Apple introduced Apple Pay Later from which customers can divide their purchases into four installments over a period of six weeks, without incurring any fees or interest charges.

Users have the option to request loans ranging from $50 to $1,000 through Apple Pay Later, which can be utilized for online and in-app transactions conducted on iPhone and iPad devices at merchants that support Apple Pay.

Getting started with Apple Pay Later is a simple process. Users can apply for a loan directly within their Wallet app without affecting their credit score. They can select the amount they wish to borrow and accept the terms and conditions of Apple Pay Later.

A soft credit inquiry will be performed during the application procedure to assess the borrower’s financial stability before granting the loan.

Once a user is approved for Apple Pay Later, they will be able to access the “Pay Later” option when they choose to use Apple Pay during checkout for online and in-app transactions on their iPhone or iPad. They can then use Apple Pay Later to complete their purchase.

Additionally, users who have already set up Apple Pay Later can apply for a loan directly within the checkout process when making a purchase.

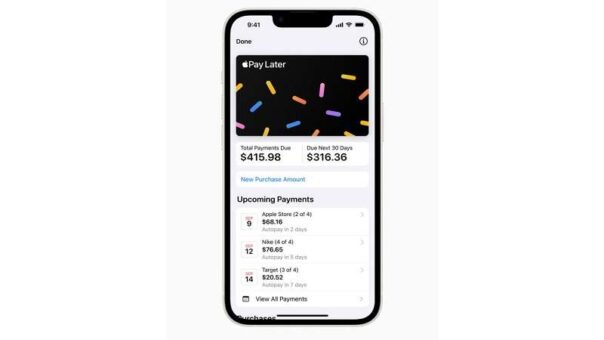

Apple Pay Later is conveniently integrated into the Wallet app, providing users with a centralized location to access, monitor, and manage all their loans. Within the Wallet app, users can easily keep track of their current and upcoming payments for all their loans, including the total amount due in the next 30 days.

A calendar view is also available to help users plan and track their payments. Notifications via Wallet and email are sent to users prior to payment deadlines to assist with timely payments.

To prevent the accumulation of further debt, only debit cards from Wallet can be linked for repayment purposes, as credit cards are not accepted.

Privacy and security are paramount in Apple Pay Later’s design. Transactions are authenticated using Face ID, Touch ID, or a passcode, and users’ transaction and loan history is never shared or sold to third parties for marketing or advertising purposes.

Apple Financing LLC, a subsidiary of Apple Inc., is responsible for assessing creditworthiness and extending credit for Apple Pay Later. Starting in the fall, Apple Financing plans to report Apple Pay Later loans to credit bureaus in the United States, aiding in building a borrower’s credit profile and encouraging responsible lending practices.