ISLAMABAD – The Federal Board of Revenue (FBR) has released comprehensive guidelines to facilitate taxpayers in updating their profiles, a mandatory requirement under the Income Tax Ordinance, 2001.

The FBR, recognizing the significance of this obligation, has extended the deadline for profile updates until March 31, 2020.

The guideline, issued on Wednesday, aims to streamline the process for taxpayers and ensure compliance with the recent amendment to the Income Tax Ordinance, 2001 through the Finance Act, 2020. This amendment, enacted to enhance transparency and regulatory oversight, mandates taxpayers to update their profiles with crucial information.

Key Provisions of the Amendment (Section 114A):

The amendment outlined in Section 114A of the Income Tax Ordinance, 2001, introduces a mandatory requirement for taxpayers to update their profiles. The specified information to be provided includes:

1. Bank Accounts:

• Taxpayers are required to furnish details of their bank accounts, providing a comprehensive overview of their financial transactions.

2. Utility Connections:

• Information regarding utility connections must be included in the updated profile, encompassing details of the taxpayer’s utility services.

3. Business Premises:

• Taxpayers must provide details of their business premises, covering manufacturing facilities, storage spaces, and retail outlets operated or leased by them.

4. Types of Businesses:

• A clear identification of the types of businesses the taxpayer is engaged in is required under the updated profile.

5. Other Prescribed Information:

• The amendment empowers the FBR to prescribe additional information that taxpayers must include in their profiles, ensuring a comprehensive overview of their financial and business activities.

Extension of Deadline:

Originally, the last date for taxpayers to update their profiles was set as December 31, 2020. However, responding to requests from tax bars and considering the complex nature of the task, the FBR extended the deadline until March 31, 2020, providing taxpayers with additional time to comply with the new requirements.

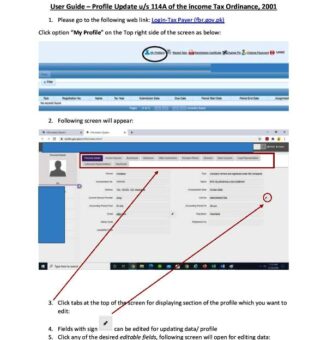

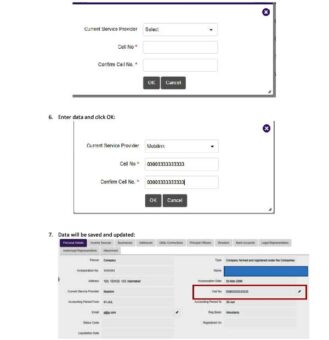

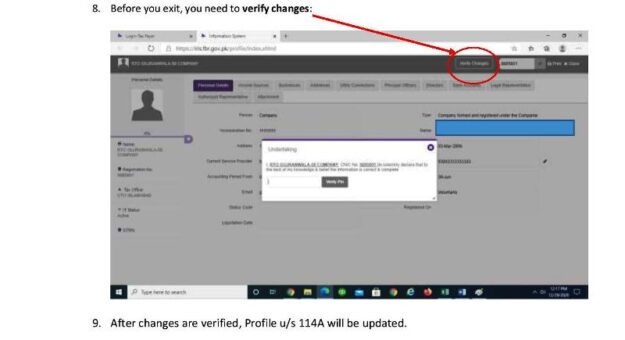

User Guide for Profile Updates:

In conjunction with the guideline, the FBR issued a user guide to assist taxpayers in the process of updating their profiles. The user guide aims to simplify the task, providing step-by-step instructions to ensure accuracy and completeness of the information submitted.

Significance of Profile Updates:

The mandatory updating of profiles holds several implications for taxpayers and the regulatory framework:

1. Enhanced Transparency:

• By requiring taxpayers to provide comprehensive details about their financial activities, the amendment contributes to enhanced transparency within the tax system.

2. Improved Regulatory Oversight:

• The availability of updated profiles enables regulatory bodies, including the FBR, to exercise improved oversight and monitoring of taxpayer activities.

3. Effective Policy Implementation:

• The updated profiles play a crucial role in policy implementation, helping authorities design and implement effective tax policies tailored to the specific economic activities of taxpayers.

4. Facilitation of Compliance:

• The guideline and user guide issued by the FBR aim to facilitate taxpayers in the process of updating their profiles, minimizing challenges and ensuring widespread compliance.

Conclusion:

As the March 31, 2020 deadline for updating profiles approaches, taxpayers are encouraged to familiarize themselves with the guidelines and user guide issued by the FBR. Compliance with this mandatory requirement not only ensures adherence to legal obligations but also contributes to the broader goals of transparency, regulatory oversight, and effective policy implementation within the taxation framework. The extension of the deadline reflects a responsive approach by the FBR to address the concerns of taxpayers and facilitate a smooth transition to the new regulatory requirements.