ISLAMABAD: Federal Board of Revenue (FBR) has extended the last date for payment of duty and tax and filing of sales tax and federal excise returns for the month of May 2019.

The FBR issued notification on Monday addressing all chief commissioners of Inland Revenue regarding extension in the date for submission of sales tax and federal excise return for the tax period of May 2019.

The dates have been extended considering the Eid holidays which are falling on June 04 to June 07, 2019.

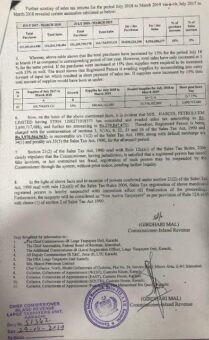

The FBR extended the date of submission of Annexure-C and Annexure-I of the sales tax and federal excise return up to June 15, 2019, the date of payment of sales tax and federal excise duty up tot June 18, 2019 and the date of submission of sales tax and federal excise return up to June 21, 2019 for the tax period May 2019 due to Eid-ul-Fitr holidays.

Earlier, tax practitioners requested the FBR to extend the dates.

A letter has been sent on Friday to FBR Chairman Syed Muhammad Shabbar Zaidi for urgent consideration and for extension of time for e-filing of sales tax annexure ‘C’ and sales tax returns for the tax period May 2019.

The Pakistan Tax Bar Association (PTBA) in its letter to FBR chairman informed that the last date for e-filing of sales tax annexure ‘C’ of sales tax returns and filing of sales tax return for the month May 2019 is June 10, 2019 and June 15, 2019, respectively. However, due to Eid Holidays due from June 04 to June 08, 2019, all the business houses will remain closed.

The PTBA further said that the first word day after Eid and weekly holidays shall be June 10, 2019 which will be the last day of filing of Annexure “C”. Therefore it would not be practically possible to submit annexure “C” and Sales Tax Return in time.

In view of above, the PTBA requested to extend the last date of e-filling of Sales Tax annexure “C” and e-filling of sales tax return up to June 18, 2019 for the tax period May 2019 to facilitate the taxpayers to fulfill their legal obligations properly.