The Federal Board of Revenue (FBR) in Pakistan has officially released the income tax return forms for companies for the tax year 2022, signaling the commencement of the annual tax filing season.

The announcement, made through SRO 978(I)/2022 dated June 30, 2022, outlines key details regarding filing requirements and deadlines for different categories of companies.

Companies operating under a special tax year are mandated to submit their annual return of income for the tax year 2022 by September 30, 2022. On the other hand, companies with a standard tax year spanning from July 2021 to June 2022 are given until December 31, 2022, to complete their filing obligations.

The release of the income tax return forms is a crucial step in the annual tax compliance process, providing businesses with the necessary documentation to report their financial activities and fulfill their tax obligations. The forms are tailored to capture specific information relevant to the tax year 2022, ensuring accuracy and transparency in the reporting process.

Companies operating under a special tax year often have unique financial cycles, necessitating a separate filing deadline. By requiring these entities to submit their returns by September 30, 2022, the FBR aims to streamline the assessment process and maintain a timely and efficient tax filing schedule.

For companies following the standard tax year, the December 31, 2022 deadline provides a reasonable timeframe for the compilation of financial data and the accurate completion of tax return forms. This deadline extension acknowledges the complexities involved in preparing comprehensive financial statements and facilitates a smoother filing process for businesses adhering to the standard tax year.

It is imperative for companies to familiarize themselves with the updated income tax return forms and adhere to the specified deadlines to avoid potential penalties or disruptions in compliance. The FBR emphasizes the importance of timely and accurate tax filings, contributing to the overall effectiveness of the country’s tax administration system.

Taxpayers are encouraged to seek guidance from tax professionals or utilize available online resources provided by the FBR to ensure compliance with the latest regulations and streamline the filing process. The FBR remains committed to facilitating a transparent and efficient tax ecosystem, promoting fiscal responsibility among businesses, and ensuring the nation’s economic stability.

As companies embark on the annual tax filing process, stakeholders will closely monitor compliance levels and the overall impact of these regulations on the business community. The successful execution of the tax filing season is integral to sustaining a robust and equitable taxation framework in Pakistan.

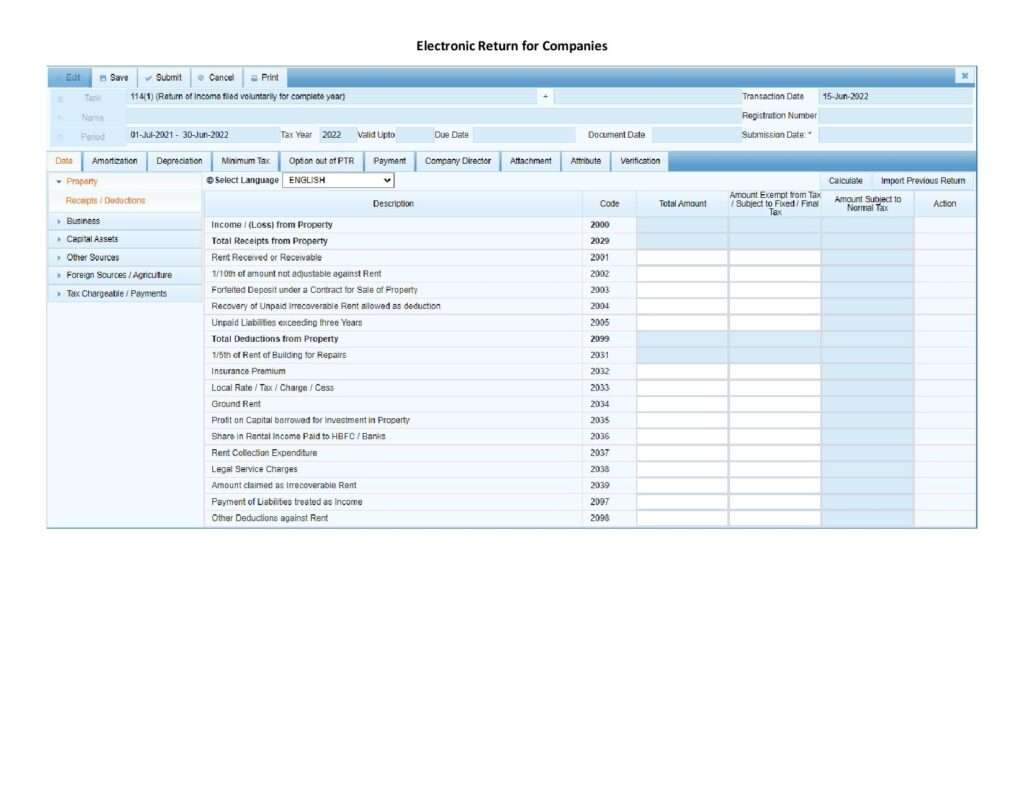

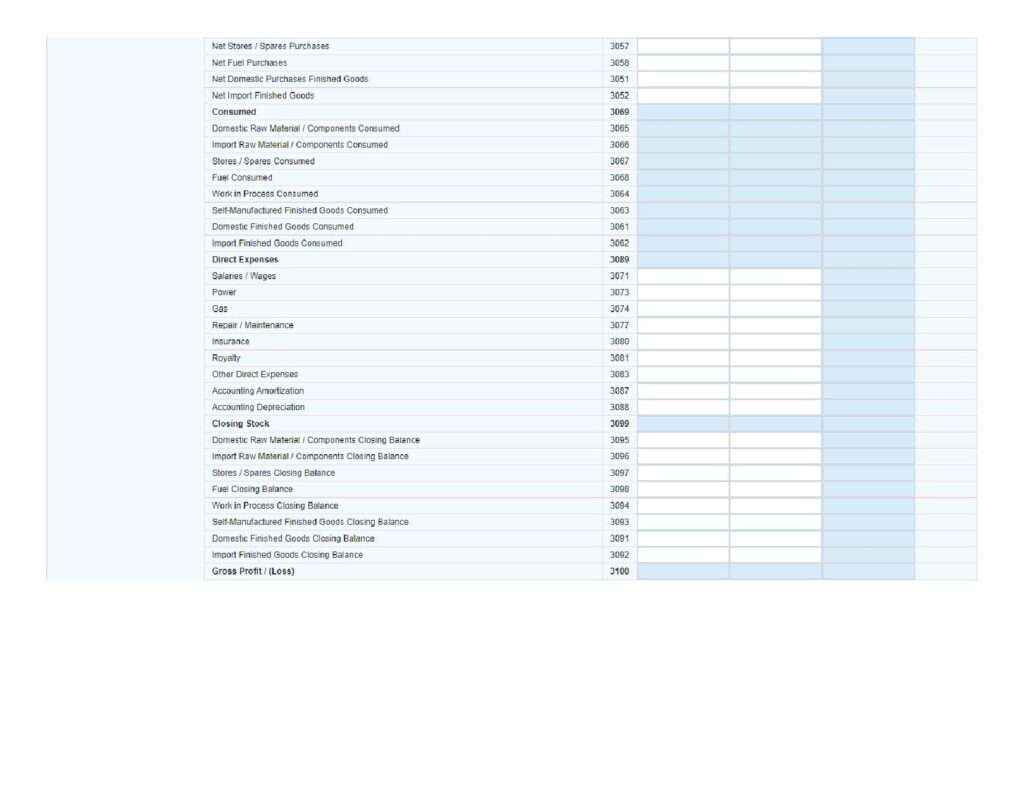

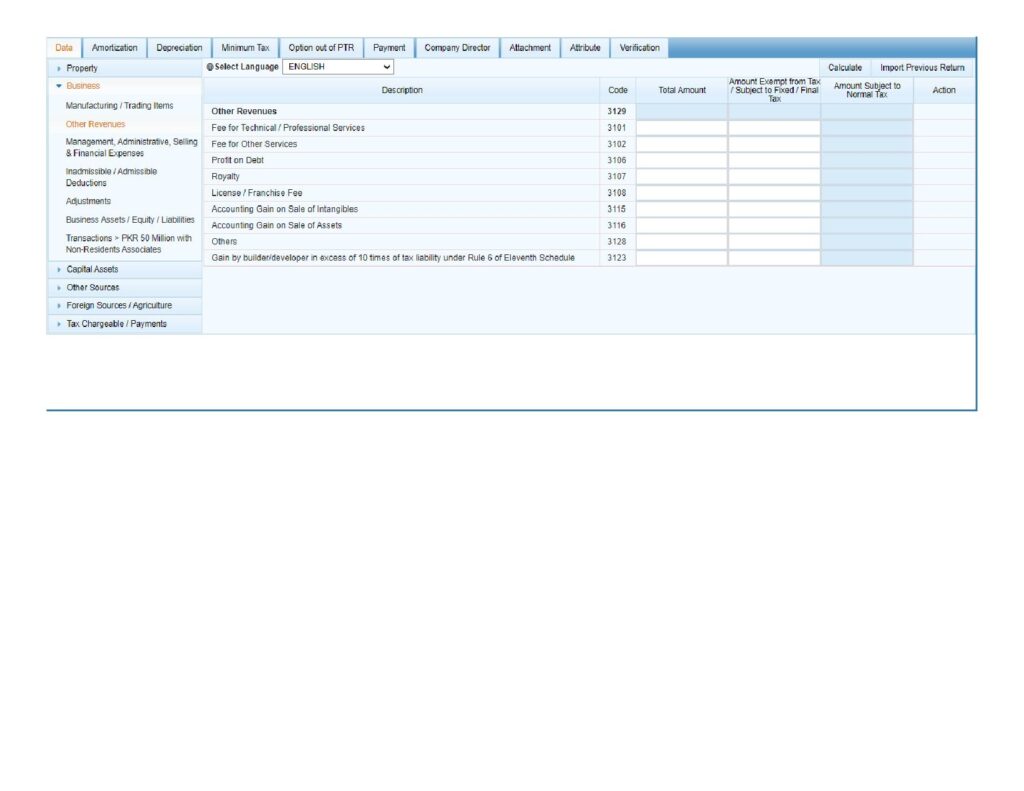

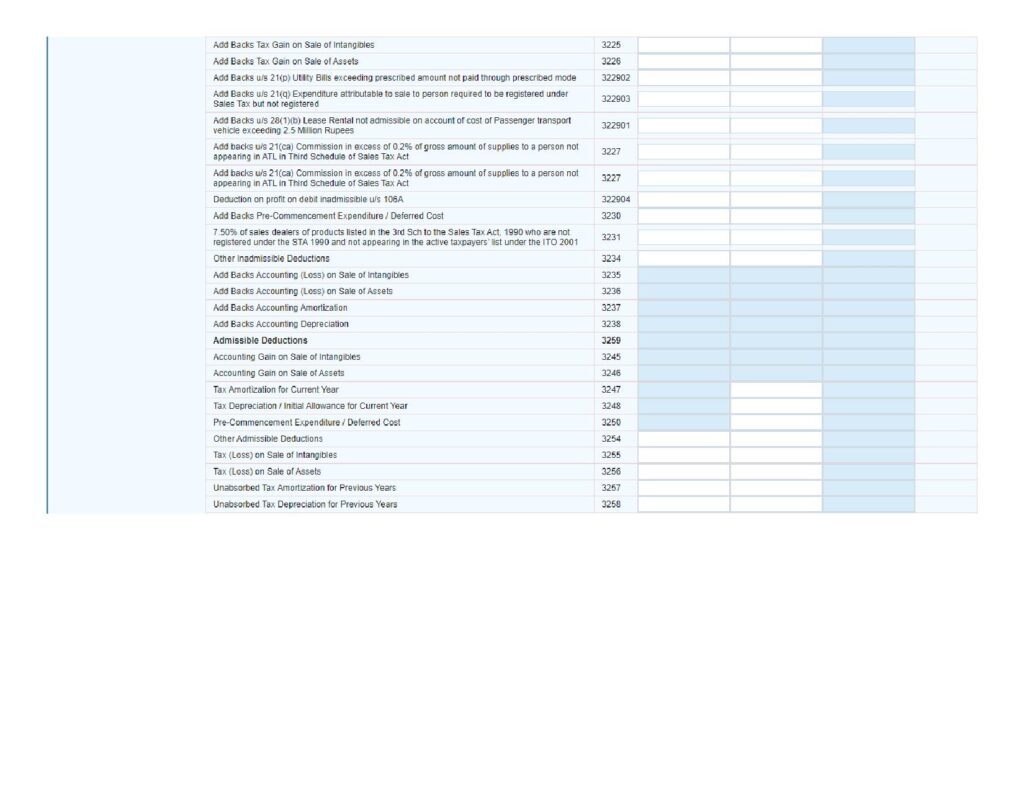

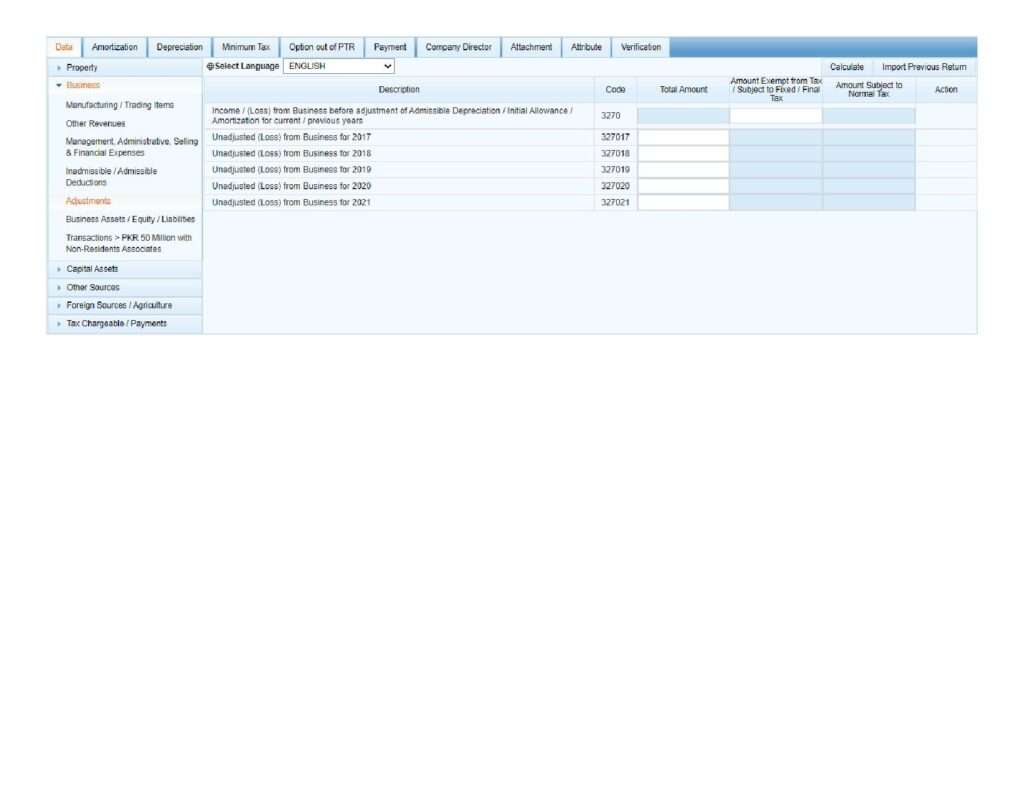

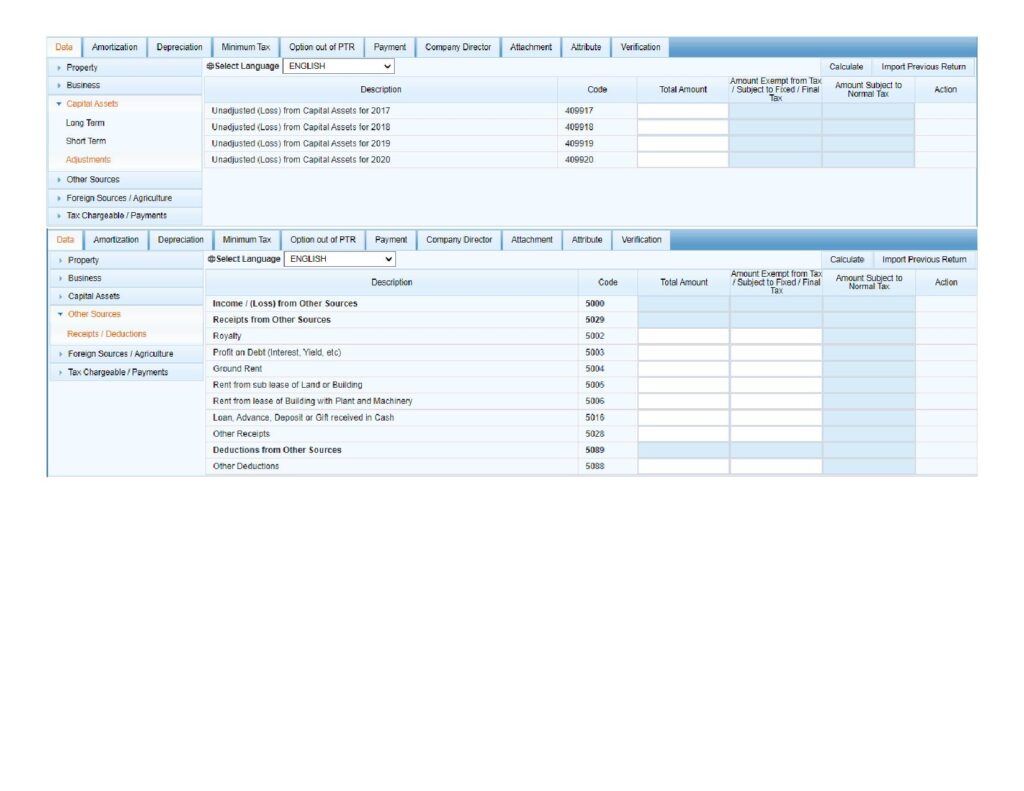

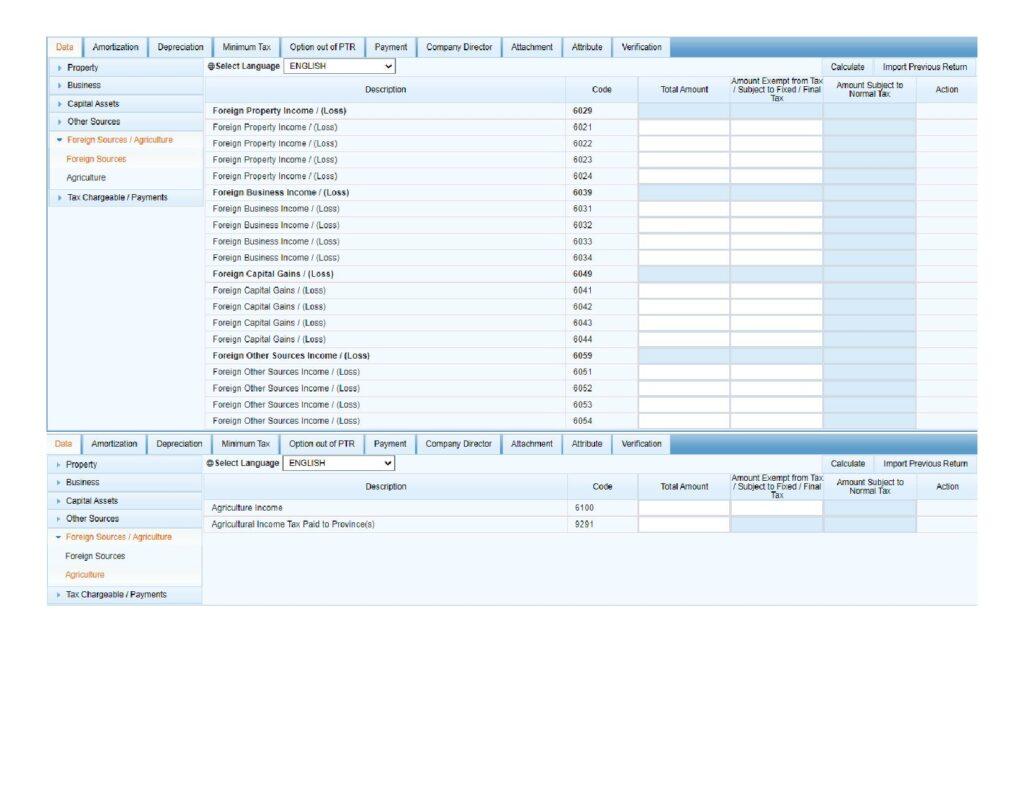

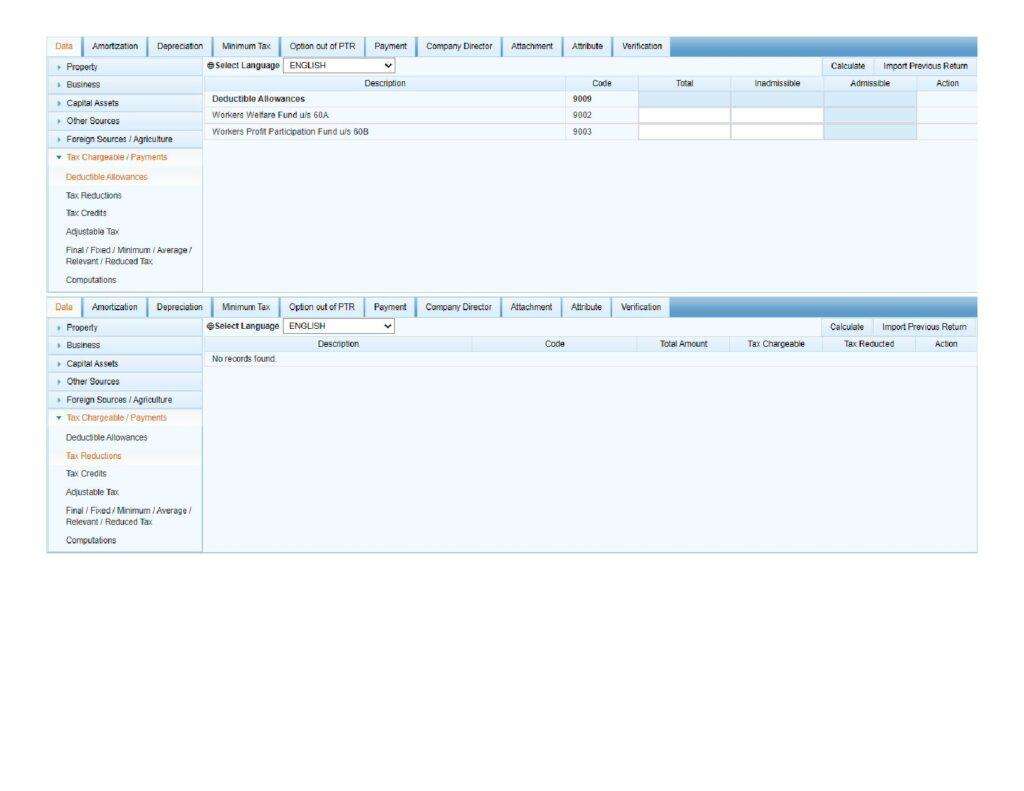

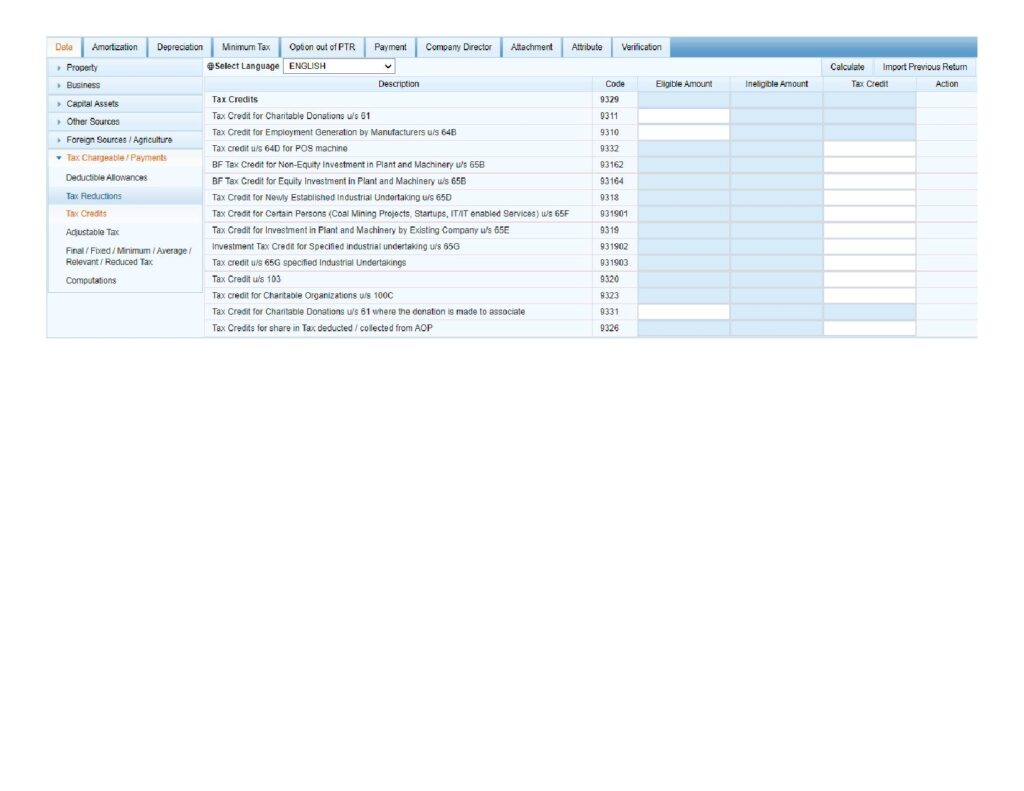

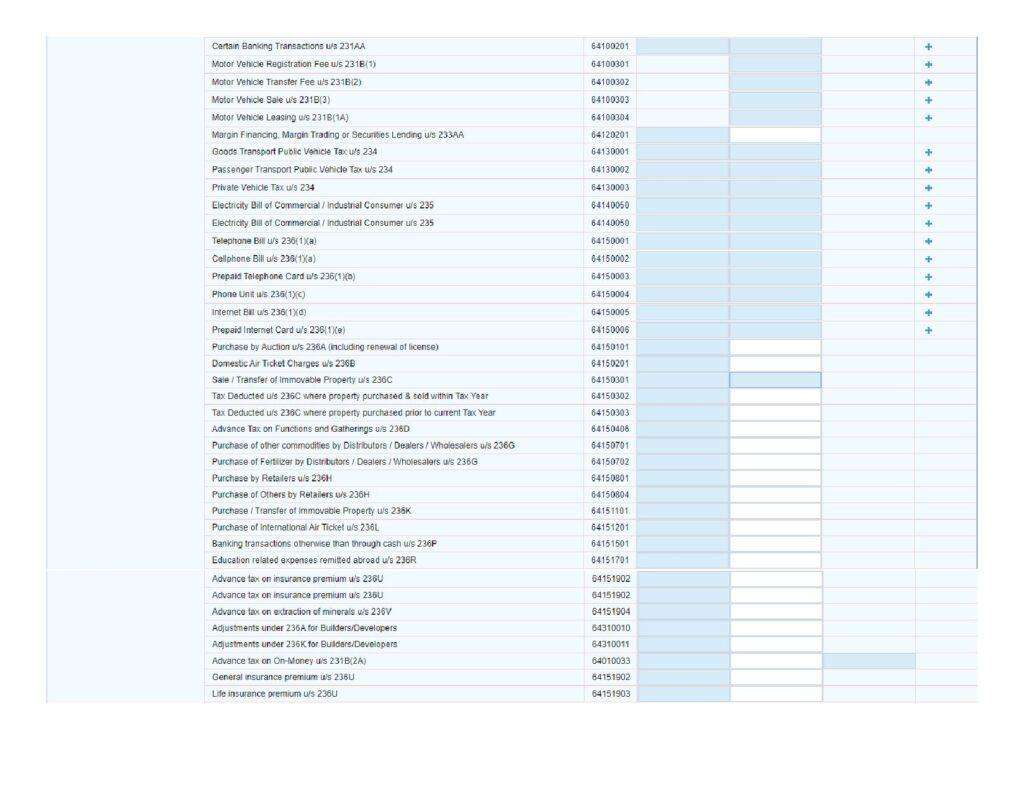

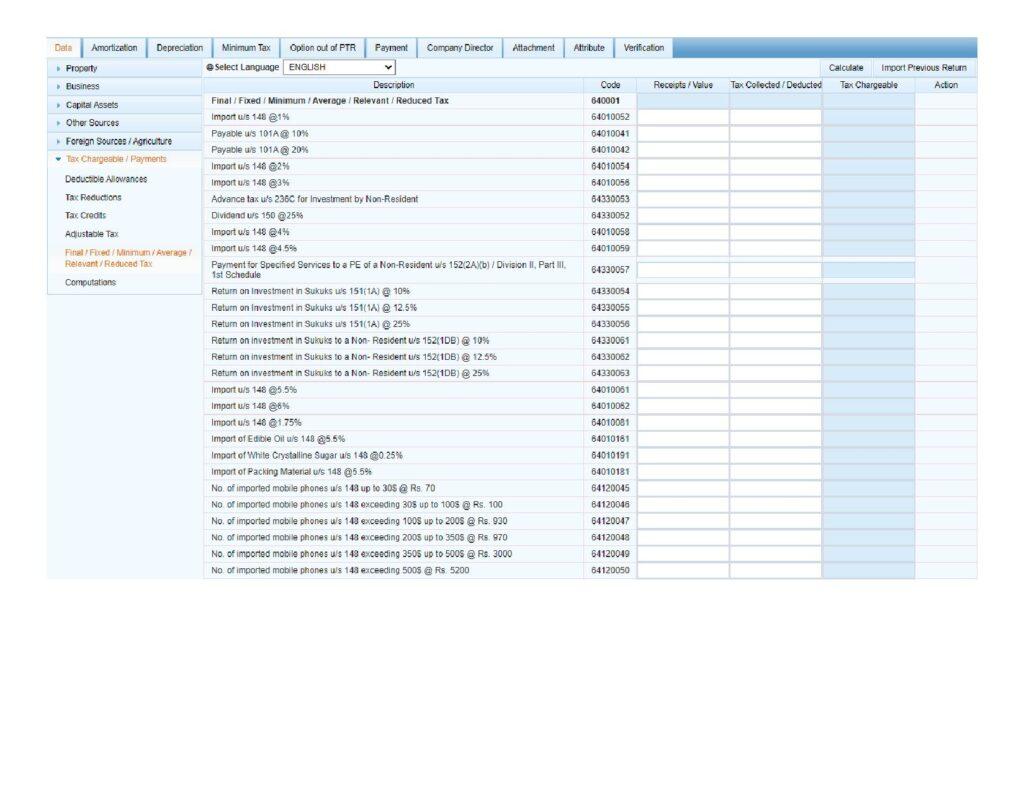

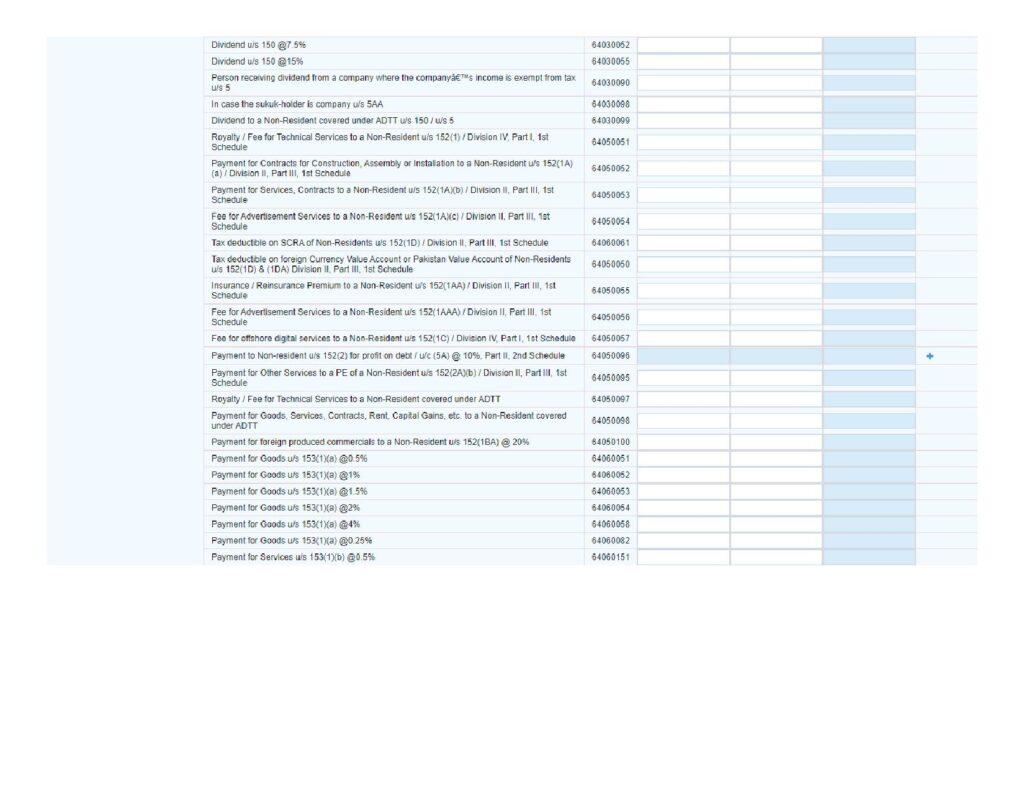

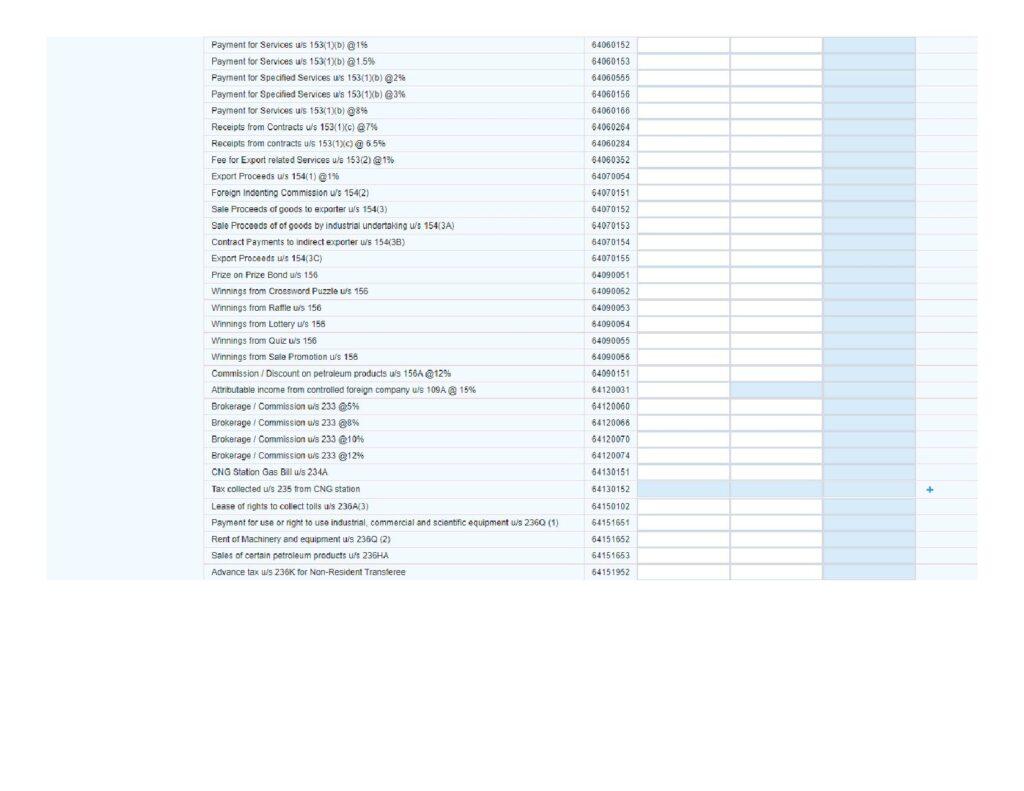

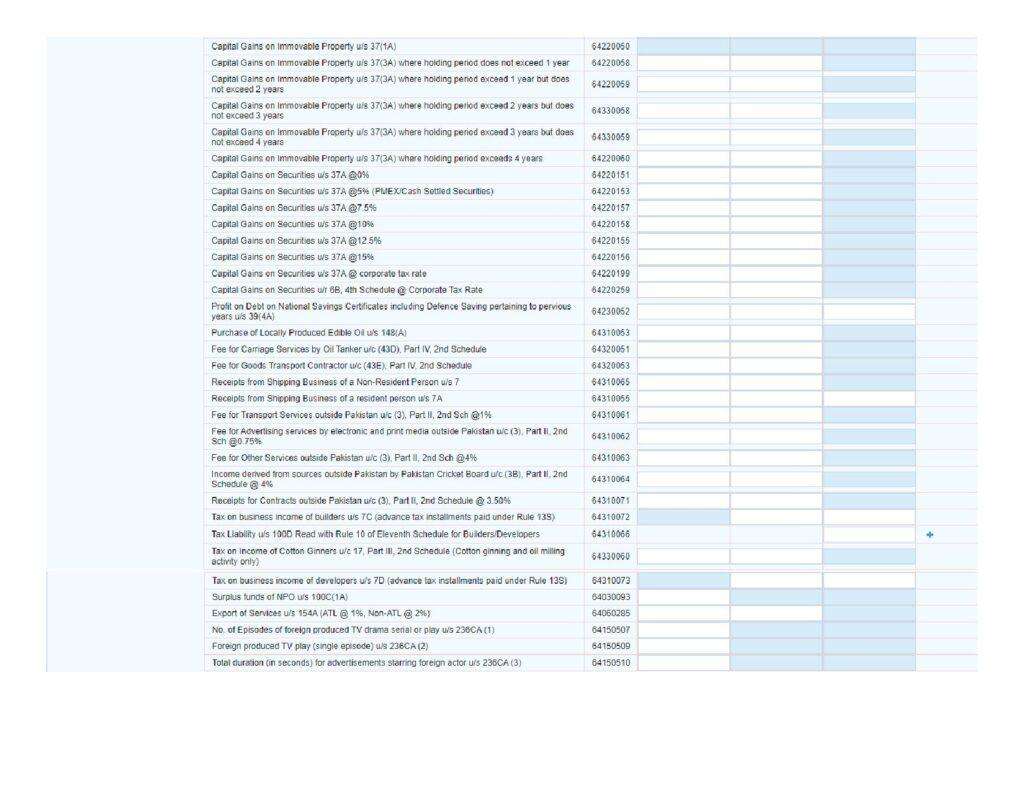

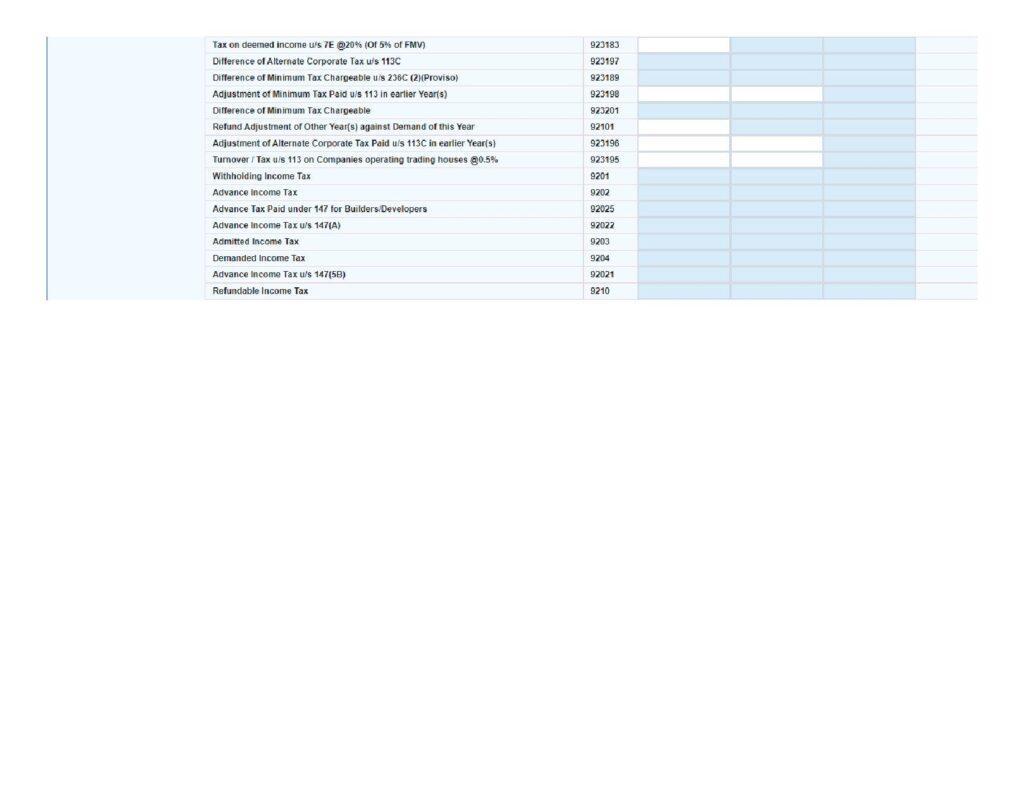

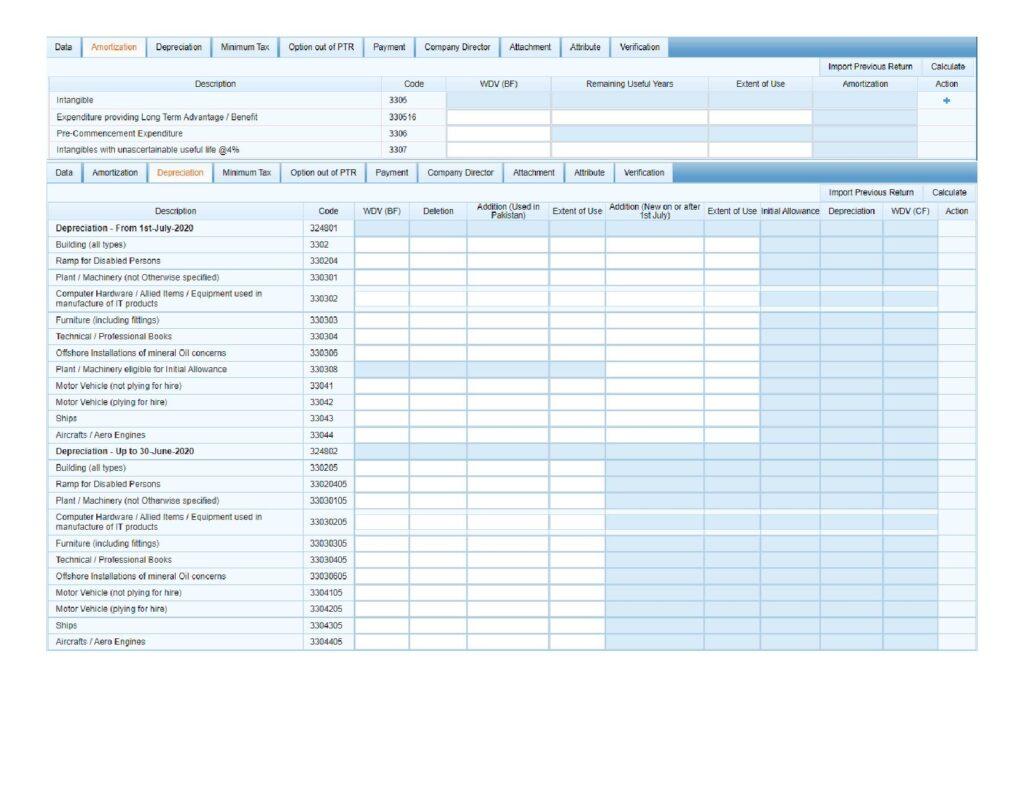

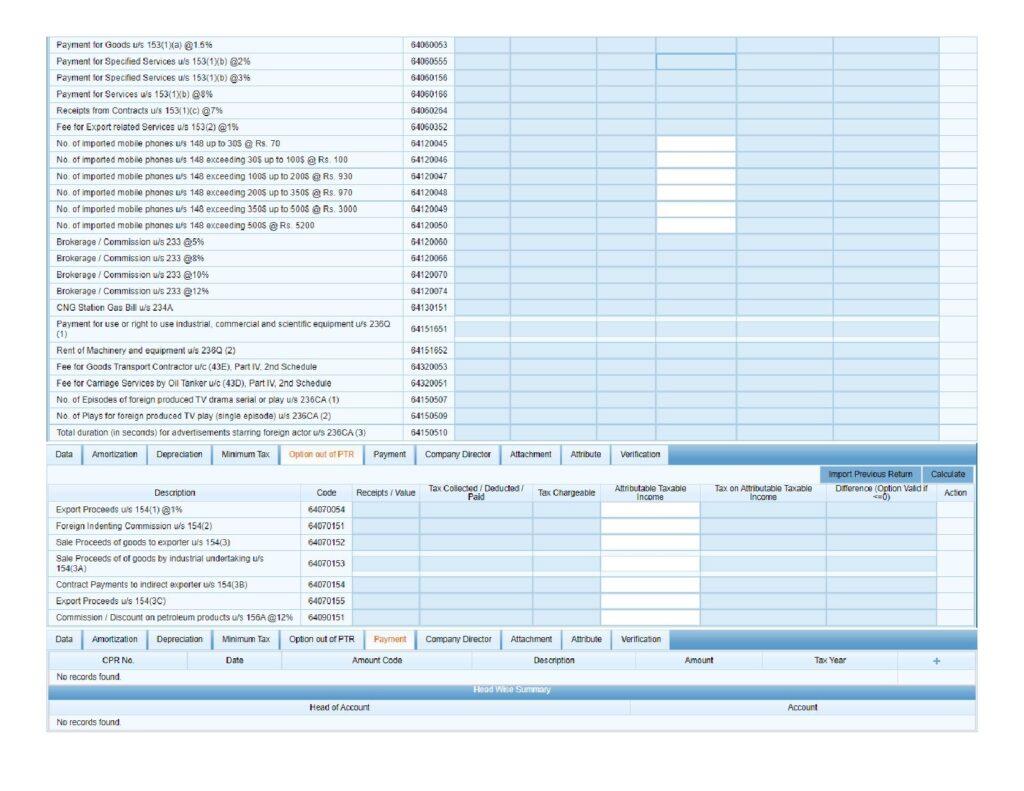

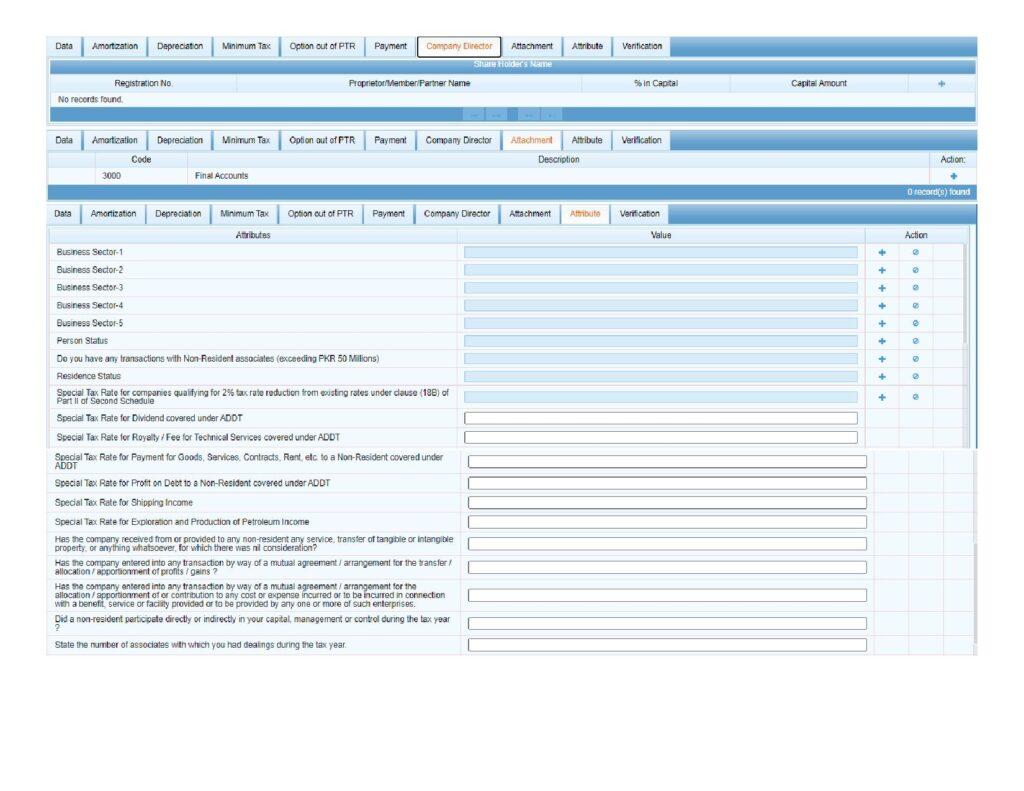

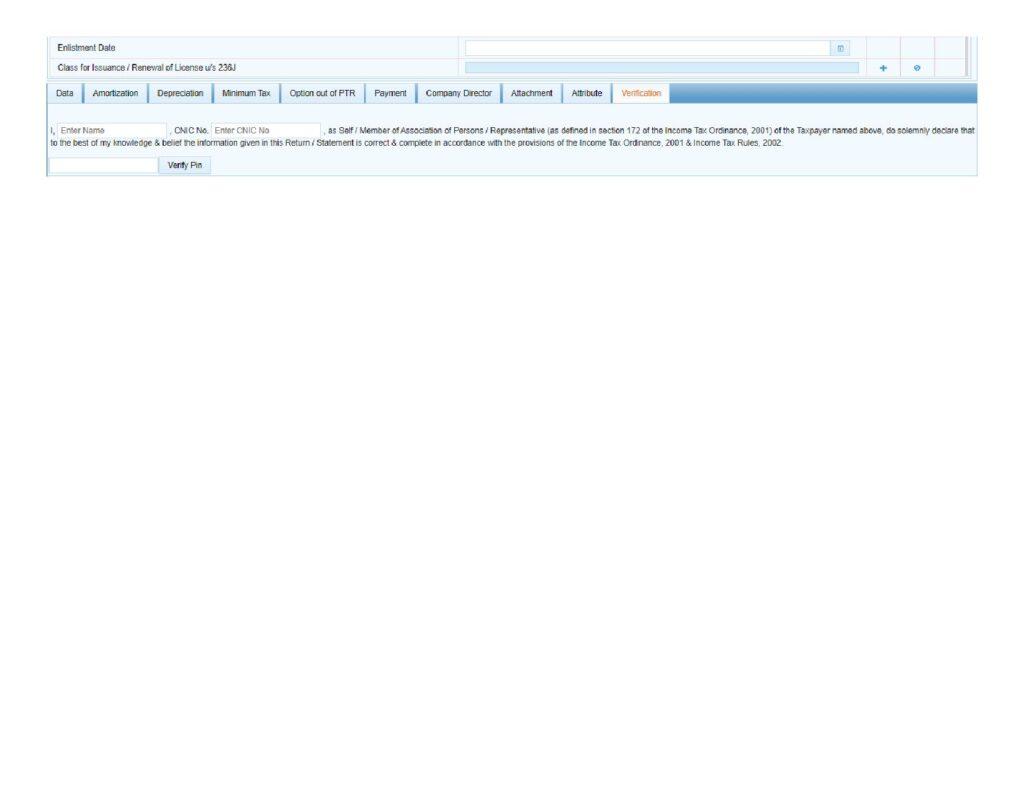

Following is finalized version of companies return form issued by the FBR: