Karachi, October 13, 2023 – Pakistan recent policy mix has been strategically designed to target macroeconomic imbalances and achieve economic stabilization.

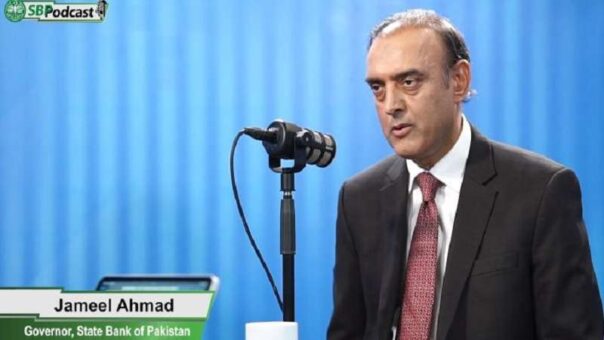

Jameel Ahmad, the governor of the State Bank of Pakistan (SBP), shared this insight with international investors during meetings with global banks, including Barclays, JP Morgan, Standard Bank, and Jefferies, held on the sidelines of the IMF-World Bank meetings in Marrakech, Morocco.

Governor Jameel Ahmad took the opportunity to brief global investors on Pakistan’s recent macroeconomic developments, policy responses to prevailing challenges, and the economic outlook for the nation. He also fielded questions from the investors.

In his discussions, Ahmad emphasized that the SBP had been among the first central banks globally to tighten monetary policy in response to rising inflation. Nevertheless, Pakistan faced domestic challenges, notably unprecedented floods at the start of the previous fiscal year, which complicated efforts to curb inflation. Over the past two years, the SBP has increased the policy rate by 1500 basis points, while the government has intensified its fiscal consolidation endeavors.

The governor noted that these stabilization measures are now producing results. Inflation has declined to 31.4 percent in September 2023, following its peak at 38.0 percent in May 2023, and it is expected to continue its downward trajectory in the months ahead. Simultaneously, Pakistan’s external account has shown considerable improvement, with foreign exchange reserves being replenished. Ahmad also mentioned that with the policy rate currently at 22 percent, real interest rates are anticipated to become substantially positive, as inflation is projected to decrease significantly in the latter half of the fiscal year. Pakistan’s Stand-By arrangement with the IMF is anticipated to bolster ongoing efforts to stabilize the economy.

Governor Jameel Ahmad underscored the vital role of the market-determined exchange rate in absorbing shocks and highlighted the support provided by multilateral and bilateral lenders in addressing external sector challenges. The current account deficit (CAD) has dropped to 0.7 percent of GDP in FY23 from 4.7 percent in FY22. Administrative measures that previously contributed to lowering the CAD have now been rescinded. However, continued stabilization efforts and a flexible exchange rate are expected to maintain the CAD within the range of 0.5-1.5 percent of GDP in FY24.

Jameel Ahmad informed investors that foreign exchange reserves have been on an upward trajectory, increasing from a low of $3.1 billion in January 2023 to $7.6 billion by the end of September 2023. This boost in reserves was primarily supported by non-debt creating inflows, aided by favorable market conditions. Additionally, SBP’s forward foreign exchange liabilities have diminished, comfortably exceeding the forward book target of $4.2 billion for end-September 2023, as agreed with the IMF. The bank is well-positioned to meet other end-September IMF targets, including Net International Reserves (NIR) and Net Domestic Assets (NDA).

Governor SBP Ahmad concluded by emphasizing the multifaceted challenges that emerging economies face, from access to capital markets and rising anti-trade sentiments to debt sustainability and the need to build climate-resilient and inclusive economies. He called for multilateral institutions like the IMF and World Bank to lead global efforts to address these challenges. Pakistan, with the support of its multilateral and bilateral partners, is on track to address long-standing structural weaknesses and achieve sustainable and inclusive economic growth over the medium term.