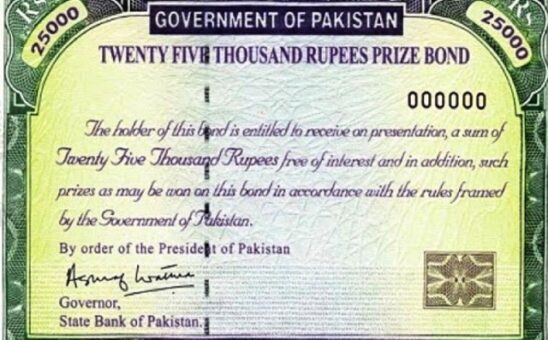

ISLAMABAD: The government has launched registered prize bonds of Rs25,000 denomination to discourage the informal economy and comply with laws related to anti-money laundering and counter financing of terrorism.

Further, the decision to document the bearer prize bonds to comply with the conditions of Financial Action Task Force (FATF).

The decision is part of documenting all unregistered prize bond of all denominations. Prior to this the government in the year 2017 launched premium prize bonds of Rs40,000 denomination. The bearer bonds of Rs40,000 denomination can be withdrawn up to December 30, 2021.

Through a notification the Finance Division approved the issuance of premium prize bonds (registered) of Rs25,000 denomination from December 09, 2020.

At a same time the government also announced to discontinue bearer bonds of Rs25,000 denomination from December 09, 2020.

The total investment in Rs25,000 denomination bearer prize bonds is around Rs164 billion by end of October 2020. The investment in the unregistered prize bonds has to be surrendered by May 31, 2021.

Holders of the bearer prize bonds can be converted to premium prize bonds through SBP Banking Services, National Bank of Pakistan, Habib Bank Limited, United Bank Limited, MCB Bank Limited, Allied Bank Limited and Bank Alfalah Limited.

Furthermore, the bearer prize bonds can also be replaced with Special Saving Certificates or Defence Saving Certificates through SBP Banking Service Corporation and authorized commercial banks and National Savings Centers.

Furthermore, the bearer bonds can be encashed by transferring the proceeds to the bond holder’s bank account through SBP Banking Services Corporation and authorized commercial bank branches and the Saving Accounts at National Saving Centers.

According to the Finance Division, the draw of premium prize bonds would be held on quarterly basis in which 707 prizes would be awarded. The first prize will be Rs30 million.

The holder of premium prize bonds shall also get profit at 1.79 percent on biannual basis.