With the pre-monsoon showers already gracing Pakistan, it’s time for drivers to gear up for the challenges the season brings. While the rain brings relief from the scorching heat, it also transforms roads into potentially hazardous landscapes.

(more…)Tag: motor car

-

Excise Department Cracks Down on Illegal Car Modifications

The Excise and Taxation (E&T) Department has ramped up its crackdown on illegal car modifications, specifically targeting vehicles with tinted windows and unauthorized number plates.

(more…) -

Essential Car Maintenance Guide for Vehicle Owners

PkRevenue.com – Owning your first car is an exciting milestone, but it also comes with the responsibility of proper maintenance to ensure longevity and reliability.

(more…) -

Sukkur Customs to auction Toyota, Suzuki cars on November 25, 2022

KARACHI: The Customs Collectorate, Sukkur has announced auction of Toyota and Suzuki cars to be held on November 25, 2022 at state warehouse of the Collectorate.

The Collectorate will present following cars for the auction:

READ MORE: Pakistan car imports surge by 108pc as restriction eases

01. Suzuki Kie Car, bearing Registration No. Without Number, Chassis No.HZ22S-675401, Engine No.K6A, Model 2006.

02. Toyota Aqua Car, bearing Registration No.BJU-862, Chassis No.NHP10-6298404, Model 2014 and Engine Capacity 1490 CC.

03. Toyota TZ Prado Jeep, bearing RegistrationNO. BD-8408 (Sindh), Chassis No. JTEBU25J005029572, Model 2005 (as per Japanese website) and Engine Capacity 4000 CC.

READ MORE: Hyderabad Customs auctions NDP vehicles on November 24, 2022

04. Toyota Prius Car, bearing Registration No.BGH-417, Chassis No.ZVW30-1358220, Engine No.2ZR-1230757, Model 2011 and Engine Capacity 1797 CC.

05. Toyota Corolla Fielder Car, Bearing Reg. No.AWV-301, Chassis No. NZE121-3384931, Engine No. 1NZ-CO15985, Model-2006 Engine Capacity 1500 CC.

READ MORE: Hyundai launch N Vision 74 Concept car

06. Toyota Axio Saloon Car, bearing Registration No.AXJ-090, Chassis No .NZE141-6015839, Engine No. 1NZ-C484965, Model 2009 and Engine Capacity 1490 CC. (As per Running Page).

07. Toyota Prado Jeep, bearing Registration No.BD-9322, Chassis No.PZJ77-0003273, Engine No.0990115, Model 1995 and Engine Capacity 3469 CC.

08. Toyota Corolla Fielder Car, Bearing Reg. No.BPU-210, Chassis No. ZZE122-0010909, Engine No. IZZ-FE, Model 2000 and Engine Capacity 1800 CC.

09. Suzuki Swift Car, Bearing Reg. No. LED-1475 (Punjab), Chassis No. ZC11S-107422, Model-2004, (as per Japanese website) and Engine Capacity 1298 CC.

READ MORE: Toyota reveal bZ Compact SUV Concept model

10. Toyota Prius Car, Bearing Reg. No.BHY-179, Chassis No. ZVW30-1121053, Engine No .2ZR-3JM5860700, Model-2014 Engine Capacity 1800 CC.

11. Suzuki Swift Car, bearing Registration No. QBA-1675, Chassis No .ZC11S-119082, Model 2004 and Engine capacity 1300 CC.

12. Toyota Premio Car, bearing Registration No.BEZ-654 (Sindh), Chassis No. AZT240-0021231, Model 2005-06 (as per Japanese website) and Engine Capacity 2000 CC.

13. Suzuki Swift Car, bearing Registration No.AZK-119, Chassis No .ZC11S-157917, Engine No. M13A, Model 2009 and Engine Capacity 1248 CC.

-

FBR slaps additional customs duty at 35% on motor vehicles

ISLAMABAD: The Federal Board of Revenue (FBR) has imposed additional customs duty at the rate of 35 per cent on import of motor vehicles under various HS Codes.

The FBR issued SRO 1572(I)/2022 dated August 22, 2022 to notify amended rates of additional customs duty on import of various items. Through the instant SRO, the revenue body amended SRO 967(I)/2022 dated June 30, 2022.

According to the latest SRO 1572(I)/2022, the FBR said thirty-five per cent additional customs duty on vehicle falling under PCT codes 8703.2323, 8703.2329, 8703.2490, 8703.3223, 8703.3225, 8703.3229, 8703.3390 and 8703.9000.

The FBR said that the notification would take effect on and from August 22, 2022 till 21st day of February 2023.

Through previous SRO 967(I)/2022 the additional customs duty was imposed at 2 per cent on cars, jeeps, light commercial vehicles in CKD condition exceeding 1,000 CC and heavy commercial vehicles in CKD condition.

The FBR imposed the additional customs duty in order to discourage luxury imports into the country in order to save foreign exchange.

It is worth mentioning that the government on May 19, 2022 through imposed a complete ban on import of luxury and non-essential items in order to stop depletion in foreign exchange reserves as well as stop free fall in rupee value.

READ MORE: Pakistan lifts ban on import of cars, phones, luxury items

However, on August 20, 2022, the government reversed its decision and allowed import of luxury and non-essential items despite the fact the foreign exchange reserves were declined drastically and the rupee value also registered massive fall against the US dollar.

Alternate to allowing import of luxury and non-essential items, the government increased regulatory duty and additional customs duty on import of various goods.

READ MORE: Pakistan raises Regulatory Duty to 100 % on motor vehicle import

-

Clearance of banned cars, phones allowed on 100% surcharge

ISLAMABAD: The government has allowed clearance of stuck up consignments of cars and mobile phones on payment of 100 per cent surcharge.

The ministry of commerce on Friday issued an office memorandum regarding prohibition / complete quantitative restrictions on import of non-essential and luxury items.

READ MORE: Pakistan lifts ban on import of cars, phones, luxury items

The ministry said that pursuant to the decision of federal cabinet on August 19, 2022, the federal government had allow release of all those consignments/shipments which had been imported in violation of SRO 598(I)/2022 dated May 19, 2022 and landed at any Pakistani port, subject to payment of surcharge.

The commerce ministry stated that to release those held up consignments, except Completely Built Unit (CBU) Auto, CBU phones and CBU home appliances, which landed after June 30, 2022 and on or before July 31, 2022 subject to payment of 25 per cent surcharge, and 35 per cent surcharge for those consignments which arrived after July 31, 2022.

READ MORE: 15% surcharge imposed for clearance of banned items

Similarly, to release held up consignments of CBU auto, CBU mobile phones and CBU home appliances, which landed after June 30, 2022 and on or before July 31, 2022 subject to payment of 100 per cent surcharge.

The ministry of commerce issued SRO 1562(I)/2022 for lifting the ban on luxury and non-essential items, including motor vehicles, mobile phones and home appliances.

The government on May 19, 2022 through a circular No. 598 (I)/2022 imposed the complete ban on import of such items in the wake of serious balance of payment crisis and to prevent fall in rupee value.

Despite the ban, the rupee fell to the historic low of Rs239.94 against the dollar on July 28, 2022.

It is worth mentioning that the foreign exchange reserves were drastically decreased despite imposition of ban on imported luxury items.

-

Super tax to hammer auto business in Pakistan: Honda Atlas

KARACHI: Honda Atlas Cars (Pakistan) Limited on Thursday said that super tax to hammer the already thin margins of the auto business in the country.

The company in its detailed financial report said: “The imposition of Super Tax will further hammer the already thin margins of auto business.”

The company said that the automobile industry is considered as one of the key sectors for rapid transformation of the economy.

READ MORE: Suzuki Motors warns plant shutdown in Pakistan

Likewise, the automobile industry of Pakistan epitomizes considerable growth, capacity building and technological prowess.

“The current state of auto sector, however, has matured differently through the quarter under review. Adverse USD/PKR exchange rate parity and global supply glitches continue to undermine the Industry’s potential throughout,” it said.

Moreover, the fiscal measures adopted by the State Bank of Pakistan (SBP) for the management of foreign reserves has unavoidably impacted the import and production schedules lately.

READ MORE: Indus Motors rebuts plant shutdown reports

Rupee devaluation has approached an alarming level under the vague economic and political direction; further aggravating the situation.

“Resultantly, the car customers are facing delays in delivery, hikes in prices and temporary non- availability of some car variants,” the company said.

Honda Atlas Cars said during the period under review, the sales and production of the four-wheeler segment have not been up to the Industry’s expectation owing to curbed auto lending, escalating inflation and soaring fuel prices.

The overall industry production for the three months ended June 2022 remained 71,745 units in comparison with 53,915 units a year ago while car sales were observed at 73,815 units against 46,679 units during the same period.

READ MORE: Toyota Indus Motors offers 100% refunds on booking cancellation

The company produced 9,324 units against 7,826 units and sold 9,446 units as compared to 7,598 units in the same period of last financial year.

The recently approved Federal Budget 2022-2023 also poses tough times ahead for the auto industry. Amid negotiations with International Monetary Fund (IMF), to release the bailout package, the Government had to enforce stringent stabilization measures. Accordingly, the purchase of automobiles with engine capacity exceeding 1300CC has now been subject to 1 per cent of Capital Value Tax (CVT).

The advance tax on vehicles with engine capacity above 1600CC has also been significantly increased.

These revenue measures by the Government will further burden the customers, which may affect the Industry’s sales volume.

READ MORE: Toyota lowers July production in Japan

The imposition of Super Tax will further hammer the already thin margins of auto business.

The auto industry may experience a further slowdown in anticipation of price revision and rising interest rates.

Ranging from raw material sourcing to management of stable commodity pricing and customary lead time, the automobile industry is currently in the midst of multiple challenges.

During the quarter, the OEMs have managed to avoid potential shut down of production due to relatively higher stock levels. This led to improved financial results for the 1st quarter of the new financial year.

During the three months ended June 30, 2022, the Company achieved net sales revenue of Rs 30,246 million as compared to Rs 21,765 million in the corresponding period last year.

Higher production volumes with better overhead absorption helped to generate gross profit of Rs 1,915 million against Rs 1,595 million, a year ago. The selling and administrative expenses were increased to Rs 575 million against Rs 363 million.

Other income improved to Rs 526 million against Rs 335 million owing to customers’ confidence on the Company’s products and better funds management; benefited by increased interest rates.

The Company posted Rs 1,094 million as profit before tax in comparison to Rs 1,364 million. After statutory tax adjustments, including super tax provision, the net profit for the three month period ended June 30, 2022 came out Rs 658 million as compared to Rs 928 million of the corresponding period last year.

The earning per share remained Rs 4.61 against Rs 6.50 for three months of the last year.

-

Toyota unveils all new Crown for first time

JAPAN: Toyota Motor Corporation on Friday unveiled its all new Crown. The four new models of Crown are Crown (Crossover Type), Crown (Sport Type), Crown (Sedan Type), and Crown (Estate Type).

The company will release the Crown (Crossover Type) as the first model during the fall of this year.

TOYOTA has unveiled the all new Crown for the first time in the world, and will release the Crown (Crossover type) as the first model around the fall of this year.

The Crown made its initial debut in 1955 as Toyota’s first mass production passenger vehicle created with Toyota’s own domestic technology. The DNA of “innovation and limit-pushing” that led to the creation of the first independently developed luxury car in the early postwar period has been passed down to successive models of Crowns for the past 67 years, always pursuing new values that are one step ahead of the times and loved by many customers.

However, the times have changed even faster, and the Crown has become unable to fully meet the diversifying needs of its customers, and its presence as a flagship vehicle has become less significant.

In designing the new Crown, the development team thoroughly reexamined what “Crown” is, and as a result of their pursuit of a “Crown for a new era,” they have created four completely new models. In addition to the Crossover type, a new style that combines a sedan and an SUV, the Sport offers a sporty driving experience with an enticing atmosphere and an easy-to-drive package. The Sedan is a new formal design that meets the needs of chauffeurs, and the Estate is a functional SUV with a mature atmosphere and ample driving space. The new series will be rolled out in about 40 countries and regions.

The details of the new Crown (Crossover type) are as follows.

Vehicle Outline

The “Crown” for the future reimagined from the ground up with a high-quality minimalist design

Exterior Design

The stylish, coupe-like silhouette is combined with elevated styling that conveys a sense of strength, achieving both fluidity and dynamism and expressing a completely new form of a flagship vehicle for a new era.

The headlights and taillights, connected from left to right in a single straight line, and the side view that expresses sophistication through surface variation without relying on character lines, combine to create a simple yet refined and majestic design.

Large-diameter tires that break with the conventional idea of a sedan have been adopted. By applying innovations to the body structure to create an underbody that extends outward close to the sides of the body and carefully examining the balance of the spaces between the body and the tires, we have created a powerful style that is neither a sedan nor an SUV with the sense of stability representative of an elevated sedan.

Interior Design

Horizontally integrating the display and operating equipment creates a functional layout that can be operated intuitively from any seat. The wrap-around form from the instrument panel to the doors also give a sense that all seats are special, enabling the driver to focus on driving and providing comfortable and enjoyable mobility for passengers.

Meticulous attention to every interior component, including the understated and welcoming decorations of WARM STEEL, an invitingly shaped and comfortable shift knob, seats that focus on instantly recognizable finishing and provide a sense of security when seated, and other features, helps create a space with a sense of quality and richness.

Color Design

In terms of body colors, the newly developed “Precious Bronze” and “Precious Ray” as well as other distinctive bytone colors are coordinated to express the new Crown’s transformation. A total of 12 body color and four interior color combinations offer a wide range of variations.

Effortless and dignified driving and a comfortable ride becoming of a Toyota flagship

2.4-liter Turbo Hybrid System

The hybrid system, which combines an inline 4-cylinder turbo engine that produces powerful torque even at low RPM, the latest eAxle electric powertrain that provides high driving torque, and a newly-developed bipolar nickel-hydrogen battery have been combined for the first time by Toyota. The hybrid system responds linearly to the operation of the accelerator by the driver creating a driving feel with a sense of comfortable acceleration.

2.5-liter Series Parallel Hybrid System

The Crown (Crossover type) is equipped with an optimized, high-efficiency hybrid system and a newly-developed bi-polar nickel-hydrogen battery, achieving class-leading fuel economy and quietness and further advancing the high-quality and smooth driving performance distinctive of the Crown.

Newly developed platform

Using a hip point higher than earlier sedans enabled through the adoption of large-diameter wheels makes entry and exit easier and allows excellent visibility. Additional space is provided above the head and to the front and rear to create a comfortable interior space with the sense that every seat is a first-class seat.

While the package prioritizes ease of entry and exit and driving, the TNGA platform provides a lightweight and well-balanced high-rigidity body. The use of McPherson struts in the front and a multi-link suspension in the rear also allows for solid straight-line stability characteristic of the Crown, agility, and a flat feeling that does not blur the line of sight. All these features along with a smooth ride with minimal vibration were pursued to achieve a comfort level that makes you want to stay in the car for a long time.

The most advanced safety and driving support systems provide reassuring and convenient driving

Toyota Safety Sense

Toyota Safety Sense, the latest active safety package with advanced and improved functions, is standard on all Crown grades. The range of accidents it can respond to has been expanded even further, enabling enjoyable driving with peace of mind.

Toyota Teammate

The new Crown (Crossover type) is equipped with Toyota Teammate, a suite of driver-assistance technologies. Advanced Drive (support during traffic congestion), which supports safe driving in traffic congestion, Advanced Park (with remote function), which automatically parks and exits from a parking space in a variety of parking situations and can be operated remotely as well, and other safety and convenient advanced functions are included.

The new Crown (Crossover type) will also start being offered via the KINTO*4 car subscription service. When ordered through KINTO, automobile insurance, periodic maintenance, and various other vehicle expenses are included in the monthly payments. Customers, corporations, and individuals can sign up either online or at a dealer to enjoy easy access.

In addition, if the “Cancellation Fee Free Plan” is selected as the payment method, the cancellation fee can be reduced to zero and the vehicle usage can be continued after the expiration of the initial three-year contract period by paying a predetermined application fee. The CROSSOVER G “Advanced Leather Package” monthly fee starts at 89,100 JPY (including tax).

-

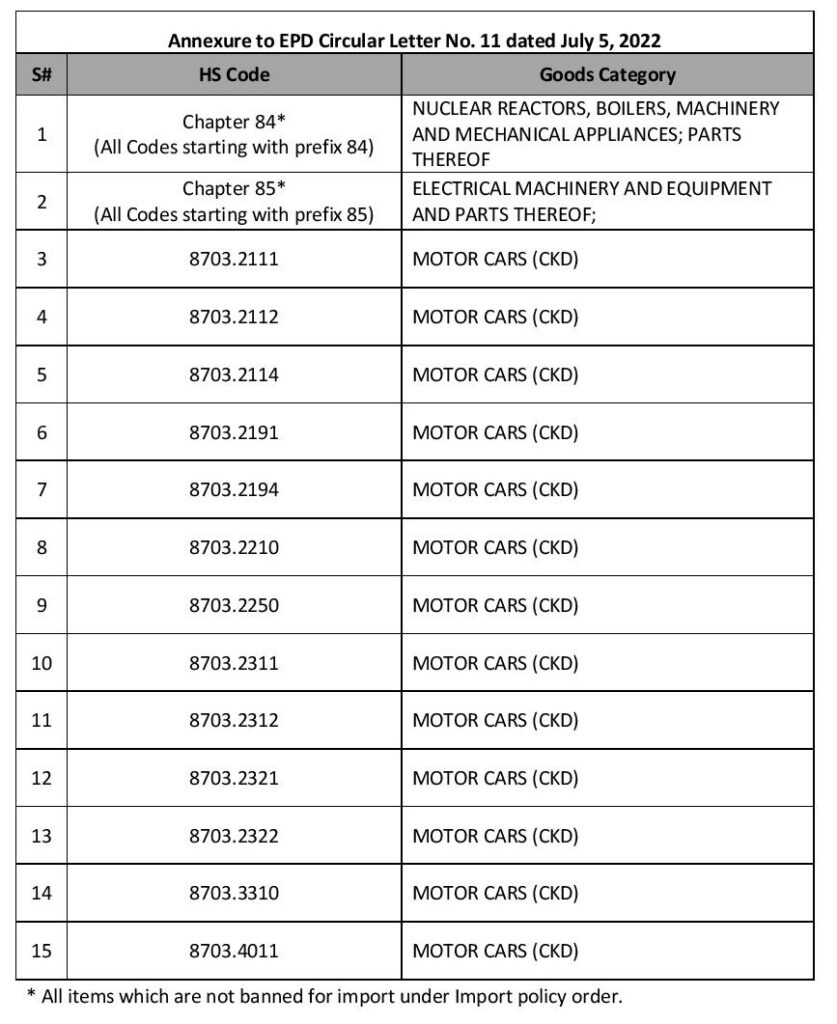

SBP makes permission mandatory for motor car import

KARACHI: The State Bank of Pakistan (SBP) on Tuesday made it mandatory for banks to take prior permission for making transactions related to import of motor cars in Completely Knocked Down (CKD).

The SBP issued a circular to implement the decision. The central bank invited attention of banks to EPD Circular Letter No. 9 dated May 20, 2022 relating to import of goods.

READ MORE: Pakistan car sales climb up by 50% in 11 months

In this regard, the list of goods for which Authorized Dealers are required to seek prior permission from Foreign Exchange Operations Department (FEOD), SBP-BSC for initiating the import transaction, has been updated.

Henceforth, Authorized Dealers shall be required to seek prior permission from FEOD, SBP-BSC before initiating transactions for import of goods listed in the enclosed Annexure.

READ MORE: Pakistan massively increases taxation on motor vehicles

All other instructions on the subject shall remain unchanged. The banks have been advised to bring the same to the knowledge of all the concerned and ensure meticulous compliance of the above and other applicable regulations on the subject.

Authorized Dealers are especially instructed to bring these instructions to the knowledge of their customers and advise them to approach the bank before initiation of import transaction of any item covered under this circular letter.

READ MORE: Pakistan allows conditional import of CBU vehicles

It is important to note that the government on May 19, 2022 imposed ban on luxury and non-essential items in order to discourage outflow of dollars.

The import ban was imposed on only motor vehicles Completely Built Unit (CBU). However, the circular of the SBP has made the CKD motor cars import subject to prior approval.

READ MORE: Honda Cars declares 40% surge in annual profit

-

Tax authorities to determine values of immovable properties, motor cars on discovery of concealment

ISLAMABAD: The tax authorities shall determine value of immovable properties and motor cars for tax purpose on discovery of concealment by a person or a company.

Officials in Federal Board of Revenue (FBR) said that under Section 111 of Income Tax Ordinance, 2001 any disclosed income or assets will be taken as concealed income and leviable to tax and prevailing fine and penalties.

Income Tax Rules, 2002 has outlined the determination of assets that are concealed by a person or a company.

(1) The valuation of immovable property for the purposes of section 111 shall be taken to be-

(a) the fair market value of immovable property shall be the value notified by the Board under sub-section (4) of section 68, in respect of area or areas specified in the said notifications;

(b) if the fair market value of any immovable property of any area or areas has not been determined by the Board in the notification referred to in sub-section (4) of section 68, the fair market value of such immovable property shall be deemed to be the value fixed by the District Officer (Revenue) or provincial or any other authority authorized in this behalf for the purposes of stamp duty; and

(c) in the case of agricultural land, the value shall be equal to the average sale price of the sales recorded in the revenue record of the estate in which the land is situated for the relevant period or time;

(d) if in a case sale price recorded in the instrument of sale of any property is higher than the fair market value as determined under clauses (a), (b) and (c), the applicable price shall be higher of the two; and

(e) in the case of sale price of any auctioned property or the fair market value as determined under clauses (a), (b) and (c), the higher price shall be applicable.

(2) For the purposes of section 111 and subject to sub-rule (2), the value of motor cars and jeeps shall be determined in the following manner, namely:-

(a) the value of the new imported car or jeep shall be the C.I.F. value of such car or the jeep, as the case may be, plus the amount of all charges, customs-duty, sales tax, levies, octroi fees and other duties and taxes leviable thereon and the costs incurred till its registration;

(b) the value of a new car or jeep purchased from the manufacturer or assembler or dealer in Pakistan, shall be the price paid by the purchaser, including the amount of all charges, customs-duty, sales tax and other taxes, levies, octroi, fees and all other duties and taxes leviable thereon and the costs incurred till its registration;

(c) the value of used car or jeep imported into Pakistan shall be the import price adopted by the customs authorities for the purposes of levy of customs-duty plus freight, insurance and all other charges, sales tax, levies octroi, fees and other duties and taxes leviable thereon and the costs incurred till its registration;

(d) the value of a car or jeep specified in clause (a), (b) and (c) at the time of its acquisition shall be the value computed in the manner specified in the clause (a), (b) or (c), as the case may be, as reduced by a sum equal to ten percent of the said clause for each successive year, upto a maximum of five years; or

(e) the value of a used car or jeep purchased by an assessee locally shall be taken to be the original cost of the car or the jeep determined in the manner specified in clause (a), (b) or (c), as the case may be, as reduced by an amount equal to ten percent for every year following the year in which it was imported or purchased from a manufacturer.

(3) In no case shall the value be determined at an amount less than fifty percent of the value determined in accordance with clause (a), (b) or (c) or the purchase price whichever is more.

(4) For the purposes of section 61, the value of any property donated to a non-profit organization shall be determined in the following manner, namely:-

(a) the value of articles or goods imported into Pakistan shall be the value determined for the purposes of levy of customs duty and the amount of such duty and sales tax, levies, fees, octroi and other duties, taxes or charges leviable thereon and paid by the donor;

(b) the value of articles and goods manufactured in Pakistan shall be the price as recorded in the purchase vouchers and the taxes, levies and charges leviable thereon and paid by the donor;

(c) the value of articles and goods which have been previously used in Pakistan and in respect of which depreciation has been allowed, the written down value, on the relevant date as determined by the Commissioner;

(d) the value of a motor vehicle shall be the value as determined in accordance with rule; and

(e) the value of articles or goods other than those specified above, shall be the fair market value as determined by the Commissioner.