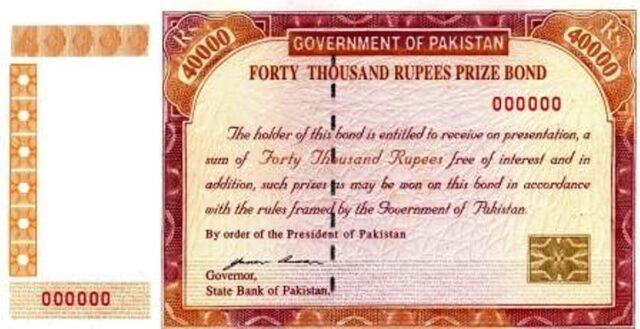

KARACHI: The investment in registered prize bonds of Rs40,000 denomination have registered phenomenal increase of 213 percent following discontinuation of bearer instruments of same denominations, official data revealed.

The investment in premium prize bonds surged to Rs18.37 billion by end of January 2020 as compared with Rs5.86 billion in the same month of the last year.

The sharp growth in investment into premium prize bonds has been attributed to discontinuation of bearer bonds of same denomination.

In order to document the economy the government launched premium prize bonds in April 2017. The premium prize bonds are being issued only against CNIC with valid bank accounts.

Further to make the instrument attractive the government also announced bi-annual profit, which transferred directly to the bond holders.

The participation of investors into registered bonds increased sharply after the announcement of the government on June 24, 2019 to discontinue the bearer bonds of Rs40,000.

The bearer bonds of Rs40,000 will be completely discontinued for legal tender by March 2020.

A massive withdrawal of investment has been seen in the bearer instrument as the total investment which was at Rs258 billion in May 2019 reduced to Rs9.57 billion by January 2020.

The State Bank of Pakistan (SBP) through a circular said that the bearer instrument can be exchanged in savings schemes such as Special Saving Certificates (SSC) or Defence Saving Certificates (DSC). The third mode of exchange the bearer bonds was direct transfer to bank accounts.

The investment in registered bonds was also increased after the government initiatives to document all instruments of National Saving Schemes as per conditions of Finance Action Task Force (FATF).

In this regard the ministry of finance notified National Savings Schemes (AML and CFT) Rules, 2019.

Under these rules the Central Directorate of National Saving (CDNS) through third party will conduct Know Your Customer (KYC) and Customers Due Diligence (CDD) of all existing and new investors.

The CDNS will ask all the investors about their annual investment and source of earnings under KYC and CDD in order to ensure clean money invested in the schemes.