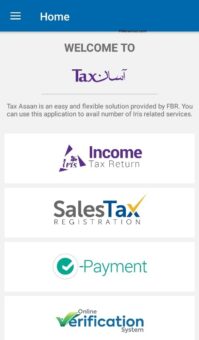

ISLAMABAD: In a significant step towards enhancing accessibility and ease of tax compliance, the Federal Board of Revenue (FBR) has officially launched a mobile application tailored for salaried individuals to file their income tax returns for the tax year 2019.

The introduction of the mobile application is aimed at streamlining the tax filing process, particularly for individuals whose primary source of income is their salary. The FBR’s initiative seeks to leverage technology to make tax compliance more convenient and efficient for the target demographic.

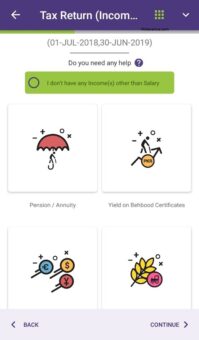

The mobile application is designed to cater specifically to individuals with more than 50 percent of their income derived from salary sources. This user-friendly platform is expected to simplify the often daunting task of filing annual income tax returns, providing salaried individuals with a hassle-free alternative to traditional filing methods.

The move aligns with the FBR’s broader strategy to embrace digital solutions and harness technology to facilitate taxpayers. By making the tax filing process accessible through a mobile app, the FBR aims to encourage a greater number of individuals to fulfill their tax obligations promptly and accurately.

Salaried persons, who often have busy schedules, can now take advantage of the convenience offered by the mobile application to file their income tax returns at their own pace and from the comfort of their smartphones. This is especially pertinent for those with straightforward tax affairs, eliminating the need for unnecessary complexity in the filing process.

The mobile application’s user interface is designed to be intuitive and user-friendly, ensuring that even those without extensive tax knowledge can navigate the process effortlessly. This simplicity is expected to boost compliance rates among salaried individuals, contributing to increased overall tax revenue for the government.

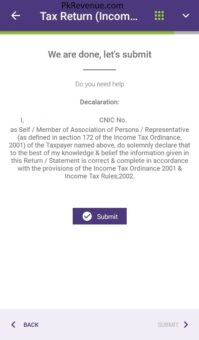

To utilize the mobile application, individuals with more than 50 percent of their income originating from salary sources can download the app and follow a step-by-step guide for filing their annual income tax returns. The application is equipped with features that facilitate the input of relevant financial information and ensures the accuracy of the filing.

The FBR’s decision to launch a mobile app for tax filing demonstrates a commitment to modernizing and simplifying the tax system. By leveraging technology, the board aims to bridge the gap between taxpayers and the regulatory process, fostering a culture of transparency and efficiency.

As technology continues to play a crucial role in governance and public services, the FBR’s mobile application serves as a noteworthy example of adapting to evolving trends. The initiative not only meets the needs of salaried individuals but also showcases the government’s dedication to embracing innovative solutions for the benefit of its citizens.

In conclusion, the Federal Board of Revenue’s launch of a mobile application for salaried individuals marks a progressive step towards modernizing tax procedures. By offering a user-friendly platform for income tax filing, the FBR is poised to enhance compliance rates and foster a culture of responsible tax practices among salaried individuals. This initiative reflects a broader commitment to leveraging technology for the betterment of the tax system and aligns with the government’s vision for a digitally empowered and efficient governance structure.

The salary persons can file their income tax returns by using easy steps showing in the following images: