KARACHI: Overseas Investors Chamber of Commerce and Industry (OICCI) has urged the tax authorities to harmonize sales tax rates.

The OICCI in its proposals for budget 2022/2022 submitted to the Federal Board of Revenue (FBR) demanded reduction in sales tax rates.

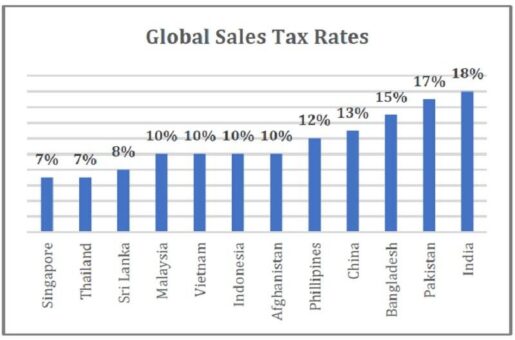

The sales tax rate in Pakistan, at 17 per cent, is the highest in Asia, as can be noted from the table here.

The analysis of the OICCI shows an average of less than 12 per cent in Asia, with a range of 6 per cent to 17 per cent.

READ MORE: OICCI suggests simplify issuance of exemption certificate

Moreover, different rates of sales tax on goods and services i.e. standard, reduced, specified etc. prevailing in the country lead to a number of issues for business organizations operating all over the country.

It is recommended that sales tax rates (federal and provincial), both on goods and services, should be harmonized throughout the country.

Earlier, the OICCI suggested the FBR to revamp withholding income tax regime in order to facilitate compliant taxpayers.

In line with the recommendations, the withholding tax regime has been subject to changes, the rationalization of withholding tax on imports and discriminating withholding tax on the basis of status of the payee is a good step towards rationalization of regime. However, there is still large room for improvement. The impact of the withholding tax regime on “Ease of Doing Business” for the large taxpayers is still very significant.

READ MORE: OICCI suggests revamping withholding tax regime

WHT regime should be revamped and reduced from existing over twenty-six to five rates only for filers.

Withholding tax should be applicable on inactive taxpayers only, or alternatively:

a) Withholding tax rates applicable on services is 8 per cent minimum tax regardless of the actual taxable income of the service provider. The nature of this tax effectively becomes indirect tax and increases the cost of doing business for service providers, hence, tax on services should be made adjustable.

READ MORE: FBR proposed to reduce minimum tax rate to 0.25%

b) Withholding tax deduction under section 153 (1)(a) of Income Tax Ordinance, 2001 which is currently considered as minimum tax for all the suppliers (except manufacturers and listed companies) should be made adjustable at least for corporates appearing in active taxpayers’ list.

READ MORE: Foreign investors seek reduction in corporate tax rate

Through Finance Act 2021 under section 165 of Income Tax Ordinance, 2001, requirement of filing reconciliation between annual withholding statement and audited accounts is introduced. It has resulted in additional compliance burden on active taxpayers and should be abolished.

Companies appearing in Active Taxpayers List (ATL) and obtained exemption certificate by discharge of full year tax liability in advance should be dispensed with requirements to obtain separate withholding tax exemption certificates under sections 151, 234, 235, 236, 236G and 236H.