3 percent ST without input tax whereas large establishments which prefer standard rate with input tax credit, have the option of to opt 13 percent with input tax credit facilities”, he added while exchanging views at a meeting during his visit to the Karachi Chamber of Commerce & Industry (KCCI).

READ MORE: Miftah assures shopkeepers of removing multiple taxes on electricity bill

The meeting was also attended by Chairman Businessmen Group Zubair Motiwala (Via Zoom), Vice Chairman BMG Jawed Bilwani, General Secretary BMG AQ Khalil, President KCCI Muhammad Idrees, Senior Vice President Abdul Rehman Naqi, Vice President Qazi Zahid Hussain, Former President Younus Bashir, Advisor SRB Mushtaq Kazmi and KCCI Managing Committee Members along with senior SRB officials.

Dr. Wasif stated that SRB performed exceptionally well during the last fiscal year wherein record-breaking Rs153 billion tax was collected therefore, the government has given an ambitious tax collection target of Rs180 billion for current fiscal year which can only be achieved through the support and cooperation of Karachi’s business community which was highly tax-compliant. “Despite the outbreak of COVID pandemic and extraordinary spells of rainfalls which terribly affected many businesses, the business community of Karachi has been regularly and sincerely paying taxes to SRB which we greatly acknowledge”, he added.

READ MORE: FTO investigates tax collection through electricity bills

He said that although Karachi contributes highest taxes to SRB but the activities of SRB were not confined to this city only as SRB’s Regional Offices have also been opened in Hyderabad, Benazirabad, Larkana, Sukkur and Mirpurkhas while an SRB Office in Ghotki will also be inaugurated soon.

In response to President KCCI’s suggestion, Chairman SRB agreed to form a joint SRB-KCCI Committee along with provision of direct helpline to KCCI members so that all their taxation issues could be promptly resolved.

Chairman BMG, in his remarks, pointed out that although Karachi contributes 94 percent taxes to SRB but it was really unfortunate that this city was not receiving sufficient development funds according to its matchless contribution which has resulted in miserably bringing down the standards of living and doing business in Karachi. “What we contribute to provincial kitty is always being highlighted and appreciated but what we get in return never comes into limelight which is very disturbing. Neither from federal government nor from provincial government, Karachi receives its due share”, he noted, adding that the injustices with this city must and brought to an end now.

READ MORE: Withdrawal of sales tax through electricity bills demanded

He stressed that keeping in view Karachi’s contribution of more than 70 percent to national exchequer and 95 percent to provincial kitty, it was high time that Karachi must receive what it deserves. Due to lack to development funds, Karachi’s infrastructure was in awful state and the same has been witnessed by the entire world during the current Monsoon season. “SRB should also have access to information about the expenditure of revenue so that we could compare revenue generation with expenditure”, he added.

Earlier, President KCCI Muhammad Idrees, while welcoming Chairman SRB, appreciated SRB’s all-time seriousness towards resolving issues being highlighted by KCCI which were promptly being responded and amicably resolved by SRB officials. “However, there are several pending taxation issues related to indenting businesses, travel agents and other businesses along with anomalies in SRB laws which also need to be extensively discussed and resolved in light of ground realities.”

To efficiently deal with all the SRB related taxation issues and revision in relevant laws, it was very crucial to form a joint committee between KCCI and SRB so these could be discussed and resolved in such a manner that the measures agreed upon result in bringing down the tax rates which would not bring down but in fact increase the provincial revenue as large number of taxpayers will certainly prefer to get registered in Sindh.

READ MORE: Tax through electricity connections on retailers, service providers

He said that thanks to KCCI’s rigorous efforts, the federal government has finally realized and agreed to treat the income of indenters as exports proceeds hence, the same must also be announced by SRB which would help minimizing the hardships being faced by indenters who were being charged heavy taxes on marginal commissions.

He appreciated the Sindh Government for paying attention to KCCI’s demand to reduce Sindh ST on IT, Software Businesses and Call Centers which would encourage a large segment of businesses to register the businesses in Sindh.

-

SBR extends date for e-filing tax return

KARACHI: The Sindh Revenue Board (SRB) has extended the date for e-filing (electronic filing) of sales tax return and payment of sales tax on services for the month of June 2022.

The provincial revenue authority on Monday issued a circular for extension in the last date for e-deposit of Sindh Sales Tax for the tax period June 2022 and for e-filing of tax return for the tax period June 2022.

READ MORE: SRB collects Rs153.5 billion tax in FY22

According the circular, the SRB permitted the registered persons, including the withholding agents covered by the provisions of the Sindh Sales Tax Procedure (Withholding) Rules, 2014, to:

READ MORE: SRB collects Rs132 billion as services tax in 11 months

i. e-deposit the amounts of Sindh Sales Tax for the tax period June 2022 on or before Thursday July 21, 2022;

ii. e-file their returns for the tax period June 2022 on or before Monday July 25, 2022.

Sources said that the SRB extended the date for making payment of sales tax on services and for filing return in order to facilitate the taxpayers.

READ MORE: Sindh integrates 56 restaurants for online tax monitoring

They said that stakeholders approached the SRB for giving reasonable time to make compliance the mandatory requirement.

The stakeholders were of the view that due to long holidays on account of Eid ul Adha, very few days were left to comply with the statutory requirement.

It is important to note that the government had announced holidays from July 8, 2022 to July 12, 2022 on account of Eid ul Adha.

READ MORE: Tax officials barred from direct freezing bank accounts