Super tax is a special levy that is imposed on certain classes of taxpayers on their income in Pakistan. The collection of super tax has been made under Income Tax Ordinance, 2001.

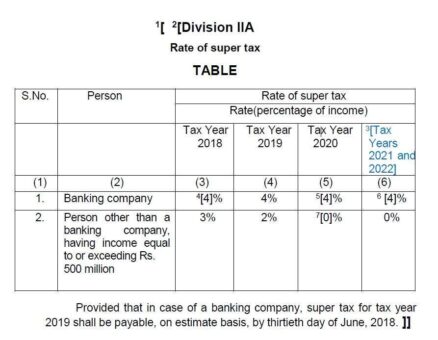

Through Section 4B of the Income Tax Ordinance, 2001, super tax for rehabilitation of temporarily displaced persons was introduced through Finance Act, 2015. The tax was imposed till Tax Year 2022.

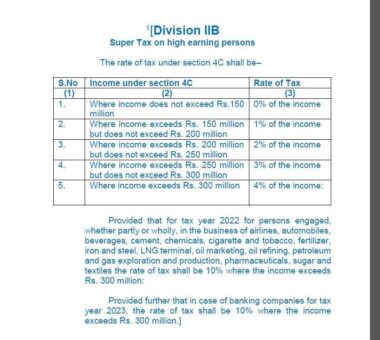

Another Section 4C of the Income Tax Ordinance, 2001, super tax on high earnings persons was introduced through Finance Act, 2022.

READ MORE: What income is taxable in Pakistan?

Following are the text of both the sections as per the Income Tax Ordinance, 2001 updated up to June 30, 2022, issued by the Federal Board of Revenue (FBR).

Section 4B. Super tax for rehabilitation of temporarily displaced persons.― (1) A super tax shall be imposed for rehabilitation of temporarily displaced persons, for tax years 2015 and onwards, at the rates specified in Division IIA of Part I of the First Schedule, on income of every person specified in the said Division.

(2) For the purposes of this section, “income” shall be the sum of the following:—

(i) profit on debt, dividend, capital gains, brokerage and commission;

(ii) taxable income(other than brought forward depreciation and brought forward business losses) under section (9) of this Ordinance, if not included in clause (i);

READ MORE: FBR, SBP discuss stuck-up consignments, LC opening

(iii) imputable income as defined in clause (28A) of section 2 excluding amounts specified in clause (i); and

(iv) income computed, other than brought forward depreciation, brought forward amortization and brought forward business lossess under Fourth, Fifth, Seventh and Eighth Schedules.

(3) The super tax payable under sub-section (1) shall be paid, collected and deposited on the date and in the manner as specified in sub-section (1) of section 137 and all provisions of Chapter X of the Ordinance shall apply.

(4) Where the super tax is not paid by a person liable to pay it, the Commissioner shall by an order in writing, determine the super tax payable, and shall serve upon the person, a notice of demand specifying the super tax payable and within the time specified under section 137 of the Ordinance.

READ MORE: World Bank satisfied with progress of Pakistan Raises Revenue Program

(5) Where the super tax is not paid by a person liable to pay it, the Commissioner shall recover the super tax payable under subsection (1) and the provisions of Part IV,X, XI and XII of Chapter X and Part I of Chapter XI of the Ordinance shall, so far as may be, apply to the collection of super tax as these apply to the collection of tax under the Ordinance.

(6) The Board may, by notification in the official Gazette, make rules for carrying out the purposes of this section.

4C. Super tax on high earning persons.― (1) A super tax shall be imposed for tax year 2022 and onwards at the rates specified in Division IIB of Part I of the First Schedule, on income of every person:

Provided that this section shall not apply to a banking company for tax year 2022.

(2) For the purposes of this section, “income” shall be the sum of the following:—

(i) profit on debt, dividend, capital gains, brokerage and commission;

(ii) taxable income (other than brought forward depreciation and brought forward business losses) under section 9 of the Ordinance, excluding amounts specified in clause (i);

(iii) imputable income as defined in clause (28A) of section 2 excluding amounts specified in clause (i); and

(iv) income computed, other than brought forward depreciation, brought forward amortization and brought forward business losses under Fourth, Fifth and Seventh Schedules.

READ MORE: FBR Member PR holds meetings to create return filing awareness

(3) The tax payable under sub-section (1) shall be paid, collected and deposited on the date and in the manner as specified in sub-section (1) of section 137 and all provisions of Chapter X of the Ordinance shall apply.

(4) Where the tax is not paid by a person liable to pay it, the Commissioner shall by an order in writing, determine the tax payable, and shall serve upon the person, a notice of demand specifying the tax payable and within the time specified under section 137 of the Ordinance.

(5) Where the tax is not paid by a person liable to pay it, the Commissioner shall recover the tax payable under sub-section (1) and the provisions of Part IV, X, XI and XII of Chapter X and Part I of Chapter XI of the Ordinance shall, so far as may be, apply to the collection of tax as these apply to the collection of tax under the Ordinance.

(6) The Board may, by notification in the official Gazette, make rules for carrying out the purposes of this section.