The Federal Board of Revenue (FBR) has taken a significant step towards initiating the annual tax filing process by issuing income tax return forms for business individuals for the tax year 2022.

The official notification, SRO 978(I)/2022 dated June 30, 2022, provides important details regarding the forms and sets a deadline for the submission of annual income tax returns.

Business individuals are mandated to file their annual return of income for the tax year 2022 by September 30, 2022, according to the latest directive from the FBR. This announcement marks the beginning of the annual tax filing season for individual taxpayers engaged in business activities.

The release of income tax return forms is a crucial milestone in the tax compliance calendar, allowing business individuals to systematically report their financial activities and fulfill their tax obligations. The forms are carefully crafted to capture relevant financial information specific to the tax year 2022, ensuring accuracy and transparency in the reporting process.

The FBR, through this initiative, aims to streamline the tax filing process for business individuals, providing them with the necessary tools to fulfill their tax responsibilities efficiently. The specified deadline of September 30, 2022, underscores the importance of timely submissions, facilitating a smoother assessment process and contributing to the overall effectiveness of the tax administration system.

As business individuals prepare to navigate the intricacies of tax return submissions, they are encouraged to familiarize themselves with the updated forms and adhere to the prescribed deadline. Timely and accurate filing is not only a legal requirement but also a crucial element in ensuring the financial health of businesses and the broader economy.

The FBR has continuously emphasized the importance of tax compliance and has taken steps to simplify the filing process through the introduction of user-friendly forms and online resources. Taxpayers are encouraged to leverage these resources to ensure accurate submissions and to seek guidance from tax professionals if needed.

This latest development aligns with the FBR’s commitment to fostering transparency and accountability in the tax system. The annual tax filing season serves as a vital mechanism for revenue collection and allows the government to gauge the economic activities within the country accurately.

Business individuals are advised to stay abreast of any updates or additional guidance provided by the FBR during the course of the tax filing season. Compliance with the prescribed deadlines and accurate reporting will not only help individual taxpayers avoid penalties but will also contribute to the broader goal of building a robust and fair taxation framework in Pakistan.

As the tax filing season unfolds, stakeholders will monitor the level of compliance among business individuals and assess the impact of these regulations on the business community. The successful execution of the tax filing season is integral to sustaining a transparent and efficient tax ecosystem in Pakistan.

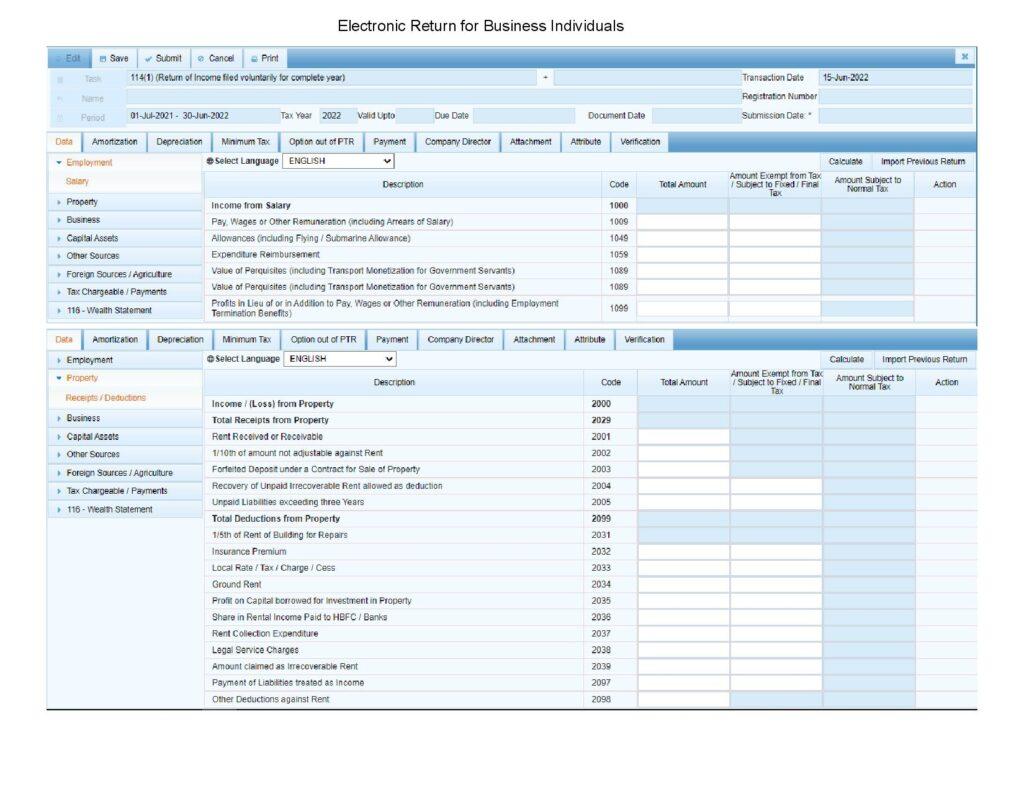

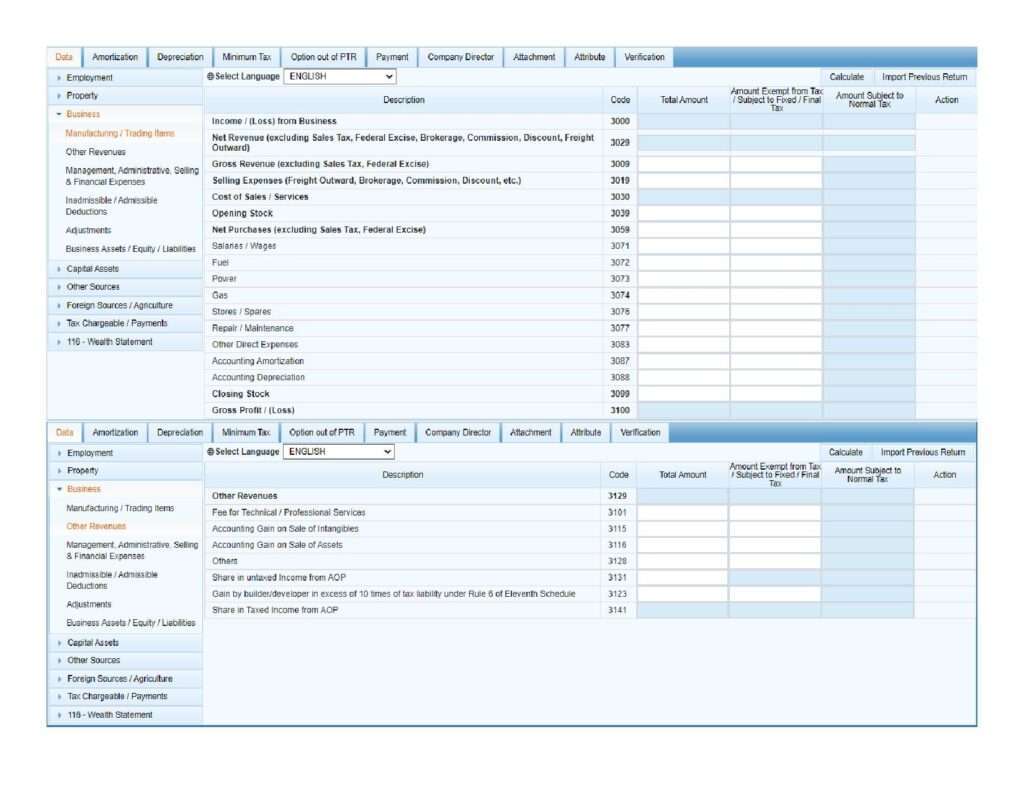

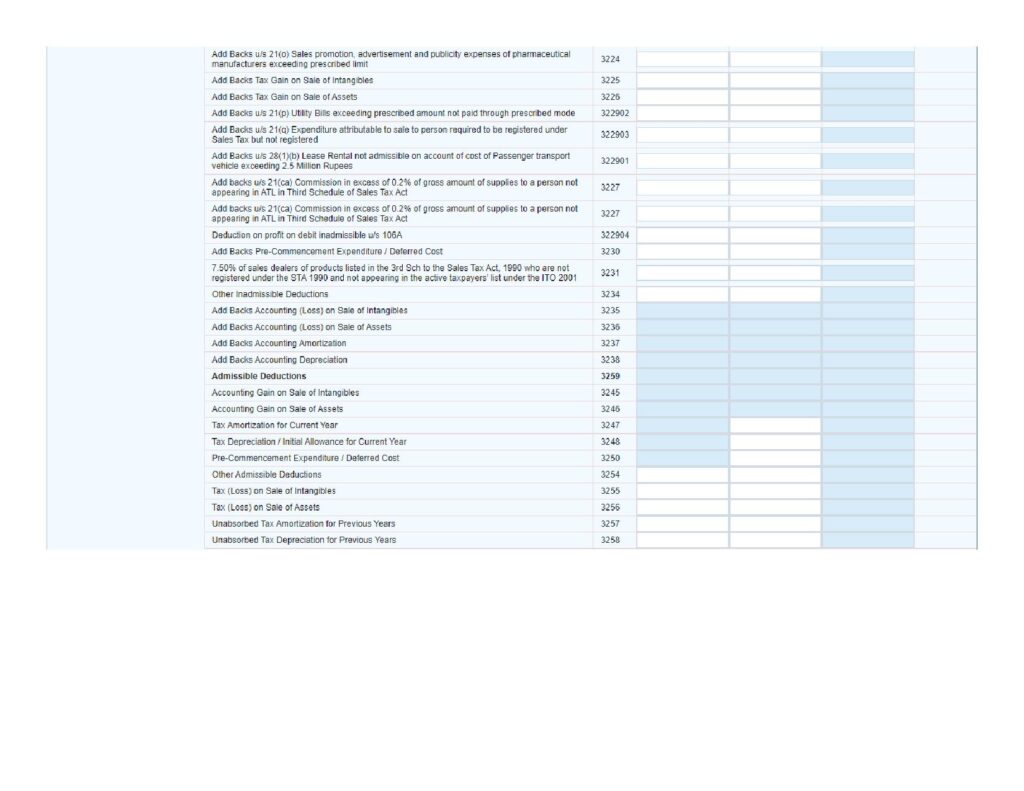

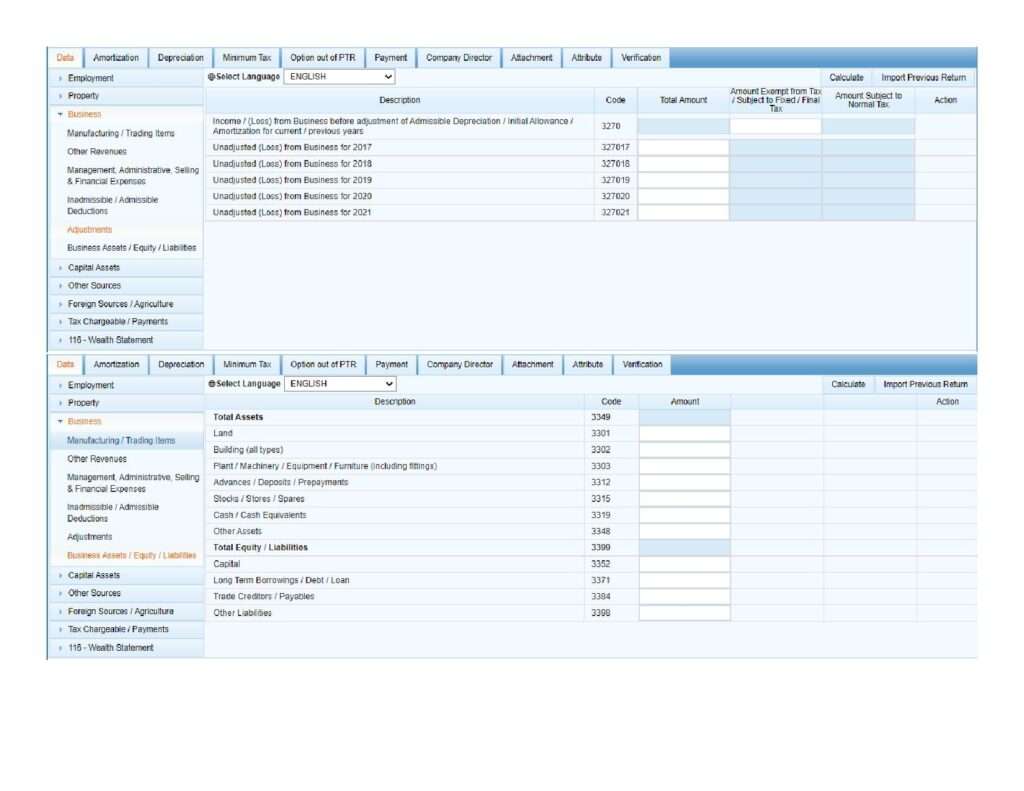

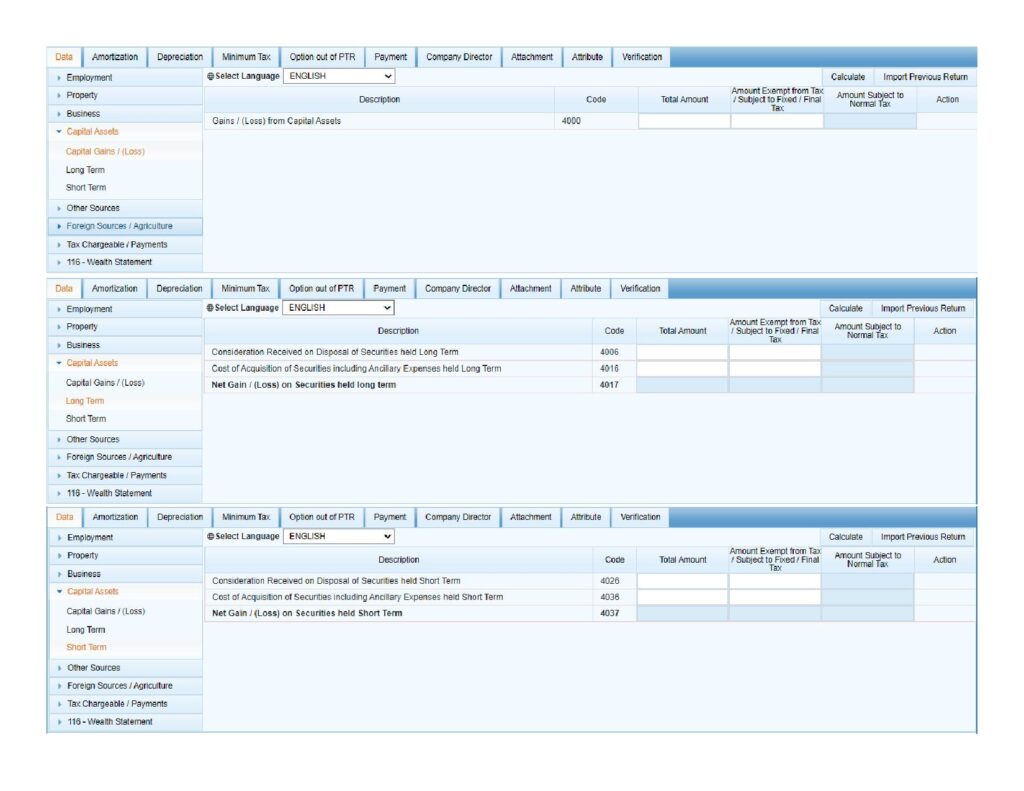

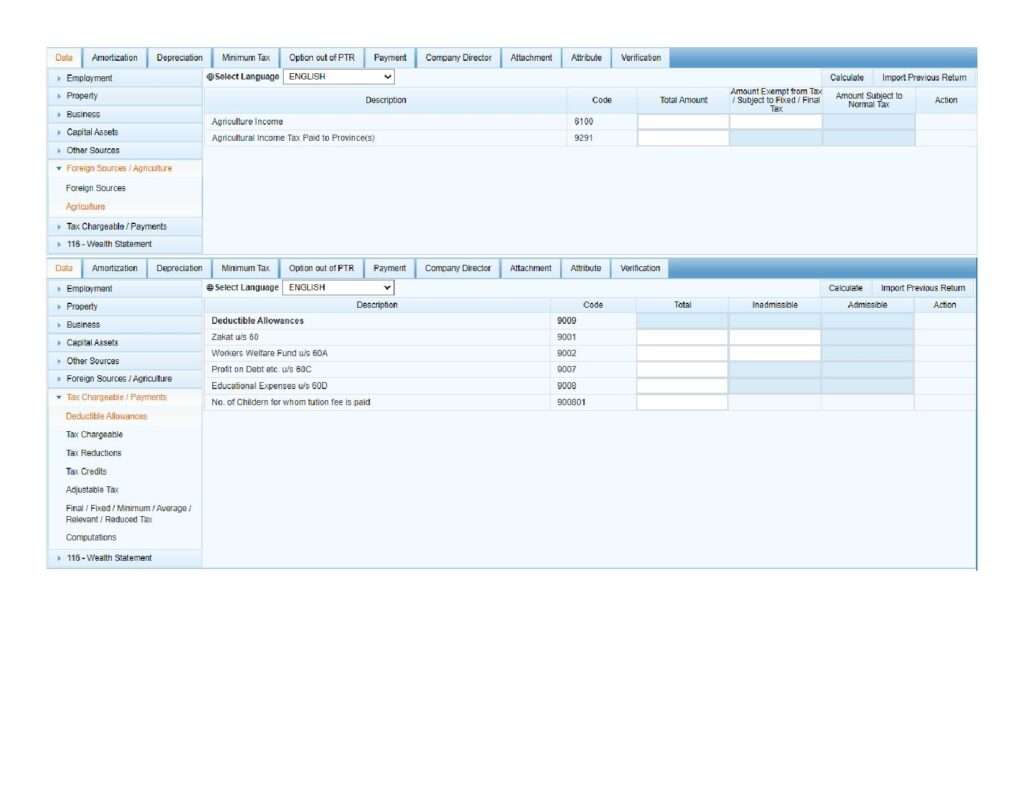

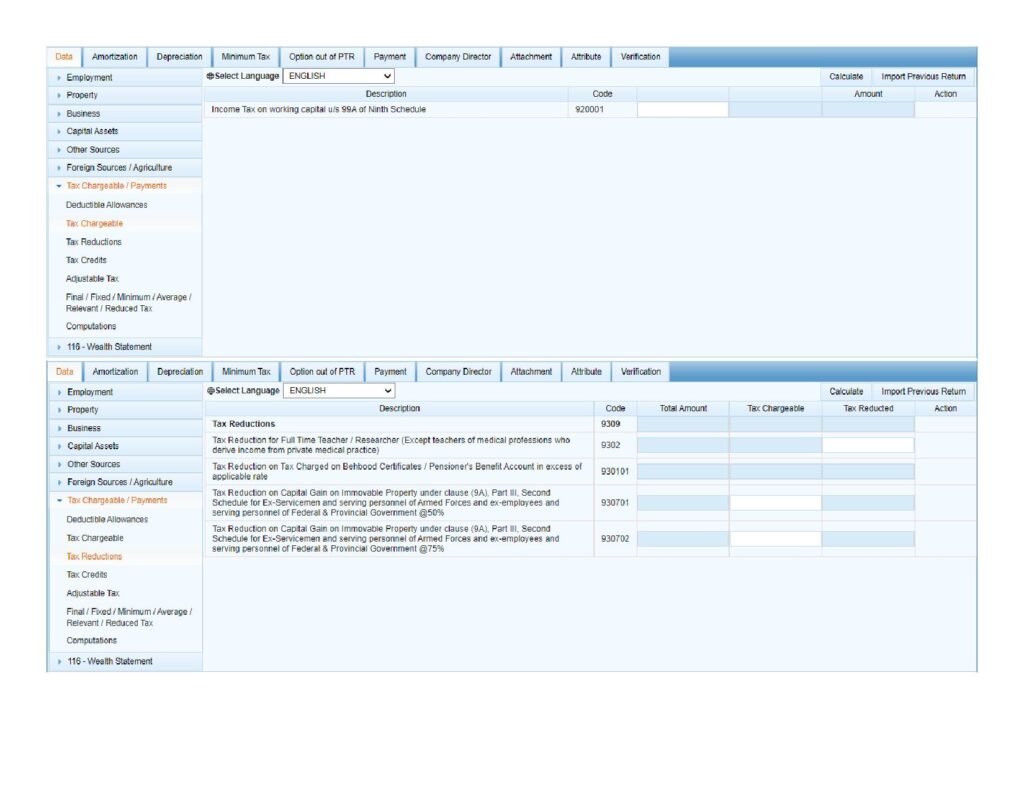

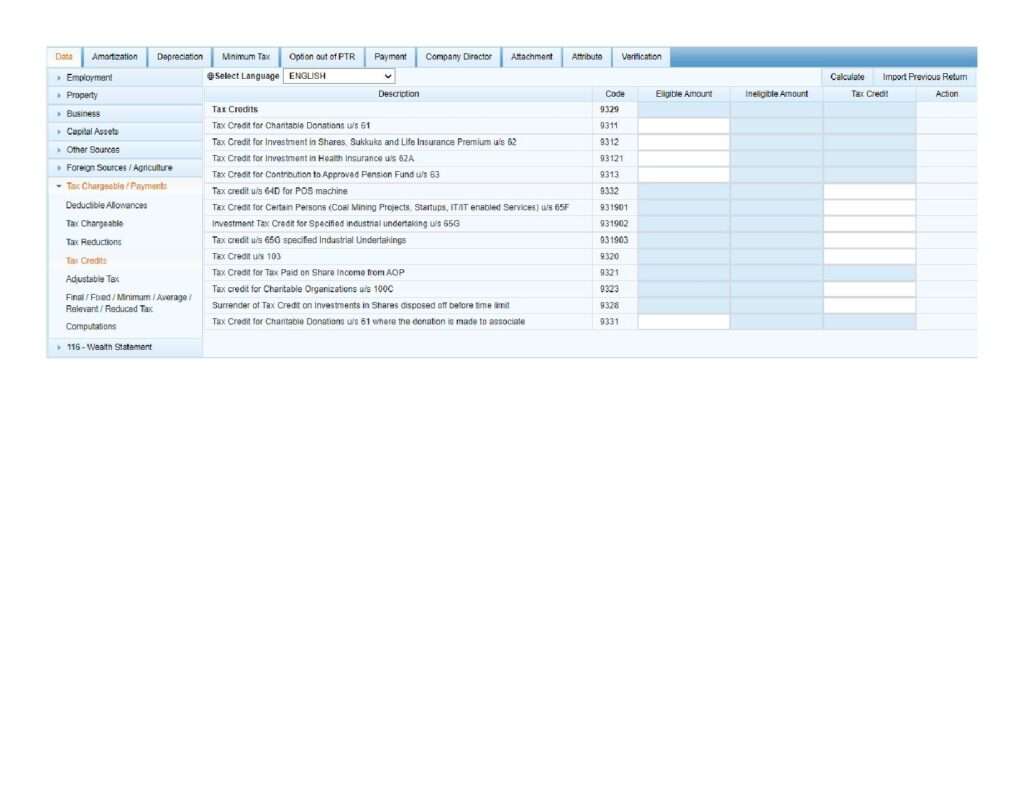

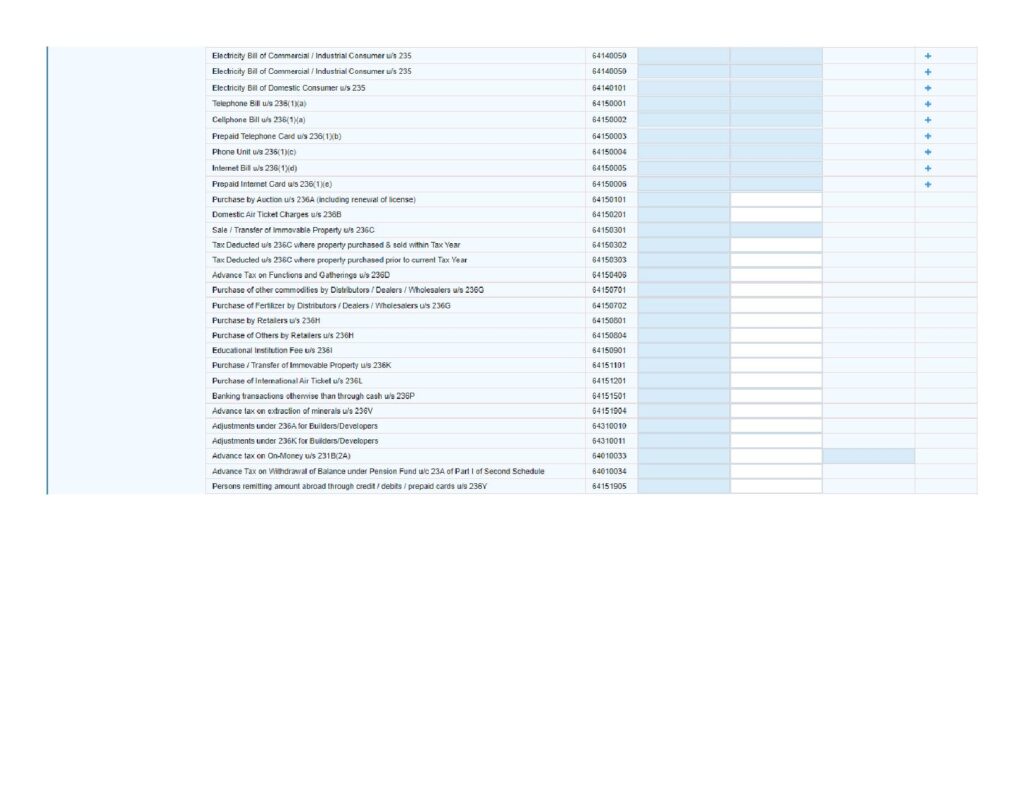

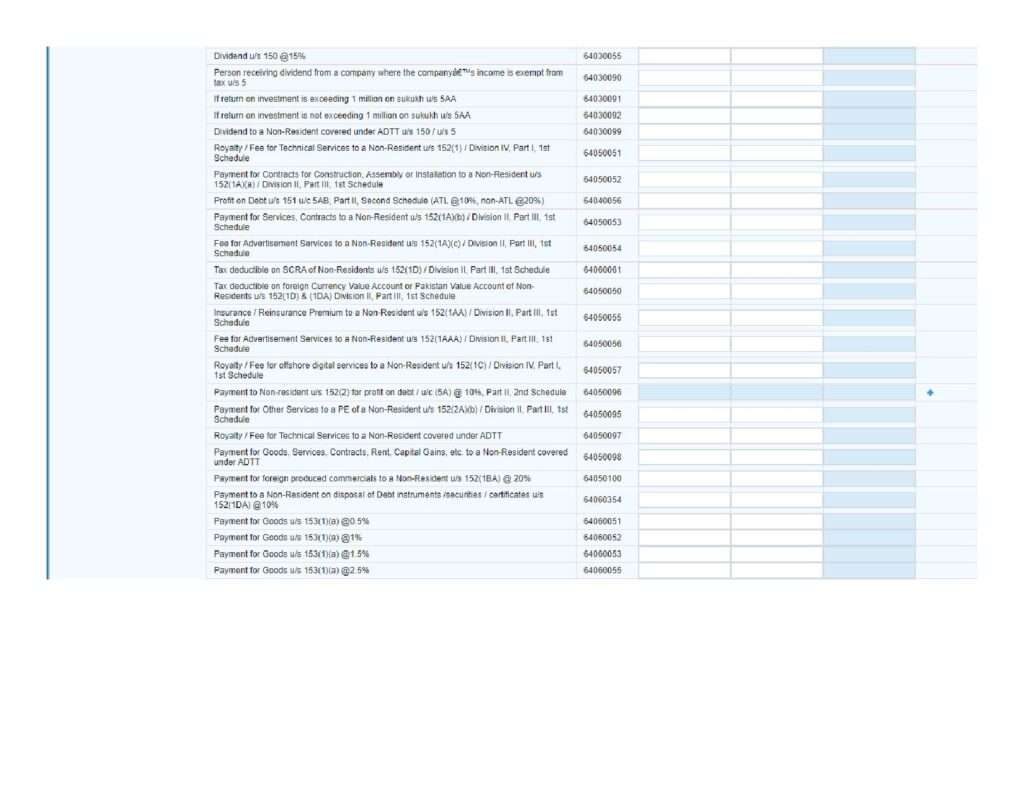

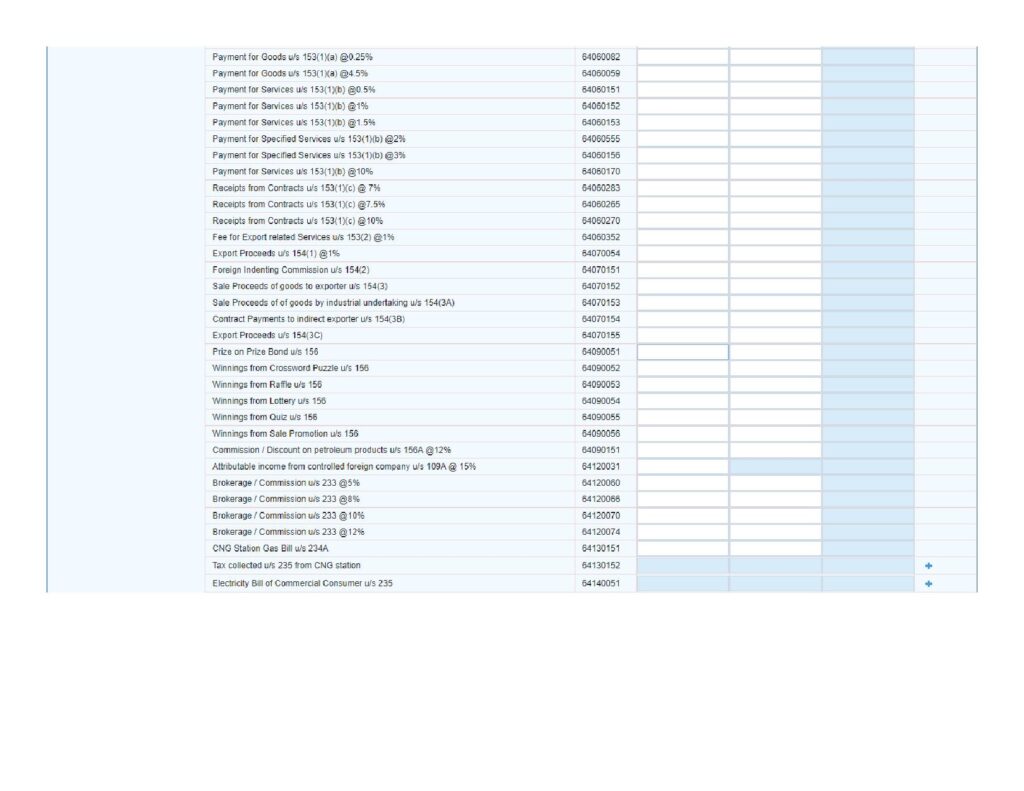

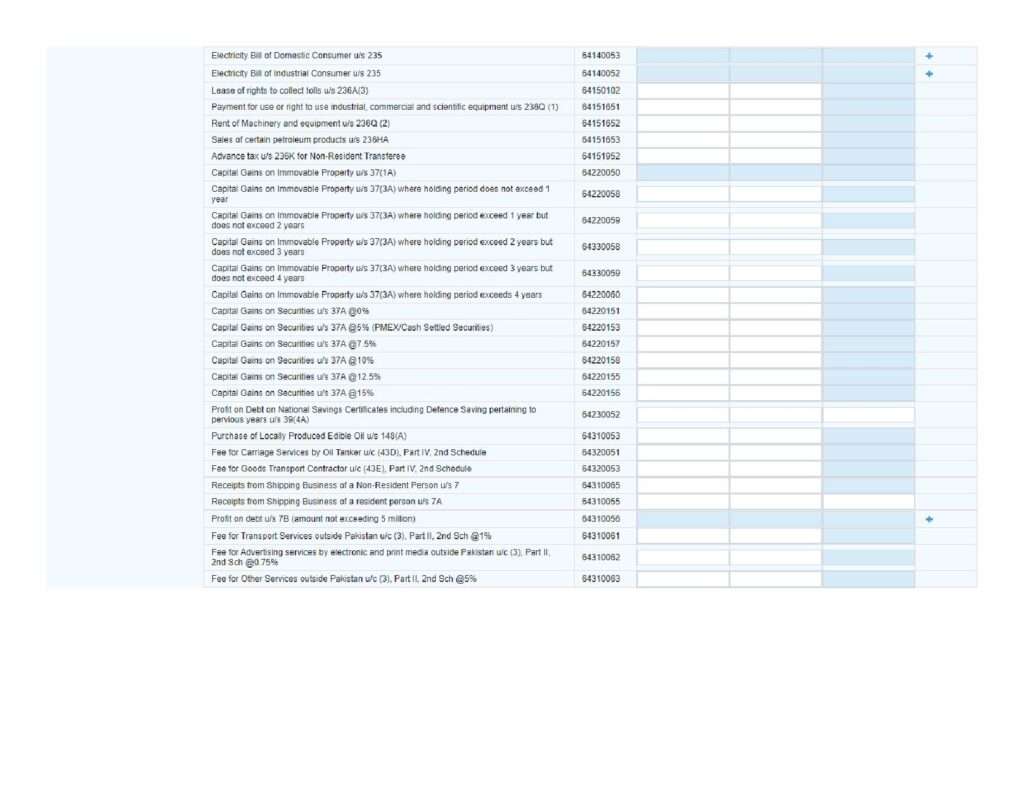

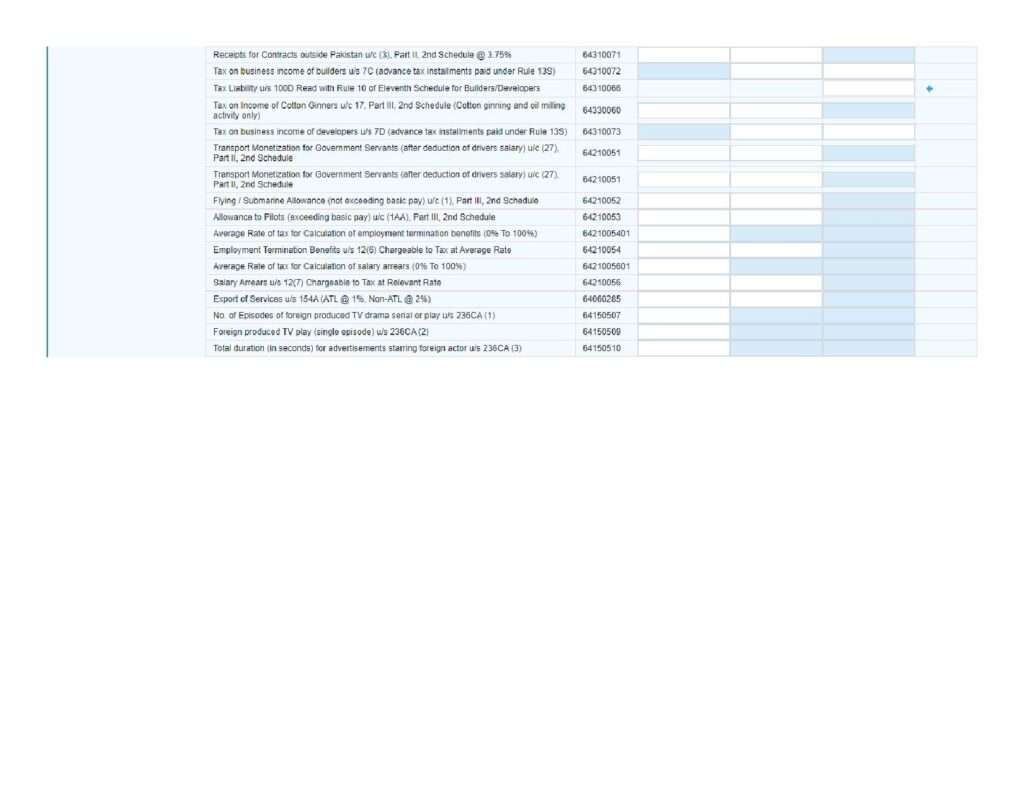

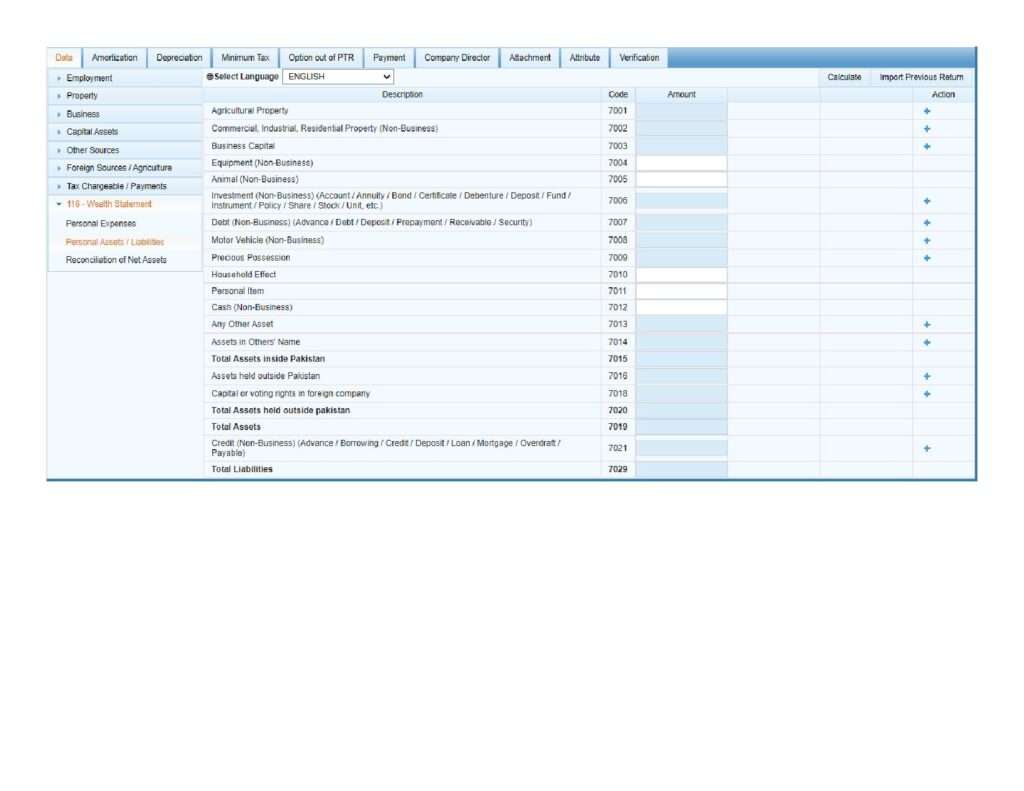

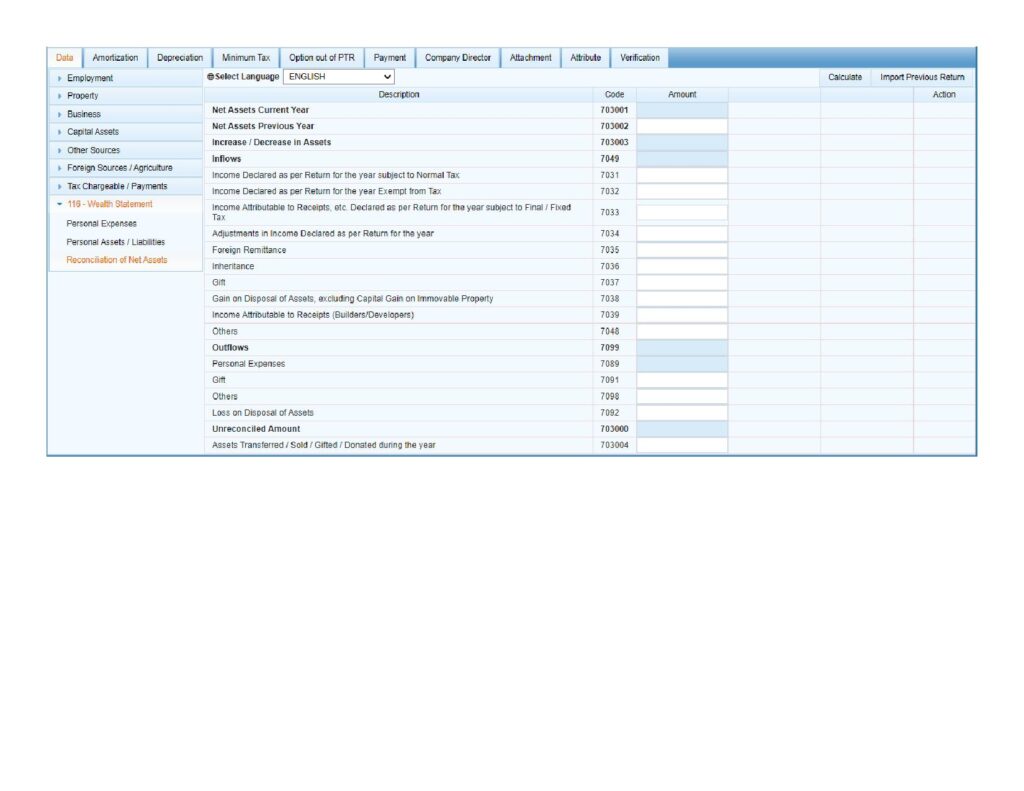

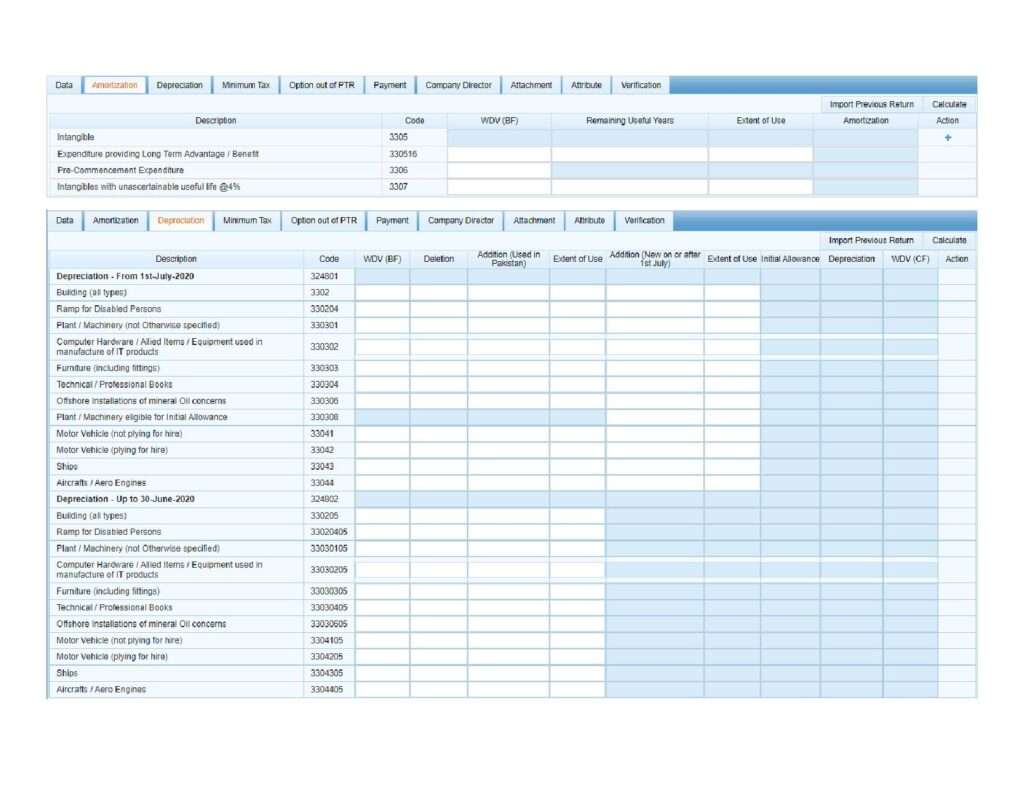

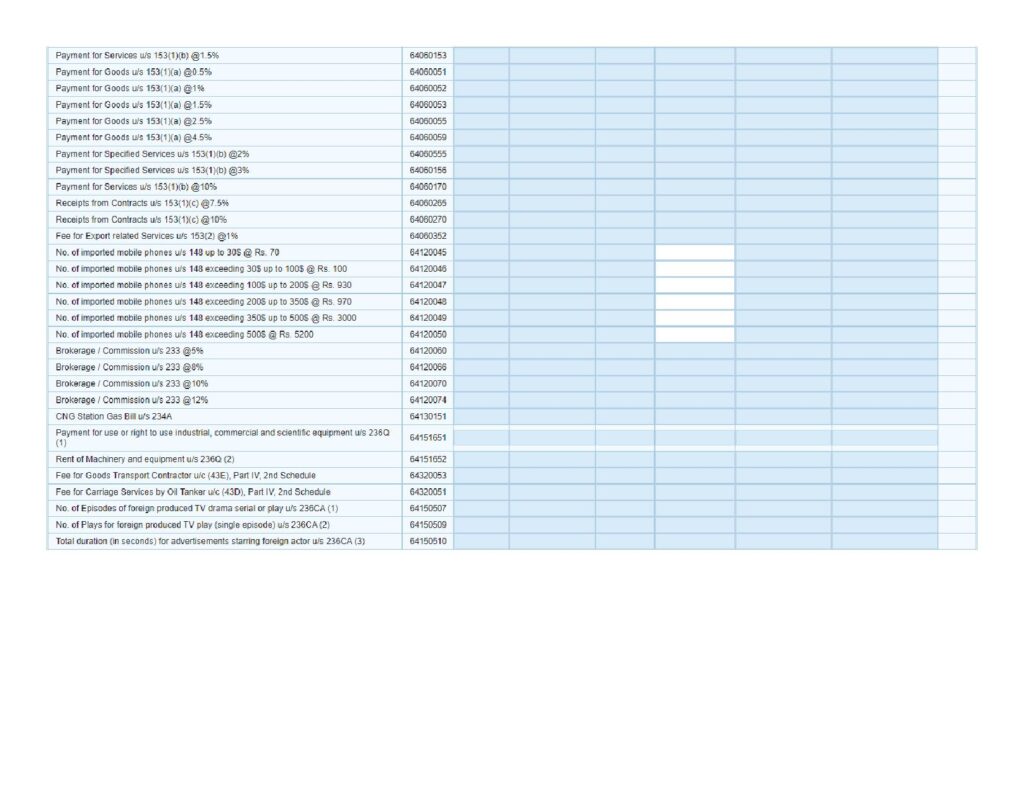

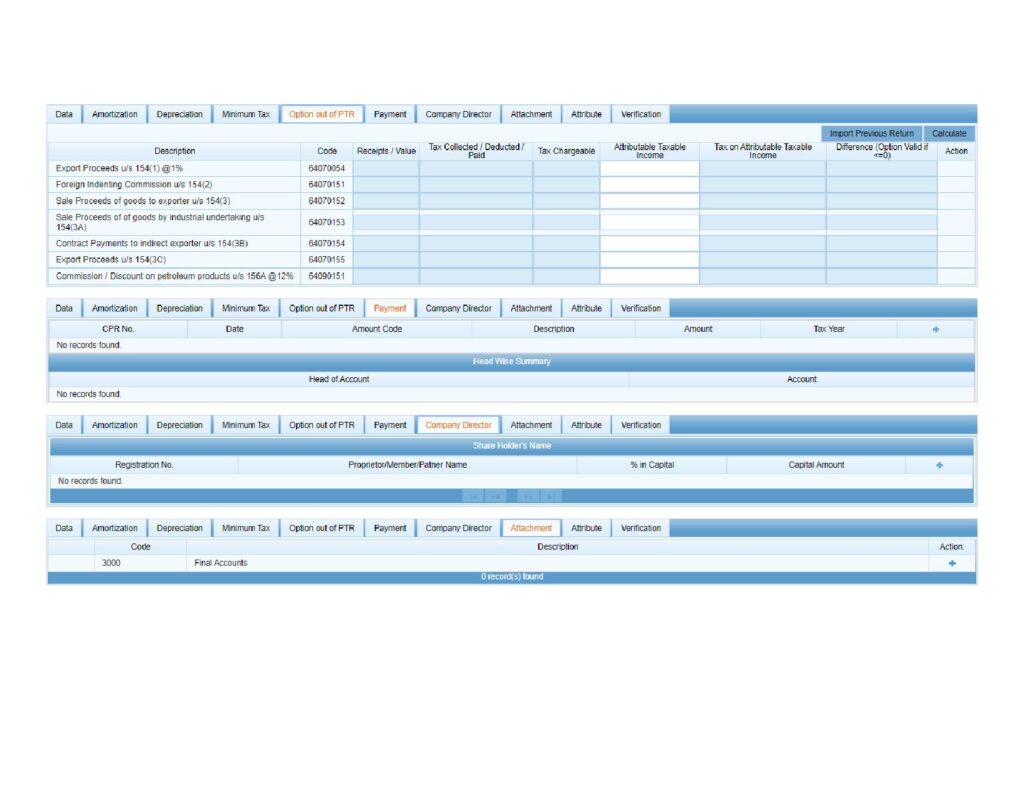

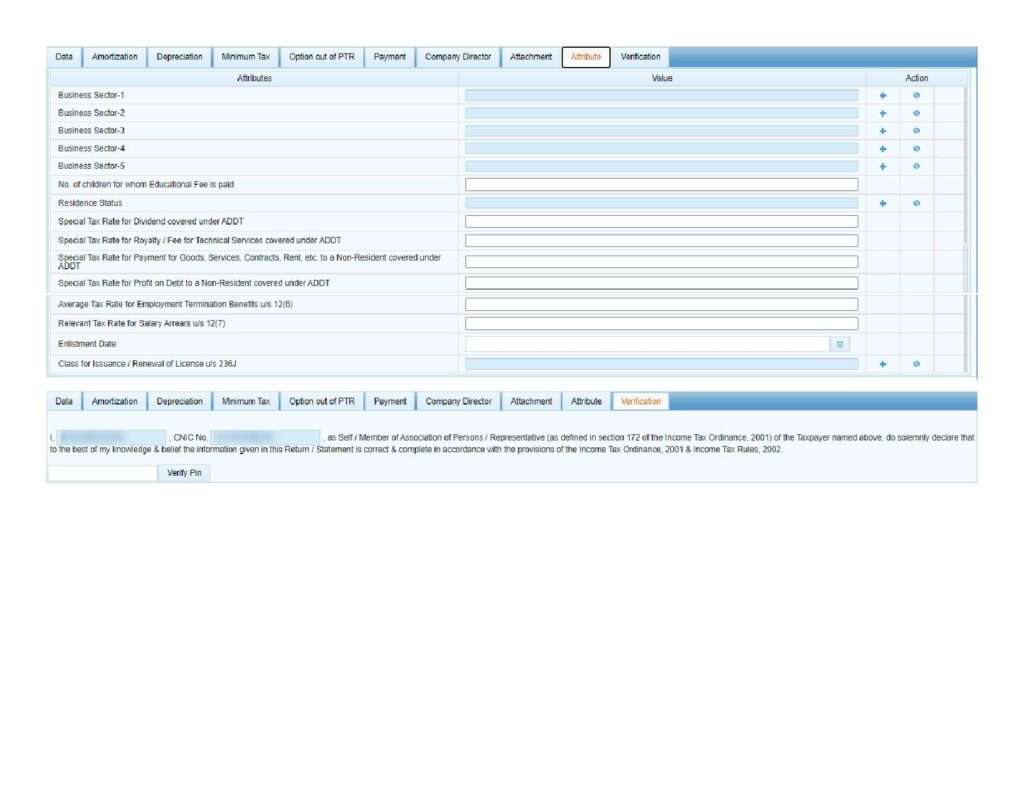

Following is finalized version of business individuals return form issued by the FBR: